A Simple Guide to Value Investing

This presents top value investing strategies to help you find undervalued stocks. Think of it like buying a game console on sale – same product, lower price. Learn how to identify these opportunities using approaches like Graham’s Net-Net and Buffett’s Moat strategy. We’ll cover key metrics and practical examples to empower you, whether you’re a beginner or a seasoned investor, to find and profit from these value investing strategies. We’ll break down complex concepts into simple terms, making it easy to understand how to potentially boost your investment returns.

1. Graham’s Net-Net Strategy

Benjamin Graham, often called the “father of value investing,” developed the Net-Net strategy during the Great Depression. This value investing strategy focuses on finding deeply undervalued companies trading below their net current asset value (NCAV). Think of it like this: NCAV is calculated by subtracting all liabilities from a company’s current assets (things they can quickly turn into cash, like inventory and cash on hand).

If a company’s stock price is less than its NCAV, it’s essentially selling for less than the value of its readily available assets, implying it’s being priced as if it’s going out of business – even if it’s not. This significant discount provides what Graham called a “margin of safety,” protecting against permanent capital loss.

Let’s use a simplified example: Imagine Company XYZ has $20 million in current assets (cash, inventory, etc.) and $10 million in total liabilities (debts). Its NCAV is $10 million ($20 million – $10 million). If there are 1 million shares outstanding, the NCAV per share is $10. If Company XYZ’s stock trades at $7 per share, it’s a net-net because the market price is lower than the NCAV per share. Graham’s strategy suggests that such a company might be significantly undervalued.

Graham’s Net-Net strategy emphasizes extreme undervaluation as its primary investment criteria. It typically targets smaller, lesser-known companies experiencing temporary distress. This approach requires minimal analysis of the company’s future earnings potential, focusing instead on the balance sheet. This makes it appealing to both beginner investors and seasoned professionals.

Pros:

- High Margin of Safety: Buying assets below their liquidating value provides a cushion against losses.

- Historically Strong Returns: This strategy has generated impressive profits over time.

- Simplicity: It’s a straightforward, quantitative approach, requiring less complex financial analysis.

- Emotion-Free Investing: The clear numerical criteria helps avoid emotional investment decisions.

- Effective in Downturns: This strategy shines during market dips when fear creates undervalued opportunities.

Cons:

- Scarcity in Bull Markets: Finding net-nets during periods of market optimism can be challenging.

- Genuine Distress: Some companies might be cheap for good reasons, facing serious operational issues.

- Illiquidity: Net-nets often involve investing in smaller, less liquid stocks.

- Potential for Underperformance in Up Markets: During bull runs, high-growth stocks often outperform net-nets.

- Ignores Qualitative Factors: This method doesn’t consider a company’s competitive advantages or management quality.

This strategy deserves a prominent place in any value investor’s toolkit. While not without its drawbacks, the Graham Net-Net strategy offers a simple, yet powerful, method for identifying deeply undervalued companies and achieving significant returns while mitigating downside risk.

It’s a classic example of a value investing strategy that continues to be relevant for investors of all levels.

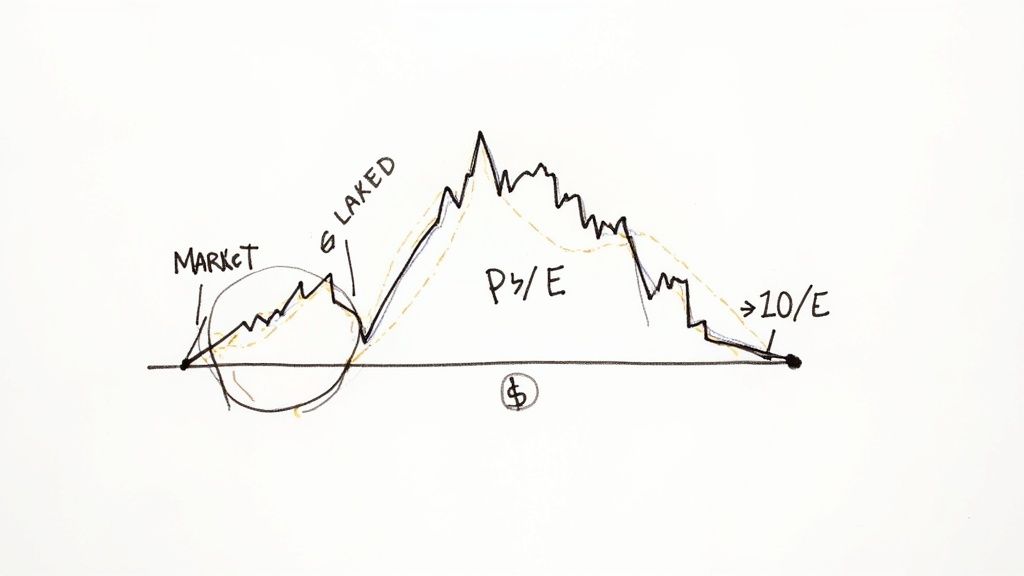

2. Low P/E Value Investing

Low P/E (Price-to-Earnings) value investing is a core strategy within the broader umbrella of value investing strategies. It focuses on identifying and purchasing stocks with below-average P/E ratios compared to the overall market or their industry competitors. This approach operates under the assumption that the stock market sometimes overreacts to bad news, driving down the prices of fundamentally solid companies more than is warranted.

This creates an opportunity for value investors to buy these “undervalued” stocks at a discount and profit when the market eventually corrects itself and recognizes the true worth of these companies.

Think of it like this: imagine a local bakery known for its delicious bread. Suddenly, a rumor spreads that the bakery is using low-quality ingredients. Customers panic, and sales drop, even though the rumor is false. The bakery’s “price” (stock price) goes down. A savvy value investor, knowing the bakery’s true value, buys its “stock” (ownership) at the lower price, confident that customers will eventually return once they realize the rumor was untrue. When the bakery’s reputation recovers, the investor profits as the “stock price” rises.

This strategy hinges on several key features. It emphasizes companies trading at low P/E ratios, often factoring in earnings growth prospects using the PEG ratio (P/E divided by growth rate). This approach can be used across various market sizes (from small to large companies) and sectors (like technology, healthcare, or finance). Low P/E investors typically hold their investments for 3-5 years, anticipating that the market will eventually re-evaluate the stock and its price will rise to reflect its true value. Dividend yield is often a secondary consideration, providing additional income while waiting for price appreciation.

Pros of Low P/E Investing:

- Simplicity: It’s easier to understand and apply than more complex valuation methods.

- Wide Applicability: A vast universe of potential investments exists across most market conditions.

- Historical Outperformance: Over the long term, low P/E strategies have generally outperformed growth-focused strategies.

- Less Susceptible to Accounting Tricks: Compared to book value approaches, P/E is less vulnerable to accounting manipulation.

- Easy to Grasp: Most investors can quickly understand the basic concept of P/E.

Cons of Low P/E Investing:

- Cyclical Pitfalls: P/E ratios can be misleading during economic peaks, appearing artificially low.

- Debt Blindness: Doesn’t inherently account for a company’s debt levels or financial structure.

- Value Traps: Can lead to investments in companies in long-term decline.

- Earnings Manipulation: Still susceptible to manipulation of reported earnings.

- Underperformance in Momentum Markets: May lag behind in markets driven by short-term price trends.

Examples of Successful Low P/E Investing:

- John Neff, manager of the Windsor Fund, famously used a low P/E approach, achieving approximately 14% annual returns over 31 years.

- Financial stocks trading at low P/Es (6-8x) after the 2008 financial crisis offered significant returns a few years later.

- Energy stocks with depressed P/Es during the 2020 COVID pandemic rebounded strongly in 2021-2022.

- Retail stocks like Target and Walmart, undervalued during the 2017 “Amazon fear” sell-off, later recovered substantially.

Low P/E investing, championed by investors like John Neff, David Dreman, John Templeton, and Michael Price, deserves its place among value investing strategies due to its historical effectiveness, relative simplicity, and broad applicability.

By understanding its nuances and potential pitfalls, investors can utilize this strategy to identify undervalued opportunities and potentially generate strong long-term returns.

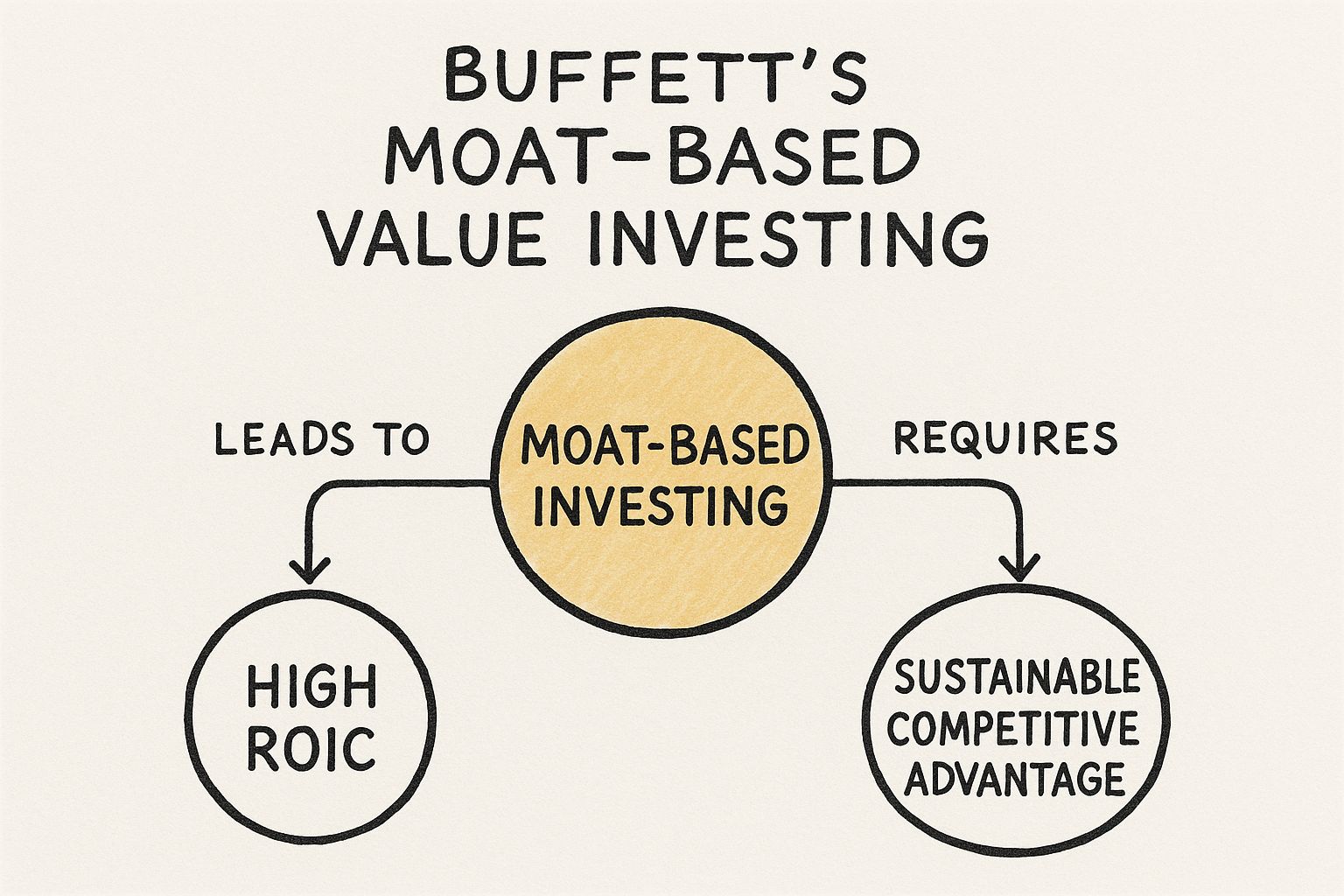

3. Buffett’s Moat-Based Value Investing

This value investing strategy, championed by Warren Buffett, goes beyond simply finding statistically cheap stocks. It focuses on identifying businesses with durable competitive advantages, often referred to as “economic moats,” that allow them to maintain high returns on invested capital (ROIC) for extended periods. Instead of seeking “fair businesses at wonderful prices,” Buffett’s approach prioritizes finding “wonderful businesses at fair prices.” This means focusing on quality first and valuation second.

The infographic above visualizes the key components of Buffett’s Moat-Based Value Investing. The central concept, “Sustainable Competitive Advantage (Moat),” is surrounded by factors that contribute to and result from a strong moat. These include high returns on invested capital, strong management, and ultimately, long-term value creation. The infographic highlights the importance of the moat as the foundation for long-term investment success. It emphasizes the interplay between qualitative factors like brand strength and quantitative metrics like ROIC.

This approach involves a combination of qualitative and quantitative analysis. Qualitatively, you assess the long-term durability of the business, the quality of management, and the industry dynamics. Quantitatively, you evaluate the business’s financial performance and determine a fair price to pay. This strategy takes a long-term perspective, typically looking at investments over a 10+ year horizon. Think of it like buying a house – you wouldn’t buy a house just because it’s cheap if the foundation is crumbling. You want a good house (strong business) at a reasonable price.

For example, imagine two lemonade stands. One sells average lemonade at a low price, while the other sells amazing lemonade at a slightly higher price. The second stand has a “moat” because its superior product creates customer loyalty. Even if the second stand is a bit more expensive initially, its loyal customers and higher profit margins make it a better long-term investment. This is similar to how Buffett thinks about companies.

Features of Moat-Based Investing:

- Emphasizes Sustainable Competitive Advantages (Economic Moats): These are factors that protect a company’s profits from competition.

- Focuses on High Returns on Invested Capital (ROIC): Shows how efficiently a company uses its capital to generate profits.

- Requires Qualitative Assessment: Evaluating the business’s intangible aspects, such as management quality.

- Long-Term Perspective: Holding investments for 10+ years.

- Concentrated Investments: Focusing on a smaller number of high-conviction holdings.

- Simple, Understandable Business Models: Preferring businesses that are easy to analyze and understand.

Pros:

- High Long-Term Returns: Potentially 20%+ annually over decades.

- Lower Costs: Reduced trading minimizes transaction fees and taxes.

- Lower Risk: Focus on quality reduces the chance of permanent capital loss.

- Compounding Returns: Businesses that reinvest profits at high rates can generate significant long-term growth.

- Performance in Various Markets: The quality buffer can help protect against market downturns.

Cons:

- Requires Business Analysis Skills: Goes beyond simple financial metrics.

- Quality is Rarely Cheap: Finding deeply discounted, high-quality companies is difficult.

- Concentration Increases Risk: If a single large holding performs poorly, the overall portfolio can suffer.

- Challenging in Overvalued Markets: Difficult to find good values when the entire market is expensive.

- Can Underperform in Speculative Markets: May lag behind during periods of market euphoria.

Examples:

- Buffett’s Investments: Coca-Cola, American Express, Apple

- Charlie Munger’s Investments: Costco

- Berkshire Hathaway Acquisitions: GEICO, See’s Candies, BNSF Railway

- Tom Gayner’s Markel Corporation: Applying similar principles in their public equities portfolio

Why This Strategy Deserves Its Place on the List:

Buffett’s Moat-Based Value Investing offers a robust framework for long-term wealth creation. By focusing on high-quality businesses with enduring competitive advantages, investors can potentially achieve superior returns while mitigating risk. This strategy requires patience and in-depth analysis, but the potential rewards make it a cornerstone of successful value investing. It’s not about finding the cheapest stock, it’s about finding the best value over the long term. This strategy, popularized by investors like Warren Buffett, Charlie Munger, and Pat Dorsey, continues to be a powerful approach to value investing in the modern market.

4. Contrarian Value Investing: Zig When Others Zag

Contrarian value investing is a value investing strategy that focuses on buying assets that are out of favor with the market. It’s about going against the crowd, zigging when others zag. This approach hinges on the belief that markets overreact to bad news, driving prices of fundamentally sound assets below their intrinsic value. This creates opportunities for contrarian investors to buy low and sell high when the market eventually recognizes its mistake and sentiment reverses. This strategy deserves a spot on any value investing list because it offers the potential for significant returns while exploiting predictable market inefficiencies.

Imagine a popular clothing company that suddenly experiences a supply chain disruption. The news sends its stock price plummeting. Most investors panic and sell, fearing further losses. A contrarian value investor, however, analyzes the underlying business. If the company’s core operations and long-term prospects remain solid, the investor might view the temporary setback as a buying opportunity. They bet that the supply chain issue will eventually be resolved and the stock price will recover. This is contrarian value investing in action.

How it Works:

Contrarian value investors deliberately target industries, sectors, or individual companies experiencing temporary distress. They look for situations where negative sentiment has pushed prices down significantly, creating a disconnect between price and underlying value. This often involves cyclical industries, like energy or commodities, which experience boom-and-bust patterns. Instead of relying on relative valuations (comparing a company to its peers), contrarians often employ absolute valuation measures, such as discounted cash flow analysis, to determine a company’s intrinsic worth. They might also look at special situations like corporate restructurings or spinoffs, which can unlock hidden value.

Pros:

- Potential for outsized returns: When market sentiment reverses, contrarian investments can generate substantial gains.

- Reduced competition: Fewer investors are willing to go against the crowd, creating less competition for attractive assets.

- Margin of safety: Depressed valuations provide a cushion against further declines.

Cons:

- Psychological difficulty: It takes discipline to withstand negative sentiment and the potential for short-term losses.

- Risk of “catching falling knives”: Not all distressed assets recover. Some continue to decline.

- Prolonged underperformance: It can take time for a contrarian thesis to play out

Contrarian value investing isn’t for everyone. It requires patience, discipline, and the ability to think independently. But for those who can master it, it offers a powerful path to long-term investment success within the broader context of value investing strategies.

5. Dividend Value Investing

Dividend value investing is a specific type of value investing strategy that focuses on finding undervalued companies that also pay out consistent and ideally growing dividends. This approach combines the potential for stock price appreciation with the steady income stream provided by dividends, offering a compelling strategy for a variety of investors. It earns its place among value investing strategies because it provides a tangible measure of a company’s financial health and commitment to shareholder returns, while also offering a margin of safety during market downturns.

How it Works:

This strategy seeks out companies with strong fundamentals: consistent cash flow, healthy balance sheets, and management teams dedicated to returning capital to shareholders through dividends. The focus is not just on the current dividend yield (the annual dividend per share divided by the share price), but also on the growth of that dividend over time. The idea is to invest in companies that can sustainably increase their dividend payments, leading to a rising income stream and potentially higher stock valuations.

Example:

Let’s say Company A and Company B are both trading at $50 per share.

Company A pays a $2 annual dividend (4% yield), while Company B pays a $1 annual dividend (2% yield). A superficial glance might suggest Company A is the better dividend stock. However, if Company A’s dividend has been stagnant for years, while Company B has consistently increased its dividend by 10% annually, Company B might be the more attractive long-term investment. The growing dividend of Company B signals underlying business strength and suggests the yield on your original investment will increase over time (assuming you reinvest the dividends or hold the shares).

Pros:

- Regular income: Dividends provide a steady income stream.

- Lower volatility: Dividend-paying stocks tend to be less volatile than non-dividend payers.

- Management accountability: Dividend payments enforce financial discipline.

- Compounding effect: Reinvesting dividends generates significant long-term returns.

- Valuation floor: Dividend yields can provide support during market corrections.

- Tax advantages (in some jurisdictions): Some tax regimes favor dividend income.

Cons:

- Potentially lower growth: May lag behind high-growth companies in capital appreciation.

- Tax inefficiency (in some jurisdictions): Dividends can be taxed unfavorably in some areas.

- Dividend traps: High yields can be a warning sign of unsustainable payouts.

- Sector concentration: Often concentrated in sectors like utilities and financials.

- Interest rate sensitivity: Rising interest rates can make dividend yields less attractive.

When to Use This Approach:

This strategy is well-suited for investors seeking a combination of income and long-term growth, especially those with a longer time horizon and a lower risk tolerance. It’s particularly relevant for income-focused investors, retirees, and those seeking a more defensive element in their portfolios.

Popularized By: Notable figures like John D. Rockefeller, Charles Dow, Geraldine Weiss, Lowell Miller, and Tom Connolly have championed dividend investing strategies.

6. Asset-Based Value Investing

Asset-based value investing is a strategy that focuses on finding companies trading for less than the value of their underlying assets. Think of it like buying a dollar bill for fifty cents. Instead of focusing on a company’s current earnings, this approach prioritizes the balance sheet – specifically the assets a company owns. The goal is to identify companies where you can effectively purchase assets at a discount, regardless of how the business is performing at the moment.

How it Works:

This strategy works by calculating a company’s intrinsic asset value, which represents the true worth of its holdings. This often involves looking beyond the stated book value on the balance sheet and digging deeper to understand the real market value of assets like real estate, natural resources, intellectual property, and even hidden assets within complex corporate structures. Then, this intrinsic value is compared to the current market price of the company’s stock. If the market price is significantly lower, it could represent a buying opportunity.

Example:

Imagine a company that owns a portfolio of apartment buildings. The book value of these buildings, based on their historical cost, might be $100 million. However, a recent appraisal shows their current market value is actually $150 million. If the company’s total liabilities are $50 million, its net asset value (NAV) is $100 million ($150 million – $50 million). If the company’s market capitalization (total value of its stock) is only $80 million, it’s trading below its NAV, suggesting it might be undervalued from an asset-based perspective.

Features and Benefits:

- Emphasis on Tangible Assets: Focuses on the value of physical assets rather than relying on earnings projections.

- Discount to NAV: Looks for companies trading below their net asset value or adjusted book value.

- Asset-Heavy Businesses: Often involves companies with significant capital investments in physical assets.

- Hidden Assets: Seeks to uncover undervalued or underutilized assets within a company’s holdings.

- Concrete Valuation Floor: Provides a more tangible basis for valuation compared to relying on earnings, which can be more volatile and subject to manipulation.

Pros:

- Less Susceptible to Earnings Fluctuations: Provides a measure of stability by focusing on asset values, which are less affected by short-term business cycles.

- Overlooked Opportunities: Identifies companies the market may be overlooking due to its focus on short-term earnings.

- Hidden Value: Uncovers potential value in complex businesses where assets may be obscured.

Cons:

- Book Value Distortion: Book values can sometimes be outdated or inaccurate, not reflecting the true market value of assets.

- Limited Relevance for Asset-Light Businesses: Less applicable to companies with primarily intangible assets, such as software companies.

- Value Traps: May identify companies whose assets consistently generate poor returns.

When to Use This Approach:

This strategy is particularly suitable for:

- Asset-heavy industries: like real estate, natural resources, and manufacturing.

- Distressed companies: where assets may be temporarily undervalued due to financial difficulties.

- Complex businesses: with hidden or underappreciated assets.

Why It Deserves a Place in the List:

Asset-based value investing provides a unique perspective that complements other value investing approaches. By focusing on the underlying assets of a company, investors can identify opportunities the market may be overlooking. It offers a more tangible and potentially less volatile approach to valuation, particularly in uncertain economic times. While not applicable to all businesses, it remains a powerful tool for discerning investors seeking undervalued opportunities. Notable investors like Seth Klarman, Marty Whitman, Bruce Berkowitz, Carl Icahn, and Wilbur Ross have successfully utilized this strategy to generate significant returns.

7. Quantitative Value Investing

Quantitative value investing represents a modern evolution of traditional value investing strategies. It merges time-tested principles of finding undervalued companies with the power of data analysis and automated trading systems. This approach allows investors to systematically scan vast numbers of stocks, applying numerous value, quality, and risk filters simultaneously. This removes emotional bias from the equation and facilitates broad diversification, aiming for consistent returns while carefully managing risk. This strategy deserves a place on this list because it offers a powerful, data-driven path toward achieving the elusive “value premium”—the tendency for undervalued stocks to outperform the market over the long term.

How It Works:

Imagine trying to sift through thousands of companies to find hidden gems. That’s where quantitative value investing shines. Instead of manually pouring over financial statements, this strategy uses computer algorithms to do the heavy lifting. These algorithms are programmed to screen stocks based on a variety of factors, such as:

- Value Metrics: Price-to-earnings ratio (P/E), price-to-book ratio (P/B), dividend yield, and free cash flow. These help identify companies trading below their intrinsic worth.

- Quality Indicators: Return on equity (ROE), debt-to-equity ratio, and profit margins. These filter out potentially troubled companies (“value traps”) that appear cheap but have underlying problems.

- Risk Factors: Volatility, market capitalization, and industry exposure. These help manage the overall risk of the portfolio.

Example:

Let’s say a quantitative value investor sets their algorithm to look for companies with a low P/E ratio, high ROE, and low debt. The algorithm scans the market and identifies Company X, which meets these criteria. Further analysis reveals that Company X is a well-managed business with a strong track record, trading at a discount due to a temporary setback. This systematic approach avoids the emotional trap of dismissing Company X based on the recent setback and instead focuses on the underlying fundamentals.

Benefits of Quantitative Value Investing:

- Efficiency: Analyze thousands of stocks simultaneously, saving considerable time and effort.

- Objectivity: Removes emotional biases that can lead to poor investment decisions.

- Consistency: Implements a disciplined approach, adhering to predefined rules.

- Risk Management: Enables precise control of risk factors and portfolio diversification.

- Testability: Allows for backtesting and validation of investment strategies.

Pros and Cons:

| Pros | Cons |

|---|---|

| Enables broad diversification | May miss qualitative insights |

| Reduces psychological biases | Can be vulnerable to data mining and overfitting |

| Provides consistent, disciplined implementation | Requires technical expertise to implement effectively |

| Allows precise risk management | Potentially higher portfolio turnover and transaction costs |

| Facilitates testing and validation | More difficult to explain individual positions |

When to Use This Approach:

Quantitative value investing is best suited for investors comfortable with data analysis and systematic approaches. It’s ideal for those who want a disciplined, rules-based strategy that removes emotional biases and allows for broad diversification. This approach requires a certain level of technical understanding, making it more suitable for experienced traders, financial analysts, and tech-savvy investors. However, with the increasing availability of research and tools, even beginner investors can explore simplified versions of this powerful strategy.

8. Special Situations Value Investing

Special situations value investing is a strategy that focuses on finding undervalued companies undergoing significant changes. Think of it like finding hidden gems during a store renovation – the mess and confusion can scare away other shoppers, creating bargains for those willing to dig a little deeper. These “changes” can include events like a company splitting into two, merging with another, going bankrupt, restructuring its finances, or other complex actions. Many investors avoid these situations because they seem complicated or risky. This creates an opportunity for savvy value investors to find mispriced companies.

Here’s how it works: These corporate events often create temporary inefficiencies in the market. Less informed investors might sell their shares indiscriminately due to uncertainty, pushing the price down below the company’s true worth. Special situation investors, however, analyze these events in detail to understand their impact on the company’s intrinsic value. If they determine that the market reaction is overly negative, they can buy the stock at a discount and profit when the price recovers.

Example: Imagine a large company, like a department store, decides to spin off its online business. Many investors might not understand the complexities of this separation and sell shares of both the original company and the new online business. This selling pressure could drive down the price of the newly independent online business, even if it has strong growth potential. A special situations investor would analyze the financials of both businesses and determine if the online business is undervalued due to this market reaction. If so, they would buy shares of the online business, betting that the market will eventually recognize its true value.

Features of Special Situations Investing:

- Company-Specific Focus: Instead of following broad market trends, this strategy focuses on individual companies and their unique circumstances.

- Temporary Inefficiencies: It aims to exploit temporary price drops caused by complex corporate actions.

- Complex Securities: It may involve investing in securities like long-term options (LEAPS), warrants, or rights offerings.

- In-Depth Analysis: It requires careful analysis of legal documents and company disclosures.

- Flexible Positioning: Investors can take both long (buying) and short (selling) positions depending on the situation.

- Definable Catalysts: Often, there are specific events or timelines that can drive the stock price toward its intrinsic value.

Pros:

- Uncorrelated Returns: Profits are often less dependent on overall market performance.

- Exploiting Market Inefficiencies: It takes advantage of situations that other investors often miss.

- Asymmetric Risk-Reward: Potential gains can be much larger than potential losses in some cases.

- Less Competition: Fewer investors have the expertise to analyze these situations, leading to less competition.

- Opportunities in All Markets: Special situations can arise in both bull and bear markets.

- Definitive Timelines: There’s often a clear timeframe for the investment thesis to play out.

Cons:

- Specialized Knowledge: It requires a deep understanding of finance, accounting, and legal documents.

- Illiquidity: Some investments may be in smaller, less liquid companies, making it harder to buy and sell.

- Regulatory and Legal Risks: Unexpected legal or regulatory hurdles can arise.

- Limited Opportunities: The number of suitable special situations can vary depending on market conditions.

- Active Monitoring: Investors must stay updated on the situation and be ready to act quickly.

- Deal Failure Risk: Mergers, acquisitions, and other corporate actions can fall apart, leading to losses.

Tips for Special Situations Investing:

- Read the Fine Print: Study original legal documents, not just summaries.

- Specialize: Focus on a specific type of special situation, like spin-offs or bankruptcies.

- Follow Management: Pay attention to management incentives and insider buying.

- Consider Taxes: Tax implications often drive the structure of corporate actions.

- Build a Network: Connect with lawyers, accountants, and other specialists.

- Manage Position Sizes: Invest more in situations with higher certainty and shorter timelines.

Popularized By: Investors like Joel Greenblatt, Seth Klarman, Martin Whitman, John Paulson, and Bill Ackman have used special situations investing successfully.

Why This Strategy Deserves its Place: Special situations investing offers the potential for high returns by exploiting market inefficiencies that most investors ignore. While it requires specialized knowledge and careful analysis, the potential rewards can be substantial for those willing to put in the effort. It offers a unique approach to value investing that can complement other strategies and provide opportunities in all market conditions.

Value Investing Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Graham’s Net-Net Strategy | Medium – requires screening NCAV | Low – minimal earnings analysis | High margin of safety, potential high returns in downturns | Deep value buy opportunities in distressed small companies | Simple quantitative, strong margin of safety, effective in downturns |

| Low P/E Value Investing | Low – straightforward ratio analysis | Low – widely available data | Moderate returns, broad opportunity set | Undervalued stocks relative to peers/market, medium-term hold | Easy to implement, large universe, historically outperforms growth |

| Buffett’s Moat-Based Investing | High – qualitative & quantitative | High – requires deep business insight | Exceptional long-term returns | Strong durable businesses with competitive advantage | Focus on quality, durable returns, lower risk, compound growth |

| Contrarian Value Investing | High – requires psychological discipline | Medium – needs behavioral analysis | Potential outsized returns, volatile | Investing against market sentiment, cyclical/ distressed assets | Exploits behavioral biases, margin of safety in unpopular assets |

| Dividend Value Investing | Medium – requires dividend sustainability analysis | Medium – cash flow & payout analysis | Regular income plus capital appreciation | Mature companies with stable dividends | Steady income, lower volatility, compounding dividends |

| Asset-Based Value Investing | High – requires detailed asset analysis | High – industry specific valuation needed | Concrete asset-value floor, potential hidden value | Asset-heavy sectors, real estate, distressed firms | Physical asset backing, less earnings volatility, uncover overlooked value |

| Quantitative Value Investing | High – needs algorithmic & statistical skills | High – data processing and model maintenance | Consistent factor-based returns | Large stock universes, automated screening | Removes bias, diversified portfolios, disciplined execution |

| Special Situations Value Investing | Very High – requires legal & event expertise | High – in-depth analysis of complex events | Asymmetric returns, low market correlation | Corporate actions, restructurings, spin-offs | Exploits unique corporate events, specific catalysts, market inefficiencies |

Putting Value Investing Strategies to Work

Value investing strategies, as we’ve explored, offer a range of approaches to identify undervalued companies with strong long-term potential. From Graham’s net-net strategy focusing on liquidation value to Buffett’s moat-based approach emphasizing competitive advantages, and from dividend investing to exploring special situations, each strategy offers unique insights into market inefficiencies. The key takeaway is that value investing isn’t about simply buying cheap stocks; it’s about understanding the intrinsic value of a business and investing with a margin of safety.

Let’s take a simple example. Imagine two companies, both selling for $10 per share. Company A has a history of stable earnings, a strong management team, and little debt, while Company B has erratic earnings, a questionable management team, and a heavy debt load. A value investor might see Company A as undervalued despite the similar price, recognizing its superior underlying fundamentals.

Mastering these value investing strategies is crucial because it allows you to look beyond short-term market fluctuations and focus on the long-term value creation of a business. This long-term perspective is key to building a resilient portfolio that can weather market downturns and generate sustainable returns. By understanding these core principles, you’re not just buying stocks; you’re investing in a piece of a business, and your portfolio becomes a collection of these ownership stakes, poised for growth.

Ready to put these value investing strategies into action? Stock Decisions provides the tools and data you need to identify and analyze undervalued companies, empowering you to make informed investment decisions based on solid fundamentals. Visit Stock Decisions today and start building a value-driven portfolio.