Understanding How the Stock Market Works

The stock market might seem scary for beginners. But really, it’s just a place to buy and sell parts of companies. Think of it like a big online auction where people trade pieces of businesses. Let’s see what happens when you decide to invest.

What Happens When You Buy A Stock?

When you buy a stock, you get a small part of a company, called a share. These shares are bought and sold on stock exchanges like the New York Stock Exchange (NYSE) or the Nasdaq. A stock’s price goes up or down based on supply and demand. If more people want to buy than sell, the price goes up. If more people sell than buy, the price goes down. This change lets investors try to buy at low prices and sell at high ones.

The Role of Stock Exchanges and Market Makers

Stock exchanges are places where people buy and sell shares. They make sure trading is fair and follows rules to keep investors safe. Market makers are key players in these exchanges. These firms are always ready to buy or sell certain stocks to make sure trades go smoothly. They make sure there’s always someone to trade with.

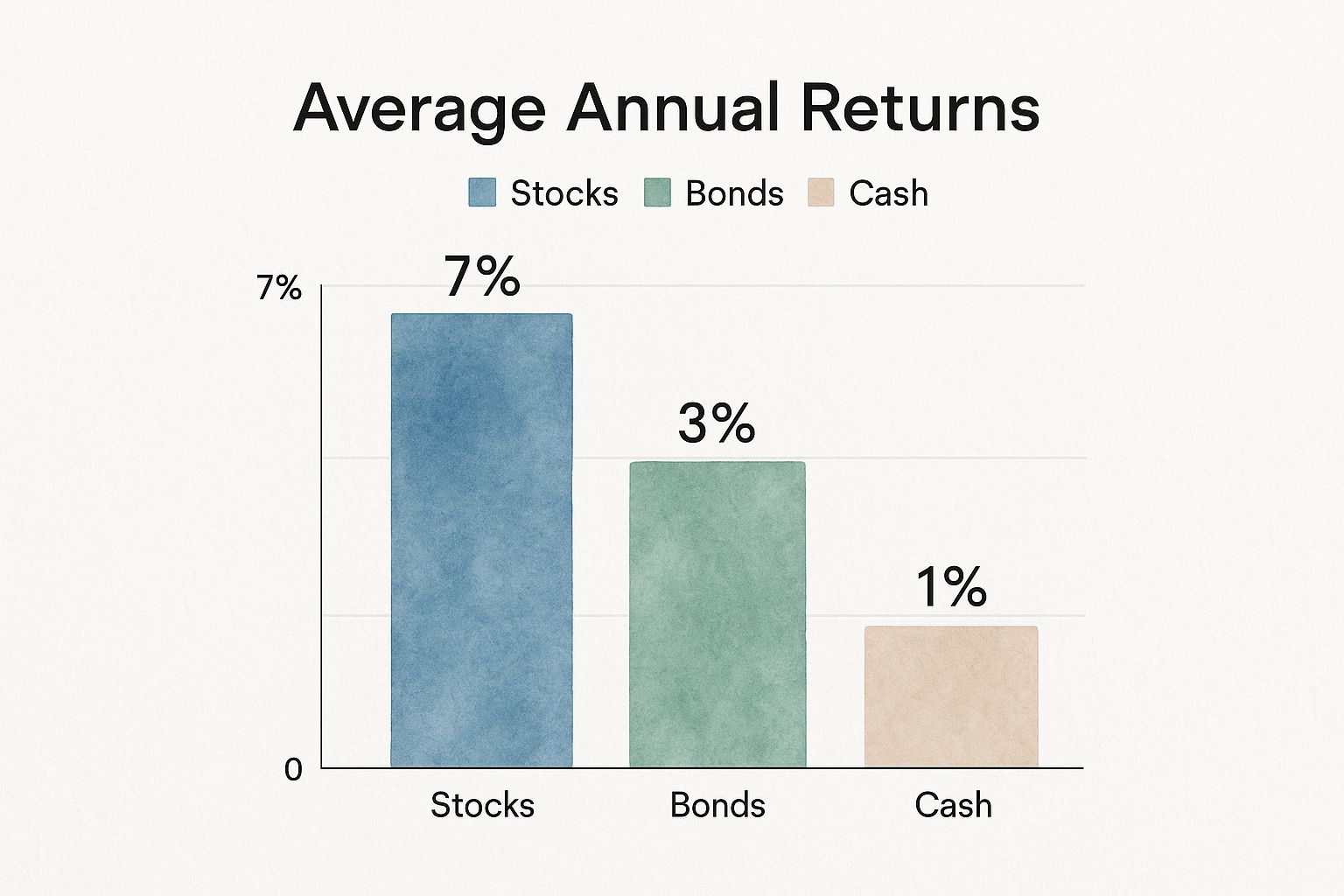

The image above shows the average yearly returns for three types of investments: stocks, bonds, and cash. Over time, stocks have done better than the others, with a yearly average of 7%, while bonds average 3% and cash just 1%. This highlights the chance for growth in the stock market over many years. But remember, just because something did well in the past doesn’t mean it will do well in the future.

The Size and Scope of the Global Stock Market

The stock market is a big part of the world’s economy. By 2025, the total value of all stocks on global exchanges reached $127.4 trillion. In the United States, stocks alone make up more than $44.8 trillion of this amount. Huge exchanges like Nasdaq ($30.2 trillion) and NYSE ($25.3 trillion) are key players. Other important exchanges include the London Stock Exchange, the Shanghai Stock Exchange, and the Hong Kong Stock Exchange. For more information on stock market stats, you can check this link.

To get a better view, let’s look at a comparison of major global exchanges:

Major Global Stock Exchanges Comparison: This table shows the value and main features of some of the biggest stock exchanges in the world.

|

Exchange |

Market Cap (Trillion $) |

Location |

Notable Features |

|---|---|---|---|

|

NYSE |

$25.3 |

USA |

Largest stock exchange by market cap, lists many well-established companies |

|

Nasdaq |

$30.2 |

USA |

Known for technology and innovative companies |

|

London Stock Exchange |

UK |

Major international exchange, significant trading hub | |

|

Shanghai Stock Exchange |

China |

One of the largest exchanges in Asia, reflects China’s economic growth | |

|

Hong Kong Stock Exchange |

Hong Kong |

Connects global investors to Asian markets |

This comparison highlights the global nature of the stock market and the diverse opportunities available to investors.

Different Types of Stocks

To build a varied investment collection, you need to understand different stock kinds. Here’s a brief look:

Common Stock: This is the most usual type. It gives you a share in the company and a say in decisions.

Preferred Stock: This type gives fixed payments and priority if the company goes bankrupt. But, it usually doesn’t let you vote.

Growth Stocks: These belong to companies expected to grow fast. They often reinvest their money instead of giving it out as payments.

Value Stocks: These are from companies thought to be worth less than they should be. They might trade at lower prices compared to their profits and sometimes pay dividends.

Your own investment aims, how much risk you can take, and how long you plan to invest will guide your choice of stocks. Starting with these basics will help you make smart choices and feel confident as you explore the stock market.

Investment Strategies That Work for Beginners

Building wealth in the stock market takes time. It’s not about getting rich quickly. Real financial growth needs patience and a clear plan. This section looks at investment methods that can help new investors reach their financial goals. We’ll talk about important ideas like diversification, dollar-cost averaging, and different ways to invest.

The Importance of Diversification

Diversification is key to smart investing. It’s like not putting all your eggs in one basket. By spreading your money across different stocks, sectors, and types of assets, you reduce risk. If you only invest in tech, a downturn there could hurt your portfolio. But if you also invest in healthcare, real estate, and bonds, you create a safety net. Losses in one area can be offset by gains in others. Diversification helps manage risk for a smoother investment journey.

Dollar-Cost Averaging: A Helpful Strategy

Dollar-cost averaging (DCA) is a great method for beginners. It’s easy and takes the emotions out of investing. With DCA, you invest the same amount of money regularly, no matter how the market is doing. This means you buy more shares when prices are low and fewer when prices are high. For example, if you invest $100 each month, you’ll get more shares when the market dips. When it rises, your shares’ value increases. DCA focuses on steady growth, not timing the market.

Growth vs. Value Investing: Choosing Your Path

There are two main ways to invest: growth investing and value investing. Growth investors look for companies expected to grow quickly. They focus on future potential, like new tech firms or innovative healthcare businesses. These companies might not make money yet but could grow a lot. Value investors, on the other hand, look for well-established companies that are priced lower than their true worth. These businesses usually have strong fundamentals and offer long-term gains. The right choice depends on your risk level, goals, and how long you plan to invest.

The Case for Passive Investing: Index Funds and ETFs

Passive investing with index funds and exchange-traded funds (ETFs) is becoming very popular. These funds follow a market index, like the S&P 500. This gives you a piece of many stocks at once. For instance, investing in an S&P 500 index fund means you own small parts of the 500 biggest U.S. companies. This way, you don’t need to pick and research individual stocks. It makes investing easier. The goal here is to grow with the market, not beat it.

Building Your Customized Investment Strategy

Starting in the stock market can be scary. But, by learning some basic ideas, you can make your own plan for financial success. First, know how much risk you are okay with and what your goals are. Think about using dollar-cost averaging and buying diverse index funds and ETFs. This is a good start. As you learn more, try growth or value investing with single stocks. The main thing is to have a plan you can stick with and understand. Investing takes time, like a long race. With the right plan, you can reach your financial goals.

Choosing Your Broker and Taking the First Step

Are you ready to start your stock market journey? A big step is picking the right broker. This is the person or service that helps you buy and sell stocks. It might seem hard at first, but knowing what to look for can help you decide. Let’s talk about what to think about when picking a broker, the types of accounts you can have, and how to take your first step into the market.

Key Broker Features for Beginners

Brokers are not all the same. As a beginner, focus on these key points to find what suits you best:

Fees: Many brokers now let you trade stocks and ETFs without paying any fees. This can save you money over time, letting you invest more in the market.

Minimum Deposits: Some brokers need you to deposit a certain amount to start. Find one that matches your budget and lets you begin with a small amount.

Research Tools: Good research and learning materials are important. Choose a broker that offers easy-to-understand guides and current market news to elp you learn.

Easy-to-Use Platform: A complicated platform can be confusing. Pick a broker with a simple and clear interface. A mobile app is also helpful for checking your investments on the go.

Customer Support: Good support can make a big difference. If you have questions or problems, helpful customer service can make your investing experience smoother.

Understanding Account Types

Picking the right account is important. Here are some common choices:

Individual Account: This basic account lets you buy and sell many types of investments. It is a good start for most beginners.

Retirement Accounts (IRAs): IRAs have tax benefits for saving for retirement. Traditional IRAs may lower your taxes now, while Roth IRAs let you take out money tax-free later. Talk to a financial advisor to see which is best for you.

Joint Account: This account is shared by two people and gives both control over the investments.

Setting Up Your Account and Making Your First Trade

After picking your broker and account type, opening your account is usually easy. You just fill out some personal info, link a bank account, and add money to your brokerage account.

Are you ready to trade for the first time? Here’s how you can do it:

Log In: Go to your brokerage account.

Find Your Stock: Look for the stock by its ticker symbol (like AAPL for Apple).

Choose Shares: Decide how many shares you want to buy.

Pick Order Type: Decide between a market order or a limit order. A market order buys at the current price, while a limit order waits for your set price.

Confirm: Check everything and confirm your order.

Security and Avoiding Scams

Keeping your money safe is very important. Good brokers use strong safety steps, like two-factor checks, to protect your account. Watch out for sites that promise too much or rush you to decide quickly. Always look into a broker’s history and check if they are registered with groups like the Securities and Exchange Commission (SEC). Doing this helps you stay away from scams and keep your money secure.

Starting in the stock market can be exciting but also a bit scary. By learning about how to pick a broker, different account types, and basic trading, you’ll be ready to start investing with confidence. Choosing the right broker is like finding a trusted friend who matches your investment goals and helps you grow as an investor. Enjoy the journey, and happy investing!

Reading Market Signals Without Getting Lost in the Noise

Starting to invest in the stock market means more than just buying and selling shares. You need to learn how to understand the ongoing news that impacts stock prices. Predicting the market’s future is not possible, but you can learn to spot important signs. This knowledge can help you make smart decisions and stay calm.

Understanding Economic Signs

Certain economic reports can greatly affect the stock market. Employment data, for example, shows how healthy the economy is. When many jobs are added, it usually makes the market feel good. The Federal Reserve’s announcements, especially on interest rates, also impact stock prices. Higher rates can make loans more expensive for companies, which might slow their growth and change stock values. Knowing these signs helps you see daily changes in a wider economic context.

Basic Technical Analysis for Beginners

Technical Analysis looks at past market trends to guess future price changes. Two basic tools are moving averages and trend lines. A moving average evens out price changes over time, helping you see the trend’s direction. Trend lines connect points in an uptrend or downtrend, showing price patterns visually. While not foolproof, technical analysis can offer helpful insights for long-term investing.

Investor Mood and Seasonal Patterns

Investor mood, or how people feel about the market, affects stock prices too. Fear can drive prices down, while greed can push them up. Market timing tools like the January Barometer give interesting facts for beginners to learn about market trends. The January Barometer suggests that if the stock market goes up in January, it might do well for the rest of the year. In 2025, the S&P 500 rose almost 3% in January, a good sign after a strong 23% gain in 2024. You can find more details on the January Barometer here. Remember, these signs are not promises of future results. Use them carefully.

Focusing on the Big Picture

When you’re new to investing, it’s easy to worry about every little change in the market. Tools like Stock Decisions can really help. They give clear and simple advice from people you can trust. This helps you make smart choices for the future, instead of reacting to every small market change. The aim is to grow your wealth steadily, not to beat the market every single day. Resources like Stock Decisions help you ignore the noise and focus on what truly matters.

Building Your First Portfolio That Grows With You

Starting your investment journey means creating a portfolio that suits your needs and dreams. It’s not just about following rules based on age. You need to understand how your life, comfort with risk, and money goals shape your plan.

Asset Allocation: Finding the Right Mix

Asset allocation means spreading your money across different types of investments like stocks, bonds, and cash. Finding the right mix is a personal journey influenced by several key factors.

Time Horizon: Time can really help in investing. If you have a long time, like saving for retirement, you can take more risks with more stocks. This helps you handle market ups and downs. As you get closer to retirement, you might want to be more careful with more bonds.

Risk Tolerance: Knowing how much risk you can handle is important. If you can take more risk, you might have more stocks in your portfolio. If you prefer less risk, you might choose more bonds.

Financial Goals: Your goals guide your investments. Short-term goals, like saving for a house, usually mean being more careful. Long-term goals, like retirement, allow you to take more risks.

Simple Ways to Pick Stocks

Picking stocks can be fun when you build your portfolio. First, look at companies you know and like. Check if they have strong financials and have done well in the past. Tools like Stock Decisions make research easier by giving useful insights.

Benefits of Index Funds and ETFs

Index funds and ETFs (Exchange Traded Funds) are an easy way to diversify your investments. They follow market indexes like the S&P 500. This means you own a mix of stocks from different sectors. This broad mix helps reduce the risks of picking single stocks.

Mixing Stocks and Market Exposure

A good investment plan often includes both individual stocks and index funds or ETFs. This lets you find specific opportunities while keeping a stable base of different holdings.

Below is a table that shows some ideas for how to divide your investments. Remember, these are just examples. Your choices should match your own situation and goals.

Let’s see how age and risk can affect how you split your assets. The table below can help you start planning your own portfolio.

|

Age Range |

Conservative |

Moderate |

Aggressive |

Stocks % |

Bonds % |

|---|---|---|---|---|---|

|

20-30 |

Cash & Bonds |

Diversified Funds |

Growth Stocks |

80-90 |

10-20 |

|

30-40 |

Balanced Portfolio |

Growth & Income Mix |

Higher Growth Stocks |

70-80 |

20-30 |

|

40-50 |

Moderate Risk |

Balanced Growth |

Blend of Growth and Value |

60-70 |

30-40 |

|

50-60 |

Increased Bonds |

Income & Growth |

Growth with Risk Management |

50-60 |

40-50 |

|

60+ |

Primarily Bonds |

Conservative Growth |

Income and Capital Preservation |

40-50 |

50-60 |

Younger investors who like taking risks often put more money into stocks. Older investors who prefer being careful usually choose more bonds.

Making Your Portfolio Work for You

Creating a good portfolio is not something you do just once. It is something you keep working on. As your life changes, your investments should too. Check your asset mix, how much risk you are okay with, and your money goals often. Make sure your investments fit your life now. Tools like Stock Decisions can give you helpful tips and updates. They can guide you to change your plan if needed. Be open to changing your investment path. This will help you reach your goals in the stock market over time.

Avoiding The Traps That Destroy Beginner Portfolios

Stepping into the stock market as a beginner can be exciting. But you need to watch out for common mistakes that can slow down your progress. It’s important to know both the mental and practical traps that can lead to bad choices. Avoiding these mistakes is as important as picking the right stocks.

Mastering Your Emotions

Emotions can be a big barrier to investing success. For example, the fear of missing out can lead you to buy popular stocks that are overpriced. This can cause big losses when the excitement fades.

On the other hand, selling in panic during market drops can lock in losses and stop you from gaining when the market recovers. Early successes can also make you overconfident, causing you to take too many risks and ignore smart investing rules.

Keeping your emotions in check is key for long-term success. Tools like Stock Decisions can help you stay disciplined by providing insights that counteract emotional reactions.

Protecting Your Capital

Managing risk is crucial for keeping and growing your money in the stock market. One simple method is position sizing, which means deciding what part of your portfolio goes to one investment.

By limiting how much you invest in one stock, you reduce potential losses. Another tool is a stop-loss order. This order sells a stock automatically if it drops to a certain price, which helps cut down losses.

These tools help protect your money in the unpredictable stock market for beginners.

Dealing with Market Changes

The stock market often goes up and down. Knowing this helps you avoid emotional decisions. It takes experience to tell the difference between normal changes and real problems.

Focus on the long-term potential of your investments instead of worrying about short-term price changes. Stock Decisions helps by giving detailed analysis and insights to understand market movements in a bigger picture.

Building mental strength is also key to handling market changes. Stock Decisions provides timely data, helping you make informed choices based on facts, not fear. This helps you stay calm during market swings and stick to your long-term plan. Staying informed and focused on your main goals is better than trying to time the market perfectly, which is nearly impossible.

Learning From Others’ Mistakes

The stock market offers many cautionary tales. Learning from the missteps of other investors, especially those new to the market, can be immensely valuable. Studying real-world instances of poor decision-making – whether driven by FOMO, panic selling, or overconfidence – can help you sidestep similar traps. By understanding the psychology behind these errors and learning how to implement practical risk management strategies, you can substantially enhance your prospects for long-term investment success.

Your Guide to Long-Term Investing Success

Starting a long-term investment plan in the stock market is about more than just choosing stocks. It involves growing steadily, adjusting to changes, and building a portfolio that matches your financial goals. This includes finding trustworthy information, keeping track of your progress, and knowing when to look for new investment options.

Resources for Ongoing Learning

The financial world keeps changing. Staying informed is crucial for making smart choices. Trusted sources like The Wall Street Journal, Bloomberg, and the Financial Times provide useful market insights. Bloomberg is especially helpful for updates. Joining online investor groups can offer guidance and shared advice.

Find reliable sources: Use information from well-known financial experts.

Join online groups: Talk with others in forums to learn from their experiences.

Look into learning platforms: Check out websites that offer courses on basic and advanced investing.

Learning regularly will help you adjust to market changes and improve your strategy.

Keeping Track of Your Portfolio

Watching your investments is key to knowing your progress. It’s easy to worry about daily market changes. Instead, focus on your long-term goals. Track how your portfolio grows over time rather than daily price shifts.

Look at long-term patterns: Don’t let short-term changes affect your plan.

Watch key numbers: Keep an eye on your portfolio’s overall return and how diverse it is.

Adjust regularly: Update your portfolio to keep your desired balance.

By focusing on the long-term, you can avoid reacting to short-term market swings.

Expanding Your Investments

As you learn more, think about widening your strategy. You might explore new markets like international stocks or focus on certain sectors. International investing can lessen your dependence on one economy. Sector focus lets you target industries with growth potential.

Look at global markets: Invest in stocks from emerging or established foreign markets.

Study different industries: Find sectors like technology or healthcare that might grow.

Consider REITs: REITs let you invest in real estate without owning property.

Trying new investment paths widens your options and diversifies your portfolio.

Setting Goals and Staying Inspired

Long-term investing requires patience. Set realistic goals to track your progress and stay motivated. These goals might include reaching a certain portfolio size or a retirement savings target.

Set clear goals: Define your financial aims to guide your choices.

Break big goals down: Divide long-term aims into smaller steps.

Celebrate achievements: Recognize your success to stay motivated.

By setting practical goals and celebrating achievements, you can keep a positive mindset on your investment journey.

Investing in stocks is a learning experience. By staying informed, tracking your progress, and expanding your knowledge, you’ll create a strong base for long-term success. Stock Decisions can help, offering analysis, updates, and risk tools to assist your decisions and goals. Explore the platform and invest confidently.