Improve Your Portfolio: Discover Stock Investment Strategies

Want to increase your investment returns? Learning stock investment strategies is important. This article shares 10 different methods—from value and dividend investing to momentum and contrarian strategies—to help you reach your financial goals. We will explain each strategy, looking at how it works and who it suits best. Whether you are new or experienced, knowing these strategies helps you make smart choices, improve your portfolio, and face the market with confidence.

1. Value Investing

Value investing is a way to build wealth by buying stocks for the long term. The idea is to find stocks that are priced lower than they should be. This happens because the market sometimes makes mistakes. Investors look at things like financial numbers, price-to-earnings, and debt-to-equity ratios to find these good deals.

This approach takes patience and careful study. It focuses on companies with strong basics, not on quick trends. Famous examples include Warren Buffett buying Coca-Cola and Benjamin Graham doing well during the Great Depression. Their success shows how strong this method can be. Joel Greenblatt’s “Magic Formula” also shows how a simple plan can work well.

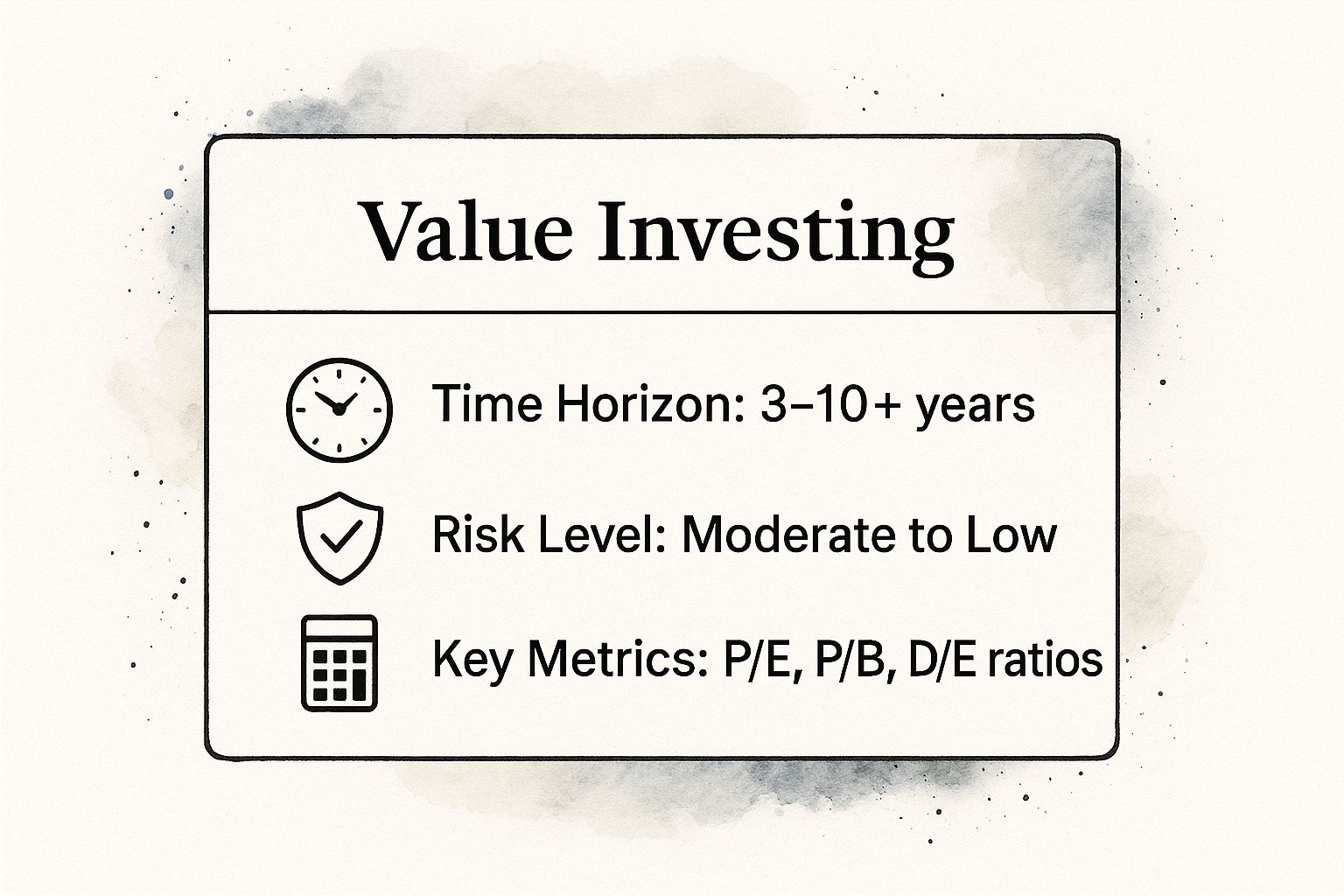

Here is a quick guide to the main points of value investing:

Value investing is a strategy for the long haul, usually lasting 3-10 years or more. It involves moderate to low risk. Important numbers like P/E, P/B, and D/E ratios help determine if a stock is priced right. This method is best for patient investors who don’t mind short-term changes and are good at doing their homework. It works well in uncertain markets, offering safety by buying stocks for less than what they’re worth.

However, value investing can fall behind when markets are rising. It needs a lot of research, and there is a risk of “value traps” where stocks look cheap but aren’t. Success depends on spotting companies with strong points and temporary problems. Patience, discipline, and spreading out your investments are key. It’s also important to keep updating your models to match market changes.

Value investing is well-known because it has often done better than the market. By focusing on basic analysis and long-term goals, it offers a solid way to build wealth and reach financial dreams. This makes it a good choice for serious investors.

2. Growth Investing

Growth investing is a plan that looks at companies that can grow quickly. It is different from value investing. Growth investing cares more about how a company might grow in the future than how much it is worth now. It focuses on businesses that might grow faster than others because they have new products, different ways of doing things, or strong leaders. This plan means you might pay more now for the chance of big returns later. It attracts investors who are okay with bigger risks for the chance of making more money.

Growth investing is about finding companies that are growing fast in earnings and sales. Investors are willing to pay more, expecting these companies to grow even more in the future. This strategy focuses on investing in companies that think ahead and in new areas, looking for new technologies and market trends. Growth investors look for the next big companies that will lead their industries.

Famous investors like Peter Lynch and Philip Fisher have done well with this method. Lynch made great returns by investing early in Dunkin’ Donuts and Home Depot, choosing companies he knew well. Likewise, early investments in Amazon, Google, and Netflix show how powerful growth investing can be. Fisher looked for companies with good leaders and a lasting edge over others, as seen with his success in Motorola.

Growth investing has big benefits, mainly in increasing wealth. As companies grow, their stock prices go up, leading to good returns. Over time, this can lead to huge gains, especially if you reinvest dividends. Investing in forward-thinking companies gives a chance to be part of new technologies and business models. During good economic times, growth stocks often do better than the market, offering great returns. Growth investing lets you invest early in leading companies, getting big gains as they grow.

Growth investing comes with risks. Growth stocks can be more unpredictable than value stocks. Their prices often change a lot. High prices can lead to big drops during market downturns. Changes in interest rates might raise borrowing costs and make investors less eager. The biggest worry is that expected growth may not happen because of unexpected problems, competition, or market changes. Growth companies often use profits to grow instead of giving dividends, which limits income.

To succeed in growth investing, look for businesses with strong advantages like good brands or special technologies. Check if the leaders can manage quick growth. Keep an eye on industry trends to find chances and spot risks. Spread your investments across different growth ideas and areas to lower risk. Use stop-losses to protect your money. Growth investing can be rewarding for those who handle its risks wisely.

3. Dividend Investing

Dividend investing focuses on picking stocks that regularly pay out money. This method gives you a steady income and the chance to grow your money over time. It offers more predictable returns than just relying on stock prices going up. This appeals to people who want both safety and growth. It uses the power of compounding to build wealth in a careful way.

Dividend investing is about picking companies that share profits with their investors. This plan looks for firms with strong money flow, reliable payout habits, and regular dividend growth. By focusing on these areas, investors hope to create a portfolio that stays strong during market ups and downs while providing steady returns.

Famous investors like John D. Rockefeller and Benjamin Graham used these principles. Geraldine Weiss and David Fish have helped make this approach more popular and clear.

Pros and Cons of Dividend Investing

Pros:

Regular income

Less market swings

Protects against inflation

Possible tax advantages

Growth by reinvesting

Con:

Limited growth in value

Affected by interest changes

Risk of dividends being cut in tough times

May focus too much on certain sectors

Different tax effects

4. Index Fund Investing: Ride the Market Wave to Financial Freedom

Index fund investing is a simple way to invest in the stock market. You don’t have to choose individual stocks. This passive method helps grow your money over time. It’s good for beginners and seasoned investors who want cheap and varied investments. It builds wealth by spreading out risks, keeping costs low, and providing steady returns.

To invest this way, you buy shares in an index fund or ETF that follows a market index, like the S&P 500. This gives you a mix of different stocks and lowers the risk of any single stock doing poorly. Instead of betting on one company, you’re betting on the market as a whole.

Index funds copy their chosen index by owning the same stocks in the same amounts. When the index changes, the fund adjusts too, leading to lower trading costs than funds managed by people.

Index funds have a strong track record. John Bogle from Vanguard supported them, and Warren Buffett recommends them. Many investors have reached their financial goals by sticking with index funds. Examples include the Vanguard Total Stock Market Index Fund and the SPDR S&P 500 ETF Trust. The iShares Core MSCI Total International Stock ETF takes this idea worldwide.

Pros and Cons of Index Fund Investing

Pros:

Low fees

Quick diversification across many stocks

Matches market performance

No need to research or pick stocks

Saves time

Cons:

Cannot beat the market

No protection if the market drops

Limited choice in stocks

Risk of buying overvalued stocks

Average returns by design

5. Dollar-Cost Averaging: A Steady Path to Investment Success

Dollar-cost averaging (DCA) is a simple way to invest in stocks. It helps people grow their money over time, even when the market changes. Famous investors like Benjamin Graham, John Bogle, and Burton Malkiel support this method. DCA removes the worry about when to buy or sell, offering a steady path to reaching financial goals. It’s a good choice if you want a stable part of your investment plan.

How Dollar-Cost Averaging Works:

DCA is easy to understand: invest a set amount of money regularly, no matter the stock price. This way, you buy more shares when prices are low and fewer when they are high. This can lower the average price you pay for each share.

For example, if you invest $200 every month and a stock is $20 per share the first month, you get 10 shares. If the price goes down to $10 the next month, you buy 20 shares. If it goes up to $25 the third month, you get 8 shares. This method helps you buy more shares at cheaper prices, making market changes less stressful.

Examples of Dollar-Cost Averaging in Action:

Many investment plans use DCA. A 401(k) plan, where part of your paycheck goes to investments, is one example. Mutual funds offer plans that move money at set times. Buying a fixed amount of index funds each month is also DCA. Systematic Investment Plans (SIPs) for investing in new markets use this strategy too.

The Benefits and Drawbacks of Dollar-Cost Averaging:

DCA has many benefits. It makes market ups and downs less scary and helps avoid bad timing decisions. It promotes steady investing and can lead to long-term growth. Buying more shares when prices are low and fewer when high can lower your cost and increase returns. It also stops emotional decisions like panic selling or buying.

But there are downsides too. If the market is going up, DCA might lead to paying more than if you invested all at once. It doesn’t protect from market drops, just smooths out the bumps. Holding cash for future buys might mean missing returns. More transactions could mean more taxes. Staying disciplined can be tough in tough times.

6. Momentum Investing: Ride the Wave of Market Trends

Momentum investing is a dynamic stock strategy that focuses on profiting from the ongoing trends of winning stocks continuing to rise and losing stocks continuing to fall in the short term. This method involves capitalizing on market trends, allowing investors to benefit from upward price movements while avoiding downturns. If you value a data-driven, action-oriented approach, momentum investing is a valuable strategy.

This approach centers on identifying stocks with strong recent performance and profiting from their continued rise, while selling those consistently declining. It operates on the belief that trends will persist, providing opportunities for significant short-term gains. Unlike value or growth investing, momentum investing emphasizes current market sentiment and price action.

Investors in this field rely on technical analysis tools like moving averages and relative strength indicators to identify trends. Shorter holding periods, from weeks to months, aim to capture the best parts of a trend. The appeal of momentum investing lies in its potential for substantial returns, as it benefits from market biases like herd mentality. It can be applied in both rising and falling markets, offering flexibility for profit. Historical successes include Richard Driehaus and trend-following hedge funds like AQR Capital Management.

However, momentum investing carries risks, including high transaction costs and vulnerability to sudden trend reversals. Rapid market shifts can turn profits into losses, necessitating constant market monitoring and quick decision-making. The strategy can also lead to higher tax liabilities and, in volatile markets, risks of buying high and selling low.

To implement momentum investing effectively, consider these tips:

Use Multiple Timeframes: Confirm momentum strength by analyzing price trends across daily, weekly, and monthly timeframes.

Set Stop-Loss Levels: Protect your capital by using stop-loss orders to limit losses in trend reversals.

Focus on Strong Stocks: Prioritize stocks outperforming their sectors or the market, showing strong momentum.

Avoid Choppy Markets: Momentum strategies are less effective in volatile or sideways markets.

Use Risk Management: Integrate momentum investing with risk management to control portfolio volatility.

Momentum investing demands active management, discipline, and technical analysis understanding. By mastering these elements, you can leverage market trends for potential significant returns. This strategy suits tech-savvy enthusiasts, experienced traders, and financial analysts, though beginners can start with momentum-based ETFs like MTUM after thorough research.

7. Contrarian Investing: Zig When Others Zag

Contrarian investing is a bold approach that thrives on defying conventional wisdom by buying unpopular assets and selling those at peak popularity. Picture yourself as a detective, uncovering hidden gems ignored by the crowd. This strategy capitalizes on market inefficiencies and the cyclical nature of fear and greed, demanding courage, patience, and analytical skill.

The core belief is that markets, swayed by emotion, often overreact to news. In panic, prices of sound companies may fall below their true value, offering buying opportunities. Conversely, during optimism, prices inflate, signaling a time to sell. This strategy identifies cycles in market sentiment, offering chances for those who think differently.

Success lies in finding companies with strong fundamentals facing temporary challenges. It’s about recognizing market overreactions, not buying failing companies. This value-oriented approach, akin to buying a dollar for fifty cents, distinguishes contrarian investing from mere speculation.

Legendary investors like Warren Buffett and John Templeton have shown the potential of contrarian thinking. Buffett’s moves during the 2008 crisis and Templeton’s during the Great Depression exemplify the long-term success possible with disciplined contrarian strategies.

Pros:

Discounted prices: Opportunities to acquire quality assets at significantly reduced valuations.

Profit from overreactions: Capitalizing on market inefficiencies and emotional swings.

Lower correlation with the market: Contrarian portfolios often move independently of broader market trends.

Strong long-term potential: History is replete with examples of successful contrarian investors.

Disciplined approach: Provides a framework for navigating emotional market cycles.

Cons:

Emotional discipline: Requires the ability to withstand social pressure and market volatility.

Timing challenges: Identifying the bottom of a downturn can be difficult, leading to the risk of “catching falling knives.”

Potential underperformance: Contrarian strategies can lag behind the market during periods of strong bullish sentiment.

Distinguishing temporary vs. permanent problems: Requires careful analysis and due diligence to avoid value traps.

Social and career risk (for professionals): Deviating from the consensus can be challenging for professional money managers.

8. Quality Investing: Building Wealth Through Business Excellence

Quality investing is about picking companies with strong basics. This approach looks for businesses with good advantages, sound finances, and smart leaders. The idea is that these companies can give better long-term profits, even if the market changes in the short term. Unlike other strategies, quality investing focuses on what a company is truly worth. It seeks to partner with great businesses to build steady wealth over time.

Investors check a company’s business plan, rivals, and finances instead of just its current price. They look for companies with high returns on equity and invested money. A strong financial position, low debt, and plenty of cash help a company handle economic problems and grow. Regular profit growth and high profit margins show the company can make money over time.

Quality investing finds companies with strong defenses like a trusted brand or unique technology. These features keep them steady in the market. The quality of management is crucial. Leaders should be good at managing money and creating value for shareholders. Steady profits are better than those that go up and down, showing a stable business.

The benefits include less risk and more protection. Financially strong companies usually have stock prices that don’t change much. While gains may not come quickly, the slow growth of quality companies can build wealth over time. This is seen in companies like Microsoft and Nestlé, or through the investing style of Warren Buffett and Terry Smith.

But quality companies often have high prices and might not do well during market bubbles. The number of top-quality companies is limited, so careful study is needed. This strategy might miss chances with cheaper stocks that are getting better.

In quality investing, focus on companies with lasting advantages and good leaders. Look for steady profits, keep an eye on returns, and wait for the right time to buy. By valuing business strength and long-term growth, quality investing can help build lasting wealth.

9. Small-Cap Investing: Unearthing Hidden Gems for Explosive Growth

Small-cap investing is all about companies with market values between $300 million and $2 billion. These smaller companies often go unnoticed but can grow a lot. Adding small-cap stocks to your portfolio can boost it greatly, though it also brings more risk.

Small-cap companies have big dreams and can grow fast. They might change industries and bring big gains to early investors. These stocks are often unnoticed, with their real worth waiting to be found. Bigger companies may want to buy them, leading to big profits.

There are many stories of small-cap companies giving great returns. Peter Lynch supported small-cap stocks at Fidelity Magellan, and the Russell 2000 sometimes does very well. Early bets on companies like Starbucks and Home Depot show what’s possible.

But while the benefits of small-cap investing are exciting, remember the risks. These stocks can go up and down a lot and react to changes in the economy. Trading might cost more because of fewer buyers and sellers and bigger price differences.

To mitigate these risks and maximize your chances of success, consider the following actionable tips:

Diversification is Key: Spread your investments across a portfolio of small-cap stocks to reduce the impact of any single company’s underperformance.

Focus on Strong Management: Look for companies with experienced and capable management teams that have a proven track record of success.

Analyze Competitive Positioning: Evaluate the company’s competitive landscape and its ability to capture market share.

Monitor Liquidity and Trading Volumes: Be mindful of trading volumes and bid-ask spreads to ensure you can enter and exit positions efficiently.

Consider Small-Cap Index Funds: If you prefer a more passive approach, small-cap index funds offer broad market exposure and diversification.

When to Embrace Small-Cap Investing

Small-cap investing is particularly well-suited for investors with a long-term investment horizon and a higher risk tolerance. It’s an ideal strategy for those seeking to outperform the broader market and participate in the growth stories of innovative companies. If you are patient, disciplined, and willing to conduct thorough research, small-cap investing can be a powerful engine for wealth creation.

Pros and Cons at a Glance:

Pros:

Higher long-term return potential

Less efficient pricing creates opportunities

Earlier access to innovative companies

Portfolio diversification benefits

Potential takeover premiums

Cons:

Higher volatility and risk

Limited liquidity and higher bid-ask spreads

Greater business and financial risk

Economic sensitivity and cyclicality

Limited resources for research and development

10. Sector Rotation: Riding the Waves of the Market

Sector rotation is a way of investing that helps you adjust to market changes and possibly earn good returns. It uses the ups and downs of the economy, knowing that different types of businesses do well at different times. By understanding these cycles and choosing where to put your money wisely, you can take advantage of new trends and lower risks. This method is helpful for both new investors and experienced ones wanting to improve their portfolios.

Sector rotation means moving your investments between different industries based on what you expect the economy to do and what the market looks like now. Unlike just buying and holding onto stocks, this approach encourages active management and changing your investments to fit the current economy.

How Sector Rotation Works:

Different industries do better at certain times in the business cycle. For example, technology and consumer goods often do well when the economy is growing, while financial stocks do better when interest rates go up. During a slowdown or recession, defensive areas like utilities and basic consumer goods tend to keep their value. As the economy picks up, companies in materials and industries might lead.

This pattern is what sector rotation is based on. By looking at things like GDP growth, inflation, and interest rates, investors try to guess which industries will do well and change their investments to focus on those.

Pros and Cons of Sector Rotation:

Sector rotation has its upsides and downsides. The good part is that it can help you beat the market by using economic cycles and spreading risk across different areas. It also might protect you when the market changes. But, you need to be good at predicting the economy, and it can cost more because of frequent trading. Timing the market is tough, and bad guesses can mean losses. This strategy might also lead to higher taxes because of buying and selling more often and requires careful watching and analysis.

Stock Investment Strategies Comparison

|

Strategy |

Implementation Complexity 🔄 |

Resource Requirements 🔄 |

Expected Outcomes 📊 |

Ideal Use Cases 💡 |

Key Advantages ⭐⚡ |

|---|---|---|---|---|---|

|

Value Investing |

Medium – requires fundamental analysis and valuation models |

Moderate – detailed research, financial metric analysis |

Moderate to High – strong long-term returns with downside protection |

Long-term investors seeking undervalued, stable companies |

Proven long-term outperformance, margin of safety, dividend income |

|

Growth Investing |

Medium to High – focus on future potential and growth metrics |

High – ongoing market and management analysis |

High – potential for significant capital appreciation |

Investors targeting above-average growth in innovative sectors |

Access to market leaders early, compounding benefits |

|

Dividend Investing |

Low to Medium – focus on reliable dividend metrics and payout sustainability |

Moderate – cash flow and payout monitoring |

Moderate – steady income with potential dividend growth |

Income-focused, conservative investors |

Regular income, lower volatility, inflation protection |

|

Index Fund Investing |

Low – passive management, minimal ongoing decisions |

Low – buy and hold, minimal research |

Market-matching returns with diversification |

Investors seeking low-cost, diversified market exposure |

Low fees, instant diversification, time-efficient |

|

Dollar-Cost Averaging |

Low – systematic fixed investments over time |

Low – automated contributions, minimal active management |

Moderate – reduces timing risk, smooths volatility |

Long-term investors with discipline, reducing market timing risk |

Reduces volatility impact, disciplined investing, emotional control |

|

Momentum Investing |

High – requires technical analysis and frequent monitoring |

High – frequent trading and trend analysis tools |

High but volatile – profits in trending markets |

Short to medium-term traders focusing on price trends |

Can capture quick gains, objective criteria, systematic approach |

|

Contrarian Investing |

Medium to High – requires market sentiment analysis and strong discipline |

Moderate to High – research and monitoring market psychology |

Moderate to High – profits from market overreactions |

Investors confident in market reversals and mean reversion |

Buying undervalued assets during market pessimism, low correlation |

|

Quality Investing |

Medium – detailed fundamental analysis of business quality |

Moderate – financial stability and management evaluation |

Moderate to High – consistent outperformance, lower risk |

Long-term investors prioritizing business excellence |

Lower volatility, downside protection, resilient performance |

|

Small-Cap Investing |

Medium to High – analysis of smaller, less covered companies |

High – due diligence on less liquid, riskier firms |

High – potential for above-market returns with higher risk |

Investors seeking growth and diversification in smaller firms |

Higher return potential, diversification, acquisition opportunities |

|

Sector Rotation |

High – requires economic cycle forecasting and active adjustments |

High – continuous market and sector analysis |

Moderate to High – tactical outperformance possible |

Tactical investors leveraging economic cycles |

Capitalizes on economic phases, diversification, potential downside protection |

Navigating the Market: Choosing Your Winning Stock Investment Strategy

From buying undervalued stocks to switching between market sectors, this article looks at ten strong ways to invest in stocks that can help you succeed financially. We’ve shared important tips on different methods, from finding hidden market gems to riding market trends. The main point is that there’s no one “best” way to invest. The right strategy depends on your risk level, goals, and timeline. Understanding these ideas helps you build a mix of stocks that fits you, setting you up for growth and security over time.

Whether you’re a pro or just starting, knowing these stock strategies is key to handling the market’s ups and downs. By always learning and adjusting to market changes, you can confidently work toward your financial goals. The stock market changes all the time, and your success depends on the smart choices you make now.

Want to improve your stock strategies with smart insights? Check out Stock Decisions (Stock Decisions) for thorough analysis, live data, and expert advice to fine-tune your plan and boost your portfolio’s growth.