Why Diversification Matters: The Real Story

Let me share how to diversify your portfolio as investing all your money in one asset can be risky. Diversification means spreading investments across different assets, providing a safer strategy. Think of it as adding layers of protection. If one investment doesn’t do well, others can help balance out the loss.

Understanding Diversification

Imagine putting all your savings into a company that then goes bankrupt. Diversification helps prevent this. By putting money into different asset types like stocks, bonds, and real estate, you don’t rely on just one investment’s success. This approach protects your wealth even if one type of asset struggles.

The dot-com bubble burst in the early 2000s is a clear example. Those who invested heavily in tech stocks lost a lot. In contrast, diversified portfolios with a mix of stocks, bonds, and other assets performed better. Diversification isn’t about removing risk but managing it well.

The Global View on Diversification

Diversification includes investing in different regions and industries like technology, healthcare, and energy. This global strategy reduces the risk of being affected by local market changes.

Global markets are more connected now. This has affected how stocks in different countries relate to each other. For example, the link between U.S. and non-U.S. stock returns grew from 0.51 in December 1989 to 0.86 by September 2020, suggesting fewer diversification benefits.

Still, diversification is important, especially for long-term investors. The increased connection is more about changing interest rates than company profits. Globalization hasn’t removed the benefits of diversification. This broader approach lets investors take advantage of global growth and reduces the risk of relying on one market. While it doesn’t remove all risks, diversification strengthens a portfolio, helping it withstand economic downturns and support long-term growth.

Mix It Up: Finding The Right Investment Blend

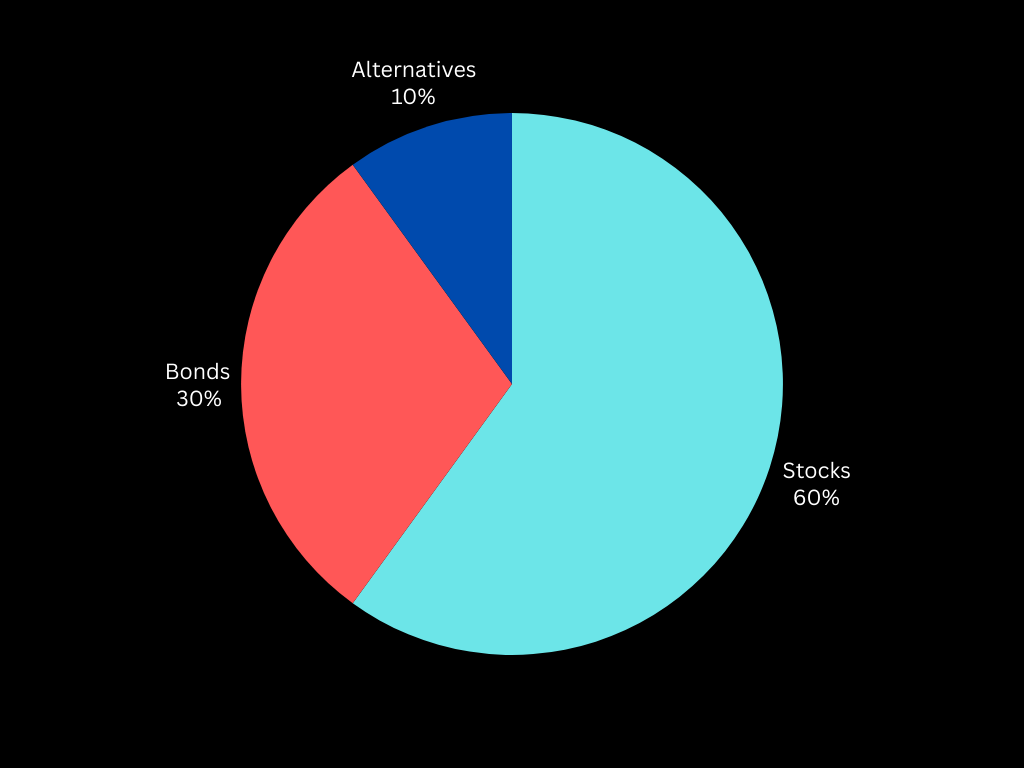

The pie chart shows how a sample investment portfolio is divided: 60% in stocks, 30% in bonds, and 10% in alternative investments. This mix shows how a diverse portfolio can work well together. Building a successful portfolio isn’t about picking one “best” investment but is about choosing a combination of assets that fit your personal financial goals.

Understanding Your Investment Choices

A diverse portfolio includes several main types of investments, each serving a specific purpose. Here are the main options:

Stocks: These are small ownership shares in a company. They can grow a lot in value but are riskier.

Bonds: These are like loans to governments or companies. They are usually less risky than stocks and give a steady income.

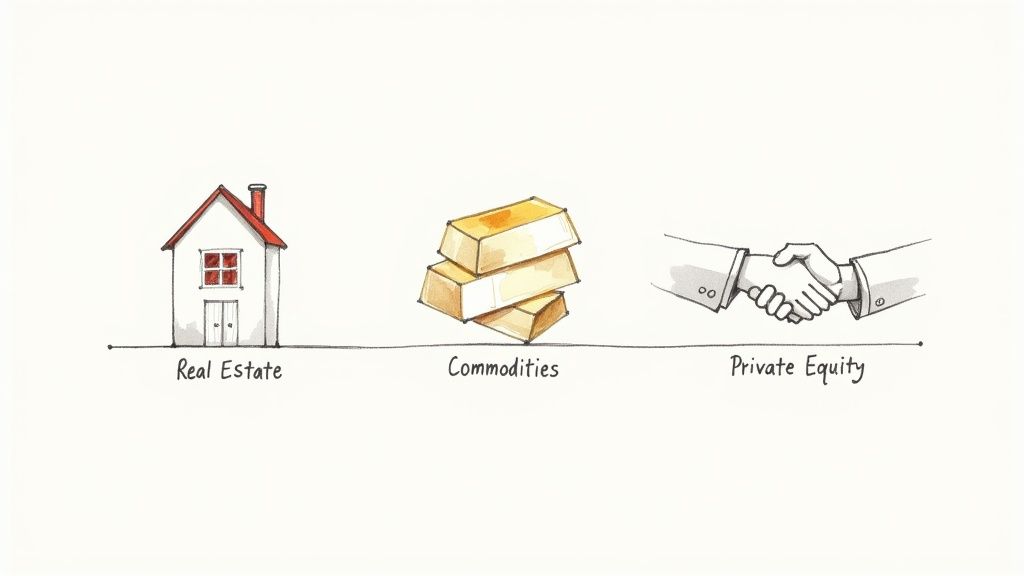

Real Estate: Investing in property adds variety, but it usually needs a lot of money upfront. REITs (Real Estate Investment Trusts) make it easier to invest in real estate.

Alternatives: This group includes gold, cryptocurrency, and commodities like oil or wheat. They can increase portfolio returns but come with higher risk, so they need to be chosen carefully.

To see how these investments differ and work together, look at a comparison table. This table gives a simple view of the risk and reward of each type and how they might relate to stocks in a portfolio.

Investment Mix Matchup: What Goes Where

A friendly comparison of major investment types showing their risk levels, potential rewards, and how they play with others in your financial sandbox

|

Investment Type |

Risk Level |

Potential Return |

Inflation Protection |

Income Potential |

How It Plays With Stocks |

|---|---|---|---|---|---|

|

Stocks |

High |

High |

Moderate |

Variable (dividends) |

Often considered the core growth component |

|

Bonds |

Low to Moderate |

Moderate |

Varies depending on the type |

Fixed (coupon payments) |

Typically acts as a ballast against stock market fluctuations |

|

Real Estate |

Moderate to High |

Moderate to High |

Good |

Moderate (rent) |

Can offer diversification benefits independent of stock market performance |

|

Gold |

Moderate |

Moderate |

Historically good |

None |

Often negatively correlated with stocks, acting as a safe haven |

|

Cryptocurrency |

Very High |

Very High |

Unproven |

Variable (staking, etc.) |

Can show high correlation or no correlation depending on market sentiment |

|

Commodities |

Moderate to High |

Moderate to High |

Varies depending on the commodity |

None |

Can be positively or negatively correlated depending on economic conditions |

This table shows the variety of investment choices and how they can be combined wisely. Keep in mind that the risk and return can be quite different within each type of investment.

Finding Your Perfect Mix

Choosing the right investment mix depends on your personal situation, especially your comfort with risk and investment time frame. A younger person might put more money into stocks, hoping for long-term growth. On the other hand, someone close to retirement might focus more on the safety of bonds.

Diversification is more than just picking different types of investments. For stocks, it means spreading money across different sectors (like technology, healthcare, energy) and regions (such as the U.S., Europe, Asia) to lower risk. This helps avoid putting too much money into one area.

Lastly, a well-diversified portfolio needs regular checking and adjustment, a process called rebalancing. Rebalancing keeps your portfolio in line with your goals and preferred risk level as markets change.

Going Global: Adventures Beyond Your Backyard

You’ve learned about spreading your investments across different types like stocks and bonds. Now, consider going global. Real diversification means not just different types but also different locations.

Why Consider Global Investments?

Imagine if you only shopped at one store—you’d miss out on better deals and unique items elsewhere. Similarly, investing only in your home country might mean missing growth opportunities in other markets. Global investing opens up access to many new markets, helping to balance your portfolio and reduce risks, especially if your local market struggles.

Developed vs. Emerging Markets

Think of choosing a restaurant. Sometimes you go for a familiar place (developed markets like Germany or Japan). Other times, you might try something new with more potential (emerging markets like India or Brazil). Both are important in a diverse investment strategy. Diversification means finding undervalued assets. A useful tool for this is a stock screener.

Developed markets offer stability with fewer price changes, forming a strong base for your portfolio. Emerging markets, though riskier, might offer bigger returns. They can improve your portfolio but need careful thought.

Understanding Global Markets

Investing globally might seem tough, but it can be straightforward. Options include international mutual funds or exchange-traded funds (ETFs). These funds gather money from many people to invest in a variety of international companies, providing an easy way to invest globally.

History shows global diversification is beneficial. Even though the U.S. stock market sometimes does very well, global diversification often reduces risk, especially for those outside the U.S. For more on the history and reasons for diversification, read this article on the history of diversification.

Making Global Diversification Work for You

Even within international investments, maintaining balance is essential. Avoid concentrating your investments within a single country or region. Just as diversifying across industries within a domestic market is prudent, spreading your international holdings across different countries mitigates risk. This approach builds a truly diversified portfolio that’s resilient to market fluctuations. By strategically allocating your investments globally, you lay a strong foundation for long-term growth and financial stability.

Spreading Bets Across Different Industries

Imagine investing all your money in Blockbuster just as Netflix started changing the market. This situation shows why it’s crucial to spread investments across different industries to keep a strong and balanced portfolio. This approach reduces the risk of big losses if one industry runs into unexpected problems.

Why Industry Diversification Is Important

Different industries respond differently to economic changes. For instance, higher gas prices might help energy companies but hurt airlines. By investing in various sectors, investors can lessen the impact of poor performance in one area. During a recession, people might spend less on luxury items but still buy necessary healthcare products. A portfolio with investments in both areas offers more stability.

Looking at Different Sectors

There are many industries to consider for investment. Some important ones include:

Technology: Includes companies in software, hardware, and internet services.

Healthcare: Includes pharmaceutical companies, hospitals, and medical device makers.

Energy: Includes oil and gas producers, renewable energy companies, and utilities.

Consumer Staples: Includes companies making essential products like food and drinks.

Financials: Includes banks, insurance companies, and investment firms.

Knowing the distinct features of each sector helps investors make smart choices about where to put their money, aiming for growth while reducing risk.

Finding the Right Balance

Determining if your portfolio is overexposed to a single industry can be straightforward. Analyze the percentage each sector represents within your overall holdings. If a significant portion is concentrated in one area, consider diversifying. This doesn’t preclude investing in favored industries; rather, it emphasizes the importance of strategically distributing capital. Understanding sector exposure and return potential is key. A portfolio solely comprised of domestic companies might have less diversified sector exposure than a global portfolio.

A mix of U.S. and international stocks generally provides more stable returns. For example, a 60%/40% mix has sometimes resulted in about 10% annual returns. This strategy reduces market-specific risks since global markets don’t usually face the same economic conditions at the same time. Diversification lowers risk and boosts potential returns by offering access to a broader range of opportunities. Discover more about international investing benefits.

Creating a Diverse Portfolio Across Sectors

Crafting a diverse portfolio can be straightforward. Investing in ETFs or mutual funds targeting specific sectors allows you to own a collection of companies within an industry. Diversifying across sectors builds a stronger portfolio that can handle market ups and downs and grow over the long term. This balanced method lays a strong foundation for your investment plan.

How Diversification Protects Your Investments

Consider diversification as a financial safeguard. It’s key for reducing risk and protecting your investments from market fluctuations. This section explains how spreading investments can protect your capital during downturns.

Risk and Diversification

Investing involves various risks. Market risk is the chance of the entire stock market dropping, while company-specific risk is the chance of one company performing poorly, even if the market is stable. Diversification manages these risks.

If you invest all your money in one company and it fails, diversification can cushion the impact as your investments are spread across various assets, preventing a total loss.

The Role of Correlation

A key aspect of diversification is correlation, or how investments move together. Low correlation means investments move differently, and high correlation means they move similarly.

Diversification focuses on low correlation. Think of it as a team: if one member underperforms, another can excel. A portfolio with low-correlation assets stays strong, even if some investments don’t do well, smoothing out returns over time.

Diversification During Market Crashes

Diversification has shown its worth in market crashes. During the dot-com bubble burst, those concentrated in tech stocks lost heavily, while diversified investors fared better with broader exposure.

The 2008 financial crisis highlighted diversification’s importance. Diversified portfolios provided a vital safety net, reducing exposure to any single sector and helping navigate the crisis more effectively.

Psychological Advantages of Diversification

Diversification offers peace of mind, not just financial benefits. Spreading investments across asset classes can help you stay calm during market volatility, making it easier to stick to your long-term plan and avoid rash decisions.

When market news causes panic, diversification supports clearer thinking, helping maintain a long-term view and avoid emotional reactions that lead to poor decisions. This emotional steadiness is crucial for successful long-term investing.

The Diversification Effect In Action

Generally, the more diversified your portfolio, the lower your overall risk exposure. The following table illustrates this principle:

To illustrate this principle, let’s examine the potential impact of diversification:

Risk Shrinking Magic: The Diversification Effect

See how adding more variety to your investment mix actually reduces your overall risk.

|

Number of Investments |

Risk Level |

Risk Reduction % |

What This Means For You |

|---|---|---|---|

|

1 |

Very High |

0% |

Extremely vulnerable to market fluctuations |

|

5 |

High |

Potentially 20-40% |

Reduced impact from individual company performance |

|

10 |

Moderate |

Potentially 40-60% |

Better protection against sector-specific downturns |

|

20+ |

Low to Moderate |

Potentially 60-80% |

Significant risk reduction and smoother market performance |

This table offers a basic example and does not show specific returns. The actual risk reduction depends on the assets chosen and their connections. Remember, diversification manages risk but doesn’t remove it entirely. Building a well-diversified portfolio is a key step towards reaching your long-term financial goals.

Keeping Balance: Maintaining Your Diversified Portfolio

Your portfolio needs regular attention, like a well-cared-for garden. This section discusses ways to keep your investment balance without constant watching. Think of rebalancing like pruning – trimming overgrowth helps a tree stay healthy. Similarly, selling assets that have grown too much and reinvesting in those that have not done well maintains your desired risk level.

Rebalancing: Why It Matters

Rebalancing is important for effective portfolio diversification over time. As investments grow at different rates, your initial asset allocation changes. For example, a starting 60/40 split between stocks and bonds might turn into 70/30 after a strong year for stocks. This higher stock allocation increases your risk beyond your initial plan. Rebalancing aligns your portfolio with your target allocation, securing profits and reducing risk.

How and When to Rebalance

There are two main rebalancing methods:

Time-based: Review and adjust your portfolio at set intervals, like every six months or annually.

Threshold-based: Rebalance when an asset class changes significantly from its target – for example, if your stock allocation goes beyond the target by 5% or more.

The best method depends on your investing style and risk tolerance. Some prefer a passive, time-based approach, while others favor the active management of a threshold-based strategy.

Common Rebalancing Mistakes

Even experienced investors can make mistakes with rebalancing:

Ignoring rebalancing: Not attending to portfolio drift increases risk and can lead to large losses during market downturns.

Over-rebalancing: Frequent, small adjustments cause unnecessary transaction fees, reducing returns.

Emotional rebalancing: Selling out of fear during market dips locks in losses and disrupts long-term strategy.

Tools and Tips for Easy Rebalancing

Keeping a diversified portfolio doesn’t need complex spreadsheets or tough calculations. Many easy-to-use apps and online platforms make the process simple, offering automated rebalancing features and personalized alerts. These tools watch portfolio performance and notify you when rebalancing is due, removing guesswork. Additionally, several robo-advisors offer automated portfolio management, including rebalancing, at a low cost. By using these resources and avoiding common mistakes, you can effectively maintain a diversified portfolio and work towards your long-term financial goals.

Taking Action: Your Diversification Game Plan

Ready to build a strong investment mix? This section simplifies diversification, making the process easy and engaging. Let’s start.

Check Your Current Investments

First, evaluate your current holdings. Do you mainly own stocks? Are these focused in one industry? Maybe your portfolio is only bonds. Like a balanced meal, a diversified portfolio includes a variety of asset types.

Too Much of One Thing?: If you have too much in one asset type, you’ll need broader diversification. It’s like eating only pizza; despite liking it, you’ll miss essential nutrients.

All Your Eggs in One Basket?: If your stocks are limited to one sector, such as tech, consider expanding into areas like healthcare or energy. This reduces risk from sector-specific downturns.

Not Sure Where to Start?: The following sections will outline easy methods for diversifying your investments, even with limited funds.

Simple Ways to Diversify, Even on a Budget

Diversification doesn’t require a lot of money. Even small contributions can have significant long-term benefits. Index funds and Exchange Traded Funds (ETFs) are especially useful tools for budget-conscious investors.

Index Funds: These funds offer fractional ownership in a range of companies, like getting a slice of a large investment pie. They usually have low expense ratios and easy access.

ETFs: Similar to index funds, ETFs represent a basket of investments. They can track specific sectors, market indices, or even international markets, offering a pre-packaged diversification strategy.

Starting Small: Many brokerage platforms allow investments with small initial deposits, often as low as $100. Like starting an exercise routine, consistent small steps add up over time.

Fixing a Lopsided Portfolio

If your portfolio is heavily weighted toward one asset class, avoid sudden changes. Gradual adjustments work better than abrupt overhauls.

Think Long Term: Make portfolio changes slowly to minimize potential tax effects. It’s like changing lanes while driving; signaling your intentions first ensures a smooth transition.

Rebalance Regularly: Over time, some investments will perform better than others, creating imbalances. Regular rebalancing keeps the desired asset allocation, like pruning a garden to maintain its shape.

Don’t Be Afraid to Ask for Help: Consulting a qualified financial advisor can provide valuable guidance, especially for those new to investing or seeking personalized advice.

Why Diversification Rewards Patience

Market ups and downs are part of investing. Diversification acts as a cushion against these changes, smoothing out the investment journey.

Weathering the Storms: During market downturns, diversification helps ensure that losses in one area are potentially offset by gains in another. This helps maintain portfolio stability during volatile periods.

Long-Term Growth: While no investment strategy guarantees returns, diversification can contribute to long-term wealth accumulation. It’s like planting a variety of seeds in a garden – some will grow more than others.

Remember, diversification is an ongoing process, not a one-time event. Periodically review and adjust your portfolio to align with your changing financial goals and risk tolerance. Just like fine-tuning a recipe, adjustments along the way improve the outcome.

Ready to improve your stock selection process? Explore Stock Decisions, a platform designed to simplify investing and provide insights for informed decision-making.