Why Data-Driven Investing Is Changing the Game

Investing can be confusing. Many people go with their gut or follow trends. This often leads to choices based on feelings instead of facts. Sadly, this can result in bad investments and losing money. Data-driven investing offers a smarter way.

Data-driven investing uses facts and studies to guide decisions. It’s like a detective solving a case. Detectives rely on evidence, not guesses, for better results. Similarly, data helps investors find good chances and avoid mistakes.

Benefits of Using Data in Investing

Data helps investors make smart choices. Here’s how:

Spot Great Deals: Data can show valuable investments that others might miss, helping you find true value.

Reduce Risk: Good data gives insights into possible issues, helping you avoid risky decisions and keep your money safe.

Stay Calm: Feelings can cloud your judgment. Data helps you stay focused and make wise choices, even when markets change.

Investing with data has proven successful. Investors using data can earn up to 20% more each year. This shows the benefit of taking guesswork and emotions out of investing. Find out more about data-driven investing. Over time, this leads to better profits.

How Data Helps You

You don’t need to be a math expert to use data. Easy-to-use tools give you clear insights. These tools present info in a simple way.

Here’s how to use data:

Check Business Health: Look at sales, profits, and overall health to pick strong companies.

Watch Market Trends: Follow market changes to make smart choices about buying and selling.

Compare Investments: Use data to compare stocks, bonds, and other options. This helps you pick the best for your goals.

Using data in investing isn’t about tough math. It’s about using info wisely to reach your financial goals. It helps you make smart choices and build a secure financial future.

Unlocking Market Insights Through Historical Data

Smart investors know that looking at past market trends can give them valuable clues for future success. This section explains how to use this data to make smarter investment choices. We’ll explore helpful patterns and discuss which ones are less relevant. Learn how successful investors use economic indicators, price changes, and company information to find good opportunities. We’ll use simple examples to show how to apply this analysis to your own investment plan without getting overwhelmed. You’ll also discover how other investors use these insights to stay calm during market fluctuations and find hidden value that others miss. Finally, we’ll look at simple ways to test your ideas before risking real money.

Why Look Back to Move Forward?

Historical data shows us how the market has performed in different situations. This can help us anticipate future trends and make better decisions. It also allows us to spot opportunities and avoid risks more effectively. For example, knowing how a stock performed during past recessions can inform your choices today.

Historical data is important for data-driven investing. It provides crucial insights into market behavior and emerging trends. Analyzing past data can help us find patterns, such as support and resistance levels. These levels are price points where a stock has historically struggled to break through, either above (resistance) or below (support). Databases like CRSP and Global Financial Data (GFD) offer a wealth of historical information. CRSP covers over 25,000 stocks and all Treasury issues since 1926. GFD provides data on global markets going back to 1700. Discover more insights about historical data.

Types of Historical Data to Use

Different kinds of data give us different ideas. Here are some important ones to think about:

Price Data: Shows how the price of something has changed over time. Helps find patterns and trends.

Economic Indicators: These numbers tell us how the economy is doing. Examples are inflation, unemployment, and interest rates.

Company Performance Data: Includes things like earnings, sales, and debts. This helps check how a company is doing financially.

Market Sentiment: Shows how investors feel about a market or asset.

Using Historical Data

Here’s how to use past data well:

Backtesting: Test your investment plan with old data. See how it might have worked. Adjust before using real money.

Identifying Trends: Look for long-term trends. This can help predict future directions.

Understanding Market Cycles: Markets rise and fall in cycles. Studying these can help you decide when to buy or sell.

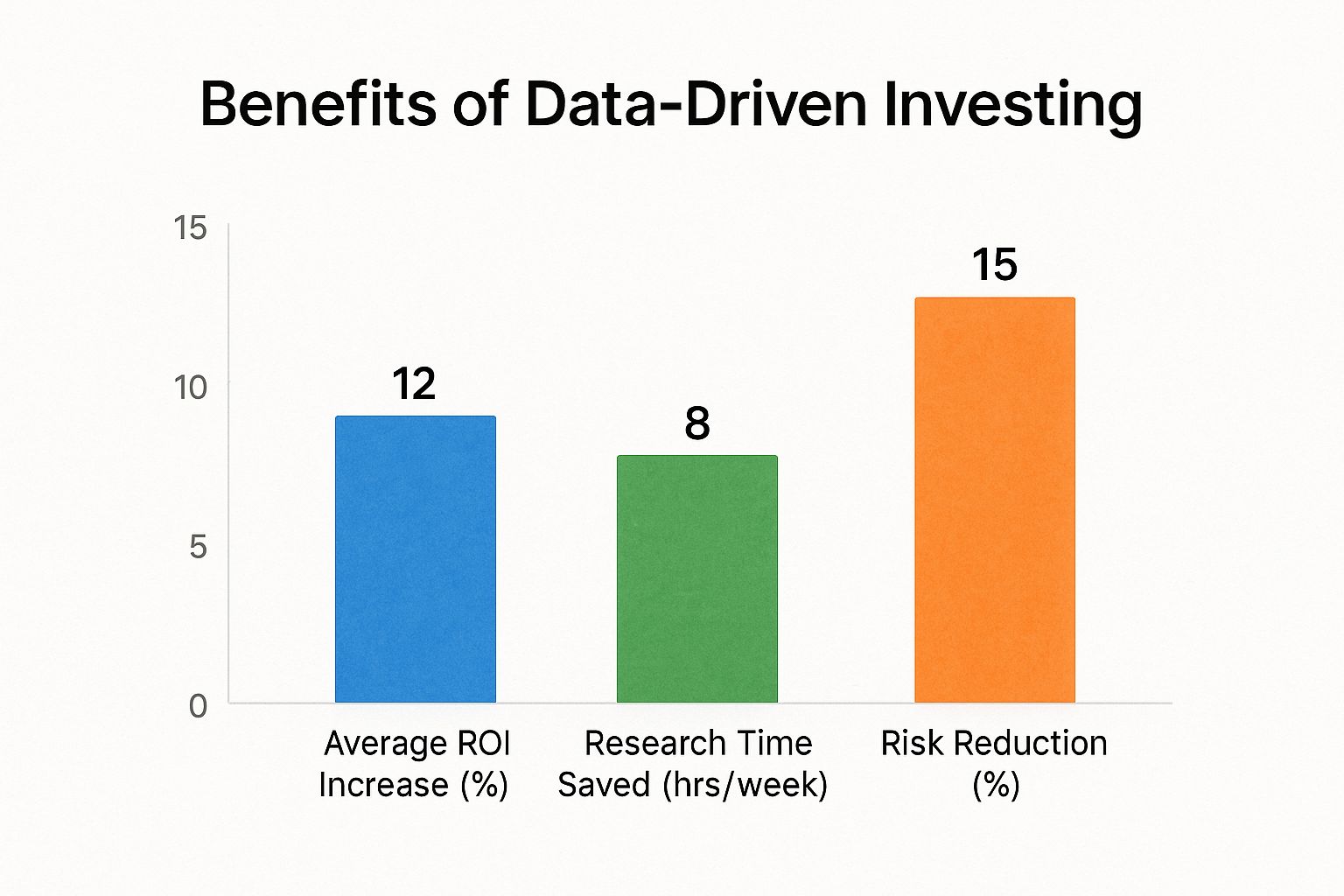

The chart below shows the benefits of using data for investing.

This chart shows that using data for investing can increase returns by 12% on average. It can also save 8 hours of research each week and lower risk by 15%. These results show how helpful data can be when making investment decisions.

To better understand the value of past data, let’s look at some important sources:

The table below compares a few key sources of historical data for investors. It shows their coverage, time periods, markets, and costs.

|

Database Name |

Data Coverage |

Time Period |

Markets Covered |

Cost Level |

|---|---|---|---|---|

|

CRSP |

Stock prices, returns, dividends, and other company-level data |

1926 – Present |

US |

High |

|

Global Financial Data (GFD) |

Macroeconomic data, interest rates, exchange rates, and commodity prices |

1700 – Present |

Global |

High |

|

Compustat |

Financial statements and other company information |

Varies by company |

Global |

High |

|

Yahoo Finance |

Stock prices, historical data, and financial news |

Varies by company |

Global |

Free (limited data), Premium options available |

|

Google Finance |

Stock prices, historical data, and financial news |

Varies by company |

Global |

Free (limited data) |

This table gives a quick look at the different places investors can find old data. Picking the right one depends on what you need and how much you want to spend. Some are free but limited, while others cost more and offer lots of data.

Avoiding Too Much Data

Having data is good, but too much can be overwhelming. Stick to the facts that matter most. Begin with a few important numbers and add more as you go. Simple ideas are often better than complicated ones. Don’t make it hard for yourself! By knowing how to use old data, you can make smarter choices and do better in the stock market. Using data helps you make wise decisions based on facts, not just guesses.

How AI Is Transforming Data-Driven Investing

Artificial intelligence (AI) is changing how we invest. What does this mean for you? Here, we’ll see how AI can help you make better investment choices. We’ll look at real examples and learn from experts in financial tech.

AI tools can spot market trends, read news, and handle data quickly. We’ll also show how easy-to-use platforms make AI simple, even if you’re not tech-savvy. Finally, we’ll talk about the limits of AI and why it’s still important to use your own judgment.

AI: Your New Investing Helper

AI can quickly go through lots of information. This speed helps investors find hidden patterns and insights. Imagine trying to read every news article about a company. It’s a big job. AI can do this in minutes.

For example, AI can:

Find Trends: AI looks at market data to find new trends and guess future price changes.

Read News: AI checks news and social media to see what people think about a company or investment. This is called sentiment analysis.

Do Tasks: AI can handle boring tasks like rebalancing a portfolio, giving you more time for other important things.

AI Tools for All Investors

Many platforms now offer AI tools that are easy to use. These tools make complex data accessible to everyone. You don’t have to be a tech expert to use them.

Some popular AI tools are:

Robo-Advisors: These platforms use AI to build and manage your investment portfolio.

Stock Screeners: These tools help you find investments that match your needs.

Sentiment Tools: These tools check the mood and opinions about a stock or market.

Data analysis and machine learning have made data-driven investing better. For example, algorithmic trading uses coded instructions to trade automatically. This is a more advanced data analysis method. Other data-driven strategies, like event-driven investing, have shown great returns, sometimes reaching 172.2%. You can learn more about this topic.

Blending AI with Human Insight

AI is a helpful tool, but it’s not a magic solution. It’s key to mix AI insights with your own thinking and research. AI can point out investment chances, but you should always check things carefully before making any decisions.

Here are some tips for using AI well:

Know the Limits: Remember, AI is always changing. Don’t depend on it completely.

Check the Source: Make sure the data feeding the AI is correct and from reliable places.

Use Your Judgment: Don’t let AI make all your choices. Use your knowledge and thinking skills to look at each opportunity.

By mixing AI’s speed and data skills with human thinking, you can make smarter investment choices. This approach lets you use the strengths of both AI and human mind. It helps you make decisions based on data while keeping a sharp and careful view.

Making Your Own Data-Driven Plan

Building a strong investment plan needs more than just instincts. It needs a plan based on data that fits your style. This section will help you create a plan that uses information well, whether you like value stocks, growing companies, or income options. We’ll look at how to pick the right data, learn from others, set clear rules, and test your plan safely.

Matching Your Style With Data

Your investment style should dictate the type of data you focus on. Value investors hunting for undervalued companies should prioritize metrics like the Price-to-Earnings (P/E) ratio and Price-to-Book (P/B) ratio. Those seeking growth stocks should look at revenue growth and Earnings Per Share (EPS) growth. If you’re an income investor, concentrate on data like dividend yield and company stability. For a more data-driven approach, consider using predictive analytics tools like Kleene.ai.

To help you visualize the connection between investment style and data, let’s look at the following table:

Must-Track Metrics for Your Investment Style

The most important data points to monitor based on your personal investing approach

|

Investment Style |

Primary Metrics |

Secondary Metrics |

Data Sources |

Review Frequency |

|---|---|---|---|---|

|

Value Investing |

P/E Ratio, P/B Ratio |

Debt-to-Equity Ratio, Dividend Yield |

Company financial reports, market data providers |

Quarterly |

|

Growth Investing |

Revenue growth, EPS growth |

Market share, Innovation potential |

Company news, industry reports |

Monthly |

|

Income Investing |

Dividend yield, Payout ratio |

Company stability, Debt levels |

Company financial reports, dividend databases |

Annually |

This table highlights the key metrics for each style, along with their sources and suggested review frequency. By focusing on the right data, you can make more informed investment choices aligned with your goals.

Setting Clear Buy and Sell Rules

Data empowers you to create objective rules for buying and selling, preventing emotional decisions. For instance, you might establish a rule to buy a stock when its P/E ratio dips below a specific threshold, or sell if a company’s debt levels become too high.

Here are a few examples of data-driven rules:

Buy Rule: Buy when a stock’s price falls 15% below its 52-week high.

Sell Rule: Sell if a stock’s earnings drop 10% or more year-over-year.

Rebalance Rule: Adjust your portfolio quarterly to maintain your target asset allocation.

Tracking and Improving Your Strategy

Keeping track of your strategy is important to see how well it works. Write down all your buys, sells, and returns. This helps you know what works and what needs fixing.

Here are some ways to track:

Spreadsheet: Use a table to record your trades and check key numbers.

Investment Apps: Try apps made for tracking and checking investments.

Journaling: Keep a diary of your choices and reasons to learn from successes and mistakes.

Testing Your Strategy Safely

Before putting in a lot of money, it’s smart to test your plan with paper trading. This lets you try trading like it’s real but with no real money, so it’s safe. Many online brokers have paper trading accounts.

By making a plan based on data, you can better control your money future. Data helps you decide wisely, boosting your chances to meet your goals.

Essential Tools That Make Data-Driven Investing Easy

Finding the right tools for investing with data can be tricky. This part looks at handy sites, apps, and resources for investors. There are free and paid choices. Whether you want stock finders, portfolio tools, or market info, we’ll help you pick what suits you. We’ll also share real user thoughts and key features for different goals. Find tools that give great insights without costing too much. Plus, get the best resources to boost your data skills. By the end, you’ll know how to build your toolkit based on what you can spend and what you need.

Stock Screeners: Finding the Right Investments

Stock screeners allow you to filter stocks based on specific criteria, making it easier to quickly identify companies that align with your investment strategy. For instance, you could screen for stocks with a low price-to-earnings (P/E) ratio, high dividend yield, or strong revenue growth.

Here are a few popular stock screeners:

Finviz: This screener provides a wide array of filters, ranging from simple metrics like market capitalization to more complex factors like analyst ratings. Finviz is known for its comprehensive data and user-friendly interface.

TradingView: While primarily recognized for its charting capabilities, TradingView also boasts powerful stock screening functionality, allowing you to combine technical and fundamental analysis.

Stock Rover: This platform offers in-depth fundamental analysis and stock screening tools designed for more sophisticated research. Stock Rover is a great choice for investors who want to delve deeper into company financials.

Portfolio Trackers: Keeping an Eye on Your Investments

Portfolio trackers enable you to monitor all your investments in a centralized location. They track your gains and losses, display your asset allocation, and can even provide performance analysis for your portfolio.

Consider these useful portfolio trackers:

Personal Capital: This free tool connects to your investment accounts to offer a comprehensive overview of your net worth and asset allocation. Personal Capital helps you see the big picture of your finances.

SigFig: Similar to Personal Capital, SigFig offers portfolio tracking, analysis, and even robo-advisor services for those seeking automated investment management.

Sharesight: This platform focuses on tracking portfolio performance, including dividends and other distributions, making it ideal for income-focused investors. Sharesight provides detailed performance reporting.

Market Updates and News: Staying Informed

Keeping up with market news is key to smart investing. Here are some trusted sources:

Bloomberg: This company offers a lot of data and news. It includes updates and expert opinions. It’s a top source for market info.

Yahoo Finance: A well-known place for free financial details. Yahoo Finance covers stocks, bonds, and other investments.

Google Finance: Good for checking stock prices and news. Google Finance gives basic market data.

Building Your Toolkit

The best tools depend on what you need and your investment style. Some people find free resources like Yahoo Finance and Google Finance enough. Others might want premium tools with more features. You can also check out Stock Decisions for specific stock info.

If you want to improve your data skills, try these:

Online Courses: Websites like Coursera and Udemy have courses on data analysis for investing.

Books and Articles: Many resources can help you learn about data-driven investing.

Practice: Learn by doing. Start with free tools and try more advanced ones as you get better.

Choosing the right tools and sources helps you make smart investment choices and track your portfolio. Data-driven investing helps you take charge of your financial future.

Overcoming Common Roadblocks in Data-Driven Investing

Even smart investors can find it hard to handle data well. This part helps you face those issues. We’ll look at common problems like too much information and not enough tech skills. We’ll give easy tips to focus on the important data for your plan. Learn how others stay on track when feelings might mess up their plans. Find simple solutions for busy people who want better results without being data experts.

Too Much Information: Focus on What Matters

One big problem in data investing is the huge amount of info. With so much data, it’s hard to know where to start. It can feel like drinking from a firehose. To make it easier, tools like a stock screener help a lot.

Here are some tips to handle the info flood:

Start Small: Use a few key numbers that fit your investing style. You don’t need to check everything at once.

Set Clear Goals: Know your investing goals. This helps you find the data that supports those goals.

Use Filters: Stock screeners and tools help you cut through the noise and focus on important points.

Technical Barriers: Simple Tools for Success

Many think data investing needs hard software or coding skills. This is not true. Many easy tools can help.

Here are some ideas to start:

Free Resources: Websites like Google Finance or Yahoo Finance are great places to start learning.

Easy Platforms: Pick tools with simple interfaces and clear instructions.

Focus on Visuals: Charts and graphs make data easier to understand.

Emotional Roadblocks: Staying Disciplined

Even with a clear data plan, feelings can mess up your choices, especially when markets change. Fear and greed can lead to rash actions that hurt your plan.

Here are ways to stay disciplined:

Stick to Your Rules: Write down your buying and selling rules and follow them, even when emotions run high.

Review Your Plan Regularly: Remind yourself of why you chose your strategy and the data that backs it.

Seek Support: Talk with other investors or a financial advisor for guidance and support.

Learning and Growing: Keep Improving

Investing with data is a journey that never ends. Be ready to change your plan as you learn and as the market shifts. What works today might not work tomorrow. Being flexible and able to change is important.

By knowing and tackling these common issues, you can use data to boost your investment results and create a stronger portfolio. Data helps us make smart choices, cut down risks, and reach our financial goals over time. Want to make better decisions? Stock Decisions gives clear tips based on solid data, helping you invest with trust. Check out the platform and start making smart, data-based choices today.