What Makes a Stock Truly Undervalued?

A stock is seen as undervalued when its market price is below its actual worth. It’s like finding a bargain – something valuable being sold for less. This can happen for different reasons. Negative news might make investors panic and sell, lowering prices. Or, the market might not see a company’s true potential. This presents chances to buy low and possibly sell high once the market adjusts.

Understanding the Difference Between Price and Worth

Spotting these chances is more than just seeking cheap stocks. It involves understanding a company’s future prospects. This means examining its financial health, strengths, and market standing. Just like you’d check an item before purchasing, you need to look into the company behind the stock.

For instance, a company may report lower earnings due to unexpected events like a natural disaster. But if it has a solid past and a good plan for the future, the current low price might not reflect its true worth. This gap can be a good chance for investors. Spotting these short-term drops and seeing long-term potential is crucial to finding undervalued stocks.

Using Financial Metrics to Find Undervaluation

Looking at financial metrics is important for spotting these opportunities. The Price-to-Earnings (P/E) ratio is a popular metric. As of April 30, 2025, some undervalued stocks in the S&P 500 index had low P/E ratios. AES Corp, for example, had a P/E ratio of 4.21, and United Airlines Holdings Inc had a ratio of 6.27. These low ratios suggest these stocks might be undervalued compared to their earnings, making them appealing to investors looking for growth. Understanding these metrics is key to judging a company’s worth. Find more detailed statistics here

Additionally, looking at ratios like Price-to-Book (P/B) and Enterprise Value-to-EBITDA (EV/EBITDA) gives a wider view of a stock’s potential. These ratios help evaluate a company’s assets, debt, and profitability against its market price. Comparing these metrics to industry averages and past trends can help find underpriced companies. This careful analysis sets apart smart investors who find undervalued stocks from those who just chase low prices without considering real worth.

Simple Numbers That Reveal Hidden Stock Bargains

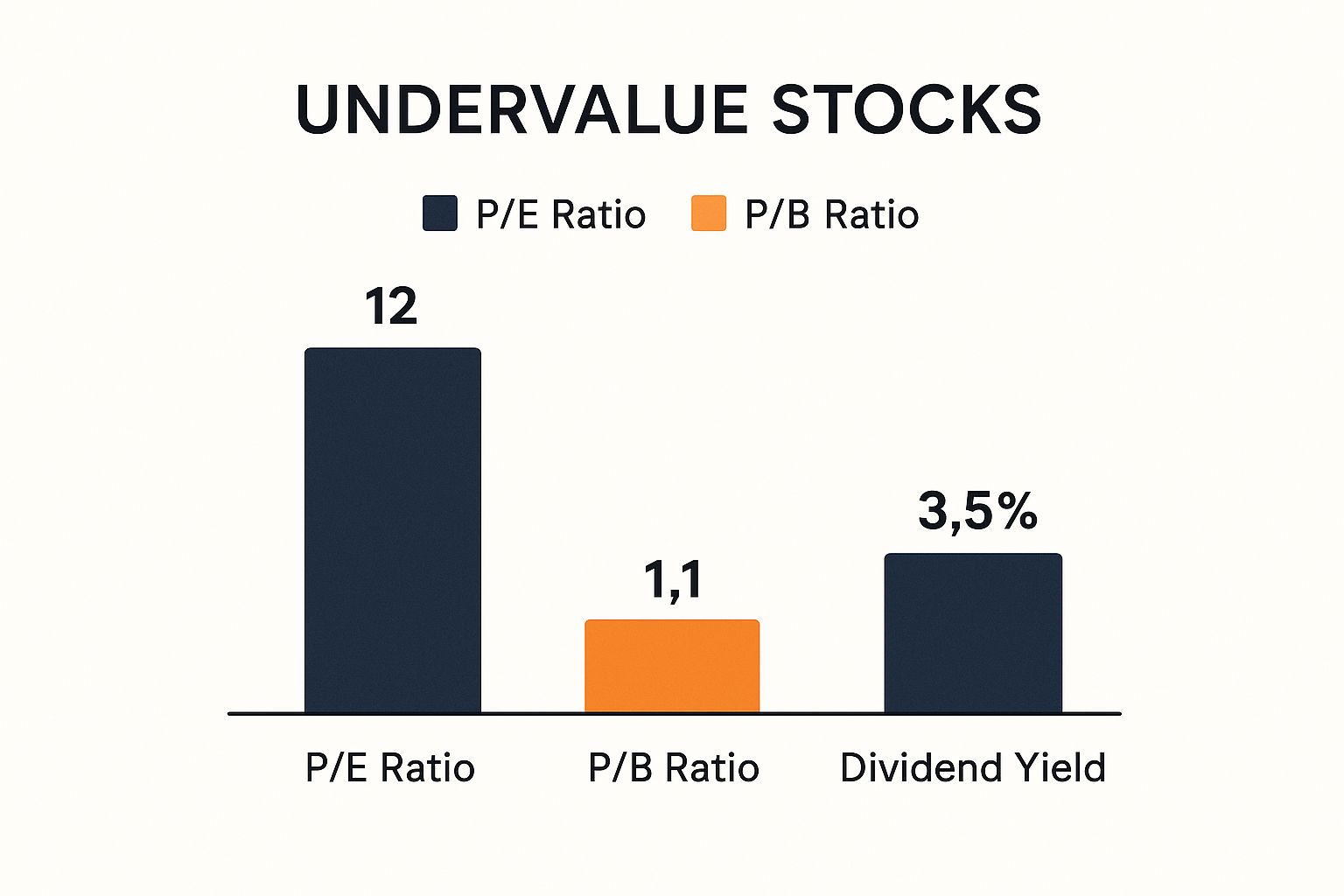

The infographic above shows three important ratios for spotting potentially undervalued stocks: Price-to-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and Dividend Yield. Lower P/E and P/B ratios, along with a good dividend yield, can point to interesting investment opportunities. These factors suggest that a stock’s price might be lower than its earnings and assets, while still offering returns to shareholders.

Finding hidden stock deals often begins with a few key numbers that reveal a company’s true value. Two of these are the P/E and P/B ratios. These numbers help compare a stock’s price with its earnings and assets.

Understanding the P/E Ratio

The P/E ratio shows how much investors will pay for each dollar of a company’s earnings. A lower P/E ratio might suggest a stock is undervalued. For instance, if Company A has a P/E ratio of 10 and Company B has a P/E of 20, Company A might be the better option because you’re paying less for each dollar of earnings. Knowing a company’s real value is important. For more details, see this beginner’s guide to stock valuation.

Looking at the P/B Ratio

The P/B ratio compares a stock’s price to its book value, which is the company’s assets minus its liabilities. A P/B ratio below 1 might mean a stock is priced below its net asset value. But like the P/E ratio, it’s important not to rely on the P/B ratio alone. Always do more research—it’s like comparing prices at different stores before buying a TV to get the best deal!

Here’s a table to show how these measures can be used together:

Finding Bargains: Easy Stock Value Tips

Simple value indicators anyone can use

| Number to Check | What It Tells You | Good Range to Look For | When It Might Mislead You |

|---|---|---|---|

| P/E Ratio | How much investors pay for each dollar of earnings | Generally, lower is better, but depends on the industry | High-growth companies often have high P/Es |

| P/B Ratio | Compares stock price to the company’s net asset value | Below 1 might suggest undervaluation | Not reliable for companies with significant intangible assets |

| Dividend Yield | Percentage of a company’s share price paid out as dividends | Higher yields can be attractive, but consider sustainability | A very high yield could signal financial distress |

This table summarizes how the P/E ratio, P/B Ratio, and Dividend Yield can help identify potentially undervalued stocks. While these metrics are helpful starting points, they shouldn’t be the only factors you consider.

Putting It All Together

Comparing a company’s P/E and P/B ratios to its competitors and its own historical averages provides a better understanding of potential undervaluation. Remember, though, these ratios are just a starting point. Further research, including company news, industry trends, and overall financial health, is vital for verifying initial insights from these numbers. This process equips you to make more informed investment choices, using both the numbers and a solid understanding of the company’s potential.

Spotting Entire Market Sections on Sale

Sometimes, finding undervalued stocks is like discovering a huge sale. It’s not just single items; whole sectors can be undervalued. This offers a big chance for smart investors. This often occurs when an industry is out of favor, maybe due to temporary issues or bad news.

Why Entire Sectors Can Become Undervalued

Several reasons can lead to a sector’s decline. Changes in consumer habits can temporarily affect an industry. For instance, streaming services like Netflix impacted traditional cable companies. New government rules can also cause uncertainty, prompting investors to sell stocks in a sector. This can create a buying chance for those willing to do their homework.

Economic factors, like rising interest rates or slowdowns, can also impact certain sectors more. For example, the real estate sector is often affected by interest rate increases. These market trends can lower the value of many stocks, even if some companies in the sector are still strong.

Historically, some sectors have been more undervalued than others. For example, entering the second quarter of 2024, sectors like real estate, utilities, and communication services were seen as the most undervalued. This can be due to market trends and investor opinions. On the other hand, sectors like industrials, technology, financial services, and consumer defensive stocks seemed overvalued. Spotting these trends can help investors find sectors with hidden opportunities. Learn more about this topic

Identifying Opportunities and Avoiding Pitfalls

It’s important to know the difference between a temporary drop and a lasting decline. Ensure the sector’s issues are short-lived, not permanent. Carefully look into why the sector is undervalued. Is it a short-term issue or a deeper problem within the industry?

Looking for Signs of a Rebound

Watch for early signs of recovery. This might include new products or services in the sector, or signs of demand picking up. For example, more investment in renewable energy could indicate a rebound in clean energy.

These signs often come before prices rise, letting you buy low before the market notices. Diversification is important. Don’t put all your investments in one place, even if it looks cheap. By considering these factors, you can focus on promising sectors and potentially find several undervalued stocks.

Handy Tools That Make Investing Easier

Searching for good stocks can be like finding a needle in a haystack. Luckily, stock analysis tools make it simpler. These tools work like personal assistants, helping you find hidden opportunities in the market. Let’s check out some useful free and paid options.

Stock Screeners: Your Stock Search Helpers

Stock screeners are like search filters for the stock market. They let you scan many stocks based on certain criteria. Want companies with low price-to-earnings (P/E) ratios or high dividend yields? Or are you interested in a specific industry? Screeners can assist. Many websites offer free basic screeners, while paid ones offer more features. For example, you could find stocks with a P/E ratio under 15 and a dividend yield above 3%. This helps you focus on companies that might be undervalued and pay regular dividends.

Comparison Tools: Checking Out Competitors

After spotting some potential stocks, comparison tools help you see how companies stack up against others. You can compare key details side-by-side, like revenue growth, profit margins, and debt levels. This helps you quickly notice companies that may be doing better than their peers but are priced lower. It’s similar to comparing different car features and prices before buying; you want the best deal!

Watchlists: Tracking Your Top Picks

As you research, you might find several companies you want to follow. Watchlists let you save these stocks and watch their progress. This is handy for tracking price changes and spotting buying chances. Think of a watchlist as a shopping list for stocks; you can add and remove companies as you adjust your investment plan.

To find undervalued stocks, many investors use platforms like Morningstar for market data and analysis. Resources like Current Market Valuation help check if the market is overvalued or undervalued and spot stocks that might be undervalued compared to their real worth. These tools often use fair value estimates to help investors make informed decisions.

To pick the right tool for you, here’s a comparison of some popular stock research platforms. The table below shows their main features, pricing, and how easy they are to use.

Stock Treasure Hunting Tools Compared

Find the perfect helper for your investment journey

| Tool Name | Perfect For | Cool Features | Price | Easy to Learn? |

|---|---|---|---|---|

| Yahoo Finance | Beginners | Basic stock screening, news, charts | Free | Yes |

| Google Finance | Casual investors | Real-time quotes, portfolio tracking | Free | Yes |

| Finviz | Intermediate investors | Advanced charting, customizable screeners | Free (basic), Paid (premium) | Medium |

| TradingView | Experienced traders | Technical analysis tools, community forums | Free (basic), Paid (premium) | Medium |

| Bloomberg Terminal | Professionals | In-depth market data, analytics | Paid (expensive) | No |

As you can see, there’s a wide range of tools available, from free resources like Yahoo Finance and Google Finance for beginners, to sophisticated platforms like TradingView and Bloomberg Terminal for seasoned professionals.

Whether you’re just starting out or you’re a seasoned investor, these tools can simplify the often complex process of finding undervalued stocks. They automate the tedious research tasks, allowing you to focus on making informed investment decisions. So, start exploring these resources and uncover your next investment opportunity.

Spotting Clues That Signal Undervalued Gems

Finding undervalued stocks involves searching for overlooked clues and signs of future potential. This guide will teach you to spot these signals and uncover investment opportunities, focusing on scenarios that may temporarily lower stock prices, presenting chances for observant investors.

Short-Term Challenges: Not Necessarily Negative

Companies sometimes face short-term problems that may deter investors, even if their long-term outlook is strong. Issues like missed earnings forecasts or negative news can affect stock prices temporarily. For example, a clothing retailer might see a stock dip after a poor quarter due to unexpected weather. This doesn’t imply a fundamental problem and may offer a buying opportunity for investors who believe in the company’s future.

Management changes can also create uncertainty. New leadership might prompt some investors to sell, but it can also introduce beneficial strategies. It’s important to evaluate the situation objectively rather than reacting out of fear.

Market Overreactions: Opportunities in Panic

Market overreactions can present good buying opportunities. Investors sometimes react strongly to bad news, pushing stock prices below their real value. During periods of market anxiety, investors may sell stocks hastily. These times may be ideal for finding undervalued companies. A stock screener can help identify and analyze these stocks.

For instance, during the early COVID-19 pandemic, many strong companies saw their stock prices fall. This was a chance to purchase high-quality stocks at a discount. Investors who recognized the temporary nature of the market’s panic were rewarded later.

Spotting Catalysts for Recovery

After identifying an undervalued stock, look for catalysts that might drive its recovery. Catalysts are events that renew investor interest, like a new product launch or cost-cutting measures. For example, a tech company developing successful software could see increased revenue and investor interest. Differentiating truly undervalued stocks from those cheap for a reason requires careful analysis.

Building Your Portfolio of Undervalued Stocks

This part offers advice on creating a portfolio of undervalued stocks while managing risk. Think of it like building a team with diverse strengths.

Diversification: Spread Your Bets

Avoid concentrating investments in one company. Diversifying across industries like technology, healthcare, and consumer goods minimizes the impact of poor performance by a single stock.

Determining Investment Amounts

Investment amounts should align with your risk tolerance and financial goals. Don’t invest more than you can afford to lose in one stock. Begin with small amounts and increase gradually as you gain experience.

Timing Your Moves

Knowing when to buy is crucial. Watch for signs of a company’s potential rebound, like a new product release or positive news. This is akin to seizing a good deal before others notice.

Monitoring Investments

Stay informed by reviewing your portfolio regularly, without obsessing over daily fluctuations. Check for significant changes in the companies you’ve invested in, such as improved financials or growing market share.

Knowing When to Sell

Recognize when to sell if a stock reaches its intrinsic value or if initial undervaluation reasons no longer apply. For instance, a high P/E ratio compared to industry averages may indicate it’s time to take profits.

By following these strategies—diversification, cautious investment sizing, smart timing, regular monitoring, and knowing when to sell—you can build a portfolio with potential for long-term growth. This approach suits those who wish to manage investments effectively without constant market monitoring.

Ready to explore undervalued stocks? Stock Decisions simplifies the process. Our platform offers tools and insights to find promising investments, providing clear data and risk assessments. Trusted by many for research on popular stocks like GOOGL, MSFT, AMZN, AAPL, META, and NVDA. Start making informed decisions today—visit Stock Decisions to learn more.