Why Investment Risk Management Matters Now

Managing risk is key for smart investing. It protects your money and helps you reach your financial goals. Think of risk management as your guide, helping you through tricky market times.

Why Investment Risk Management Matters

Why is it so important today? Markets change a lot. There are always new chances and challenges. Things like changes in interest rates, inflation, and events around the world can affect your money. A good risk plan helps you handle these shifts.

The financial world is also getting more complicated with many investment choices. This makes risk management even more important. A clear plan lets you make smart choices and keep your savings safe. Risk management gives you the tools to deal with these challenges. For those looking to boost their online presence in finance, SEO for Financial Services offers helpful tips.

How Risk Management Helps You

Investment risk management doesn’t mean getting rid of risk. Taking some risk can lead to bigger profits. The key is to take enough risk to help you grow without risking your financial safety.

Risk management is becoming more important. The market grew from $12.09 billion in 2024 to $13.78 billion in 2025. It might reach $21.62 billion by 2029. This shows that more people see how important risk management is.

Starting With Risk Management

First, figure out how much risk you can handle. Are you careful, or do you like taking more chances? Knowing this helps you pick the right investments. Learn about different risks too. Market ups and downs, bad economies, and company issues all matter.

By knowing these risks and planning for them, you can feel more sure when investing and improve your chances of doing well over time.

Knowing Your Risk Comfort Zone

Before you start investing, it’s important to know your risk comfort zone. This is how much risk you can handle. Think of it like choosing how spicy you want your food. Some people like mild, others like it hot. Knowing your zone helps you pick the right investments for you.

Knowing Your Risk Tolerance

Risk tolerance is how well you can deal with gains and losses without getting stressed. Some people are okay with big changes in the market, hoping for big returns. Others like steady growth, even if it means smaller gains. There’s no right answer. The best choice is what keeps you calm and focused on your long-term goals.

Several things can affect your risk tolerance:

Age: Younger people can often handle more risk because they have time to bounce back from losses.

Goals: If you’re saving for something soon, like a house, you might take less risk than someone saving for retirement years away.

Job: A stable job with steady income might let you take more risks than someone with an unpredictable income.

Time: A longer investment timeline generally allows for more risk.

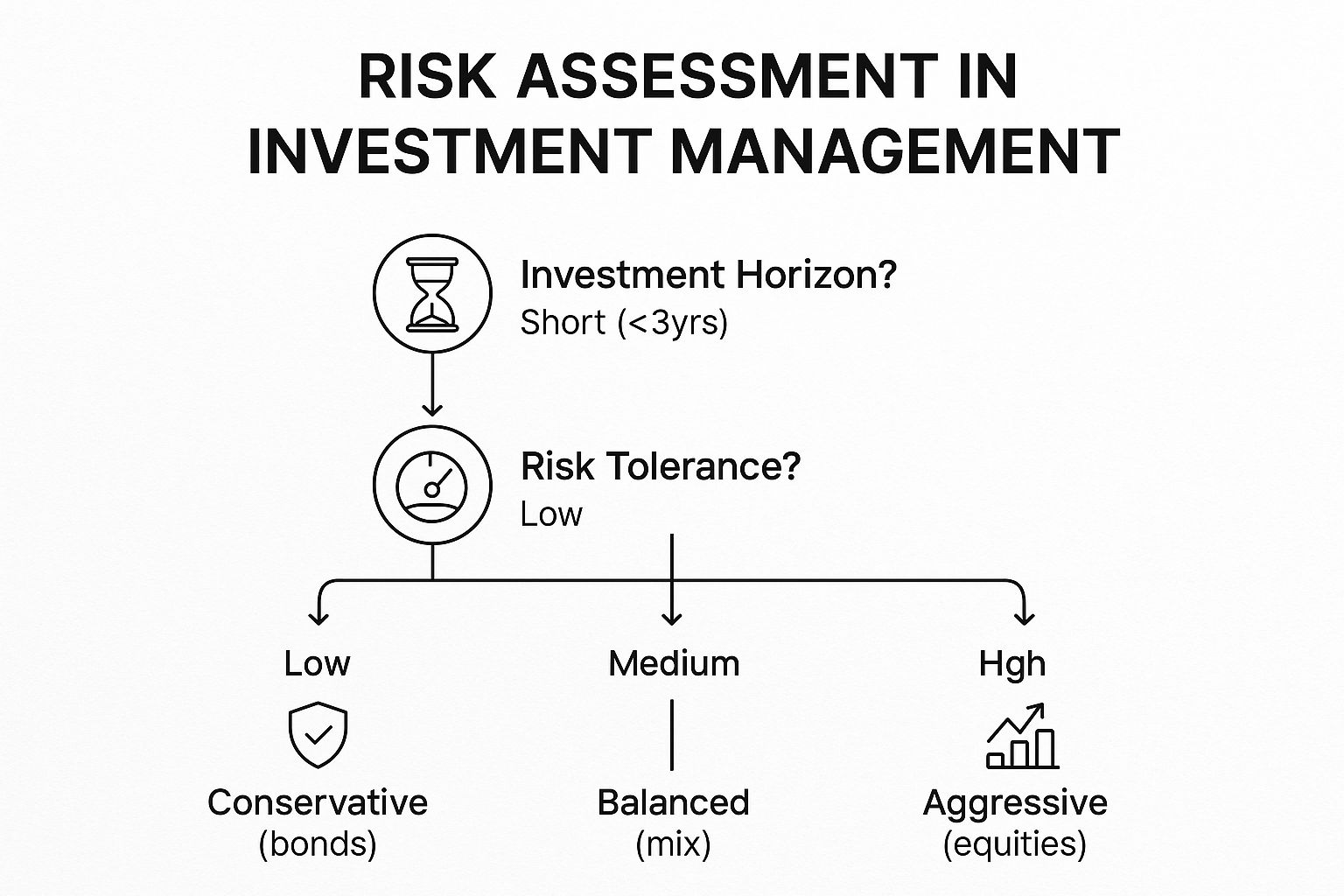

Visualizing Risk Assessment

The infographic below shows how your investment timeframe and risk tolerance can guide your investment strategy.

This decision tree shows how things like how long you plan to invest and how much risk you can handle affect your investment choices. If you plan to invest for a long time and are okay with risk, you might choose risky options like stocks. If you need your money soon and don’t like risk, you might pick safer options like bonds. A mix of both can work well if you can handle some risk and have more time.

Find Your Risk Comfort Zone

To figure out what risk level suits you, check the table below. It gives a simple guide based on everyday situations.

|

Risk Level |

Age Range |

Income Stability |

Investment Timeline |

Financial Goals |

Best Investment Choices |

|---|---|---|---|---|---|

|

Conservative |

Older, nearing retirement |

Stable or fixed |

Short-term |

Preserve capital, generate income |

Bonds, CDs, money market accounts |

|

Moderate |

Middle-aged, established career |

Relatively stable |

Medium-term |

Balance growth and preservation |

Mix of stocks, bonds, and other assets |

|

Aggressive |

Younger, early career |

May be variable |

Long-term |

Maximize growth potential |

Primarily stocks, some alternative investments |

Remember, this table is just a simple guide. Your comfort with risk might differ. It’s always wise to speak with a financial advisor for advice suited to you.

Different Risk Profiles

Here are some examples. Sarah is young and saving for retirement. She’s okay with some risk and wants her money to grow over time. She’s a moderate investor. David is close to retiring. He wants to keep his savings safe. He’s a conservative investor, looking for safe choices. Maria has been investing for a long time and earns a lot. She’s ready to take big risks for bigger returns. She’s an aggressive investor. Each person picks what fits their risk comfort level.

Knowing your risk comfort helps you make good investment choices. These choices should fit your money goals and make you feel secure. This is the base of good risk management in investing.

Proven Investment Risk Management Tactics That Work

Let’s look at some simple ways to manage investment risks. These tips can help protect your money and reach your financial goals.

Spread Your Investments: Don’t Put All Your Eggs in One Basket

Putting all your money in one stock is risky. If it does poorly, you could lose a lot. Diversification means spreading your money across different types of investments. It’s like having eggs in different baskets.

Stocks: Owning a piece of a company.

Bonds: Loans you give to a government or company.

Real Estate: Physical properties like houses or land.

Commodities: Raw materials such as gold or oil.

By spreading your investments, you lessen the impact if one does badly.

Rebalance Regularly: Keep Your Risk Steady

The market goes up and down, changing your risk level. Rebalancing means adjusting your investments to stick to your plan.

For instance, if your stocks grow more than other investments, they might take up more of your portfolio than planned. Rebalancing means selling some stocks and buying other assets to keep your risk level steady.

Dollar-Cost Averaging: Invest Regularly Through Ups and Downs

Dollar-cost averaging is about investing a set amount regularly, no matter the market. This can reduce risk over time. When prices are high, you buy fewer shares; when low, you buy more. This helps you get a lower average price.

Managing Different Kinds of Risks: Be Prepared

To manage risk well, know the types of risks. Market risk is the ups and downs of the market. Credit risk is when a borrower might not pay back a loan. Liquidity risk is the trouble of selling an investment quickly. Other risks include inflation and interest rate changes. A survey by Deloitte showed that while financial institutions handle financial risks well, they struggle with non-financial ones. Check the Deloitte Risk Management Survey for more details. By knowing and managing these risks, you can protect your investments better.

Diversification, rebalancing, and dollar-cost averaging are key ways to handle investment risks. These strategies can help you build a strong financial future.

How World Events Affect Your Investment Risks

Big events in the world can greatly affect your investments. Wars, trade fights, elections, and new rules from governments can all cause markets to change. Knowing about these events and how they might affect you is important for managing investment risks.

Learning From the Past

History can teach us about how markets behave. By looking at how markets reacted to big events before, we can see patterns. For example, after the crisis in 2008, markets went down fast but then got better. This shows how markets can bounce back. Studying past patterns can help you make better choices when things are uncertain.

Telling the Difference Between Noise and Real Threats

There is a lot of news all the time. It’s important to know what news is just noise and what news really matters for your long-term goals. Not every news story means you need to change your investment plan. For tips on making strong plans, you can check out different Risk Management Frameworks. These can give you helpful tools and ideas.

Staying Informed Without Worry

It’s good to stay informed, but don’t get overloaded with information. Stick to reliable news and don’t watch market changes too closely. Keep checking your investment plan instead of reacting to every news story. This is a key part of managing investment risks. Being clear-headed and calm is important when the market is shaky.

Global Risks and Market Feelings

World events bring many risks. Knowing about these risks is key for managing investments well. These risks can change how investors feel and how markets are valued. BlackRock‘s Geopolitical Risk Indicator (BGRI), updated in April 2025, helps us see how these risks are viewed by the market. It uses news and market data to follow discussions on global instability. You can learn more at BlackRock’s Geopolitical Risk Dashboard.

Protecting Your Portfolio in Uncertain Times

Several strategies can help protect your investments during periods of global uncertainty. Diversifying your portfolio with a mix of asset classes, such as stocks and bonds, can provide a cushion against market downturns. You can also adjust your investment allocations to maintain your desired risk level. Most importantly, avoid making hasty decisions driven by fear. Adhering to your long-term investment plan, while making informed adjustments, is crucial for successful investment risk management.

Tech Tools That Make Risk Management Easier

Managing investment risk can seem tough, but technology makes it easier. There are lots of tools to help protect your money, like apps and websites. Let’s look at some helpful ones.

Portfolio Trackers: See All Your Investments

Portfolio trackers show all your investments in one place. They give a quick look at how your investments are doing. Two popular ones are Personal Capital and Mint.

Many trackers connect to your accounts. This keeps them updated, so you can watch your progress. Some trackers also check how your investments are spread out, which helps manage risk.

Scenario Planners: Plan for Different Situations

Scenario planners let you see how your investments might do in different situations. You can test what happens if the market crashes or interest rates go up.

This helps you get ready for bad times and change your plan if needed. Some investment sites have these tools, while others need separate software.

Risk Calculators: Know Your Risk Level

Risk calculators are simple quizzes. They help you find out how much risk you can handle. By answering questions about your goals and how you feel about market changes, you get a risk score. This helps you choose investments that fit your risk level.

Many companies have free risk calculators on their websites. They help you understand your investment choices and make smart decisions.

Free vs. Paid Tools: Making the Right Choice

There are many free tools for managing risk, like simple portfolio trackers and risk calculators. But, if you want more features and deeper insights, you might think about paying for a tool. Paid tools can include detailed scenario planning or personal financial advice.

The best choice depends on what you need and how much you can spend. Look at what’s available and pick the tools that match how you invest.

To help you decide, let’s look at some popular risk management tools. We’ll compare them based on features, cost, and who they are good for.

Here is a comparison table to guide your decision: It shows the main features, good points, and downsides of different risk management tools.

Risk Management Tools Comparison

Find the right tool for your needs and budget

|

Tool Type |

Main Purpose |

Best For |

Price Range |

Key Benefits |

Drawbacks |

|---|---|---|---|---|---|

|

Portfolio Tracker |

Track investments, view performance |

All investors |

Free – $$ |

Easy overview, automatic updates |

Limited analysis |

|

Scenario Planner |

Test portfolio in different situations |

Moderate to aggressive investors |

$ – $$$ |

Prepare for various outcomes |

Can be complex |

|

Risk Calculator |

Determine risk tolerance |

All investors |

Usually Free |

Helps choose appropriate investments |

Simple assessment |

As this table shows, there’s a range of tools available to fit different investing styles. Portfolio trackers are great for a quick overview, while scenario planners offer deeper insights. Risk calculators provide a simple starting point for understanding your risk tolerance.

Finding the Right Tools: Matching Your Investing Style

The ideal investment risk management tools depend largely on your personal investing style and goals. Hands-on investors might benefit from platforms with advanced charting and analysis features. Those who prefer a simpler approach may find a basic portfolio tracker sufficient.

Some platforms also offer valuable educational resources, such as articles and tutorials, to help you expand your investment knowledge. Others provide access to financial advisors for personalized guidance and support.

Technology empowers you to take control of your financial future by simplifying investment risk management. Exploring and utilizing the numerous tools available will help you make informed decisions and navigate the complexities of the market with greater confidence. Choose the tools that best align with your investment needs, budget, and preferred approach, and watch your financial goals become a reality.

Crafting Your Personal Investment Safety Plan

Creating a plan to handle investment risks is like drawing a map for your money journey. It helps you make choices no matter how the market changes. This plan can be simple. Here’s a straightforward guide to making your own.

Know Your Risk Goals: Decide What You Want

Before you start investing, think about your money goals. Are you saving for a house? Planning for retirement? Your goals will affect how much risk you can take. If you need the money soon, safer investments are better. If you have time, you might choose options with higher returns and risks. Clear goals keep you focused.

Watch for Warning Signs: Know When to Change

Set up signals that tell you to review your plan. These might be a big market drop, rising interest rates, or poor investment performance. These signals are like alarms, warning you early about possible problems. Spotting issues early helps you act calmly and avoid losses.

Have Backup Plans: Be Prepared

Think about different market scenarios, especially bad ones. What will you do if the market falls? Will you sell, hold, or buy more? Having a plan helps you stay calm and make smart choices when things get rough.

Regular Checkups: Stay on Course

You don’t need to check your plan daily. Looking at it once or twice a year is enough. Big life changes like a new job or family might need more reviews. It’s like a yearly visit to the doctor to ensure your plan is healthy and fits your goals.

Avoid Common Mistakes: Learn from Others

Common mistakes include reacting emotionally to market changes. Selling in panic or buying in excitement often leads to poor results. Also, don’t put all your investments in one place. Spread them out to manage risk better. Don’t put all your eggs in one basket.

Your Risk Management Checklist: Keep It Simple

Use this checklist to make and keep your investment risk plan:

Set Your Investment Goals: What are you saving for?

Know Your Risk Comfort: How much risk can you handle?

Pick Your Investments: Choose ones that match your goals and risk level.

Spot Warning Signs: What will trigger a plan review?

Create Backup Plans: What actions will you take if the market changes?

Review Regularly: Update your plan, especially with life changes.

By following these steps, you can create a personal investment safety plan to protect your money and reach your goals. This approach builds confidence and helps you stay calm during market ups and downs.

Ready to take charge of your investments? Stock Decisions makes market information simple and useful. Our platform offers in-depth analysis, risk tools, and real-time data to help you make smart investment choices. Visit us today to start making better investment decisions.