Why Your Portfolio Drifts Away From You

Imagine your investment portfolio as a garden. You start with 60% sunflowers, which stand for stocks, for growth. Then, you add 40% tomatoes, meaning bonds, for stability. This mix is your asset allocation – your choice of different investments.

But gardens, like portfolios, change. Sunflowers often grow quicker than tomatoes, altering the 60/40 mix. This change, due to market ups and downs, is called portfolio drift. Some investments do better than others, shifting your planned balance.

This drift can quietly raise your risk. If those fast-growing sunflowers (stocks) suddenly drop in value during a market downturn, your losses can be bigger because they now take up more of your garden.

Understanding Portfolio Drift and Rebalancing

Drift makes portfolio rebalancing tricky. It feels wrong to cut back on your successful sunflowers (stocks) to buy more of the slower-growing tomatoes (bonds). Our instinct is to hold onto winners.

When stocks rise and your mix changes from 60% to 75%, it feels good, even if it means more risk than you wanted. This is when knowing about investor behavior is important. We often prefer keeping winners, even if it makes our portfolio unbalanced.

Think of your portfolio as a ship sailing to an island (your financial goals). Rebalancing is like adjusting the sails and rudder to stay on course. Without these changes, winds and currents (market changes) can push you off track.

Here’s a simple example of how drift happens.

The table, “Portfolio Drift Example Over 12 Months”, shows how a basic 60/40 stock/bond portfolio can change over time if not rebalanced.

|

Time Period |

Stock Allocation |

Bond Allocation |

Drift from Target |

|---|---|---|---|

|

Start |

60% |

40% |

0% |

|

Month 3 |

63% |

37% |

3% |

|

Month 6 |

68% |

32% |

8% |

|

Month 9 |

72% |

28% |

12% |

|

Month 12 |

75% |

25% |

15% |

Even small changes in the market can cause big shifts over time. When stocks do better than bonds, your stock portion grows, which can mean more risk.

The Importance of Discipline

Successful investors, like Warren Buffett, know how important it is to rebalance regularly. It might feel strange to sell some winning stocks and buy more of the lower-performing ones, but rebalancing is key. It helps keep your investments in line with your goals. This increases your chances of success in the long run. Knowing when to rebalance is important for keeping a healthy mix of investments.

The Once-a-Year Sweet Spot That Actually Works

Understanding how your portfolio can veer off track is crucial. The important question is: how often should you make adjustments? Surprisingly, for many successful long-term investors, the answer is just once a year.

This doesn’t mean ignoring your investments. It’s about finding balance. You want to stay focused without constantly making changes. Think of it like a yearly doctor visit. It’s often enough to catch problems early, but not so often that you’re worried about every small issue.

This yearly routine allows market trends to unfold naturally while keeping your portfolio close to your ideal mix of investments (your target asset allocation). It recognizes that markets have ups and downs but avoids reacting to short-term changes. This steady approach is great for long-term investors.

Why Annual Rebalancing Is Smart

Annual rebalancing is simple and can save you money. Trading too often means more fees, which can reduce your returns over time. By rebalancing once a year, you lower these costs, letting more of your money grow. This is very important for smaller portfolios where fees can hurt more.

Another perk? Less stress. Watching your portfolio and reacting to every market move can lead to emotional decisions. A yearly check helps you pause, see the bigger picture, and make smarter choices.

The frequency of rebalancing is key to managing investments. Different methods have their own pros and cons. For many, annual rebalancing is just right. It keeps your portfolio on target without adding lots of fees. This is especially valuable for long-term investors, as too much rebalancing can increase costs without boosting results. A study by Vanguard showed that annual rebalancing offered a cost-effective way to maintain structure. Historically, this yearly method has been a smart choice, making it popular among investors.

Putting Annual Rebalancing into Practice

Many investors choose a date each year, like early January or a special anniversary, to review and adjust their investments. This creates a regular routine, helping them avoid the urge to time the market or make quick decisions during market changes.

With a steady routine, rebalancing turns into a habit, not a task. This helps you look at the long term, focusing on your big financial goals instead of daily market ups and downs. Think of it as a yearly check-up for your investment “garden,” keeping it healthy and on track for your financial aims.

When Your Portfolio Needs Attention

Imagine if your portfolio could gently remind you when it needs some care, instead of you always checking on it. That’s the idea behind tolerance band rebalancing. It’s like setting up smart alerts that notify you when your investments drift too far. Instead of rebalancing every January, you set your own comfort zones.

These zones, called deviation thresholds, signal when to act. Many investors choose bands of 5% to 10%. So, if your ideal stock share is 60%, a rise to 65% or a fall to 55% prompts a rebalance. It’s like having an advisor who calls only when it’s important.

Here’s how this is different from calendar rebalancing. With tolerance bands, you respond to real portfolio shifts, not just the calendar. This drift-based method offers more freedom and might cut costs. You don’t adjust constantly, just when needed.

For example, consider a 5% tolerance band. If any asset moves more than 5% from its target, you rebalance to fix it. This helps in bumpy markets, keeping your risk steady without too much trading. This method appeals to those who want to balance saving money and keeping their portfolio stable. Want to learn more about tolerance bands? Check out this helpful article: What Optimal Portfolio Rebalancing Strategy.

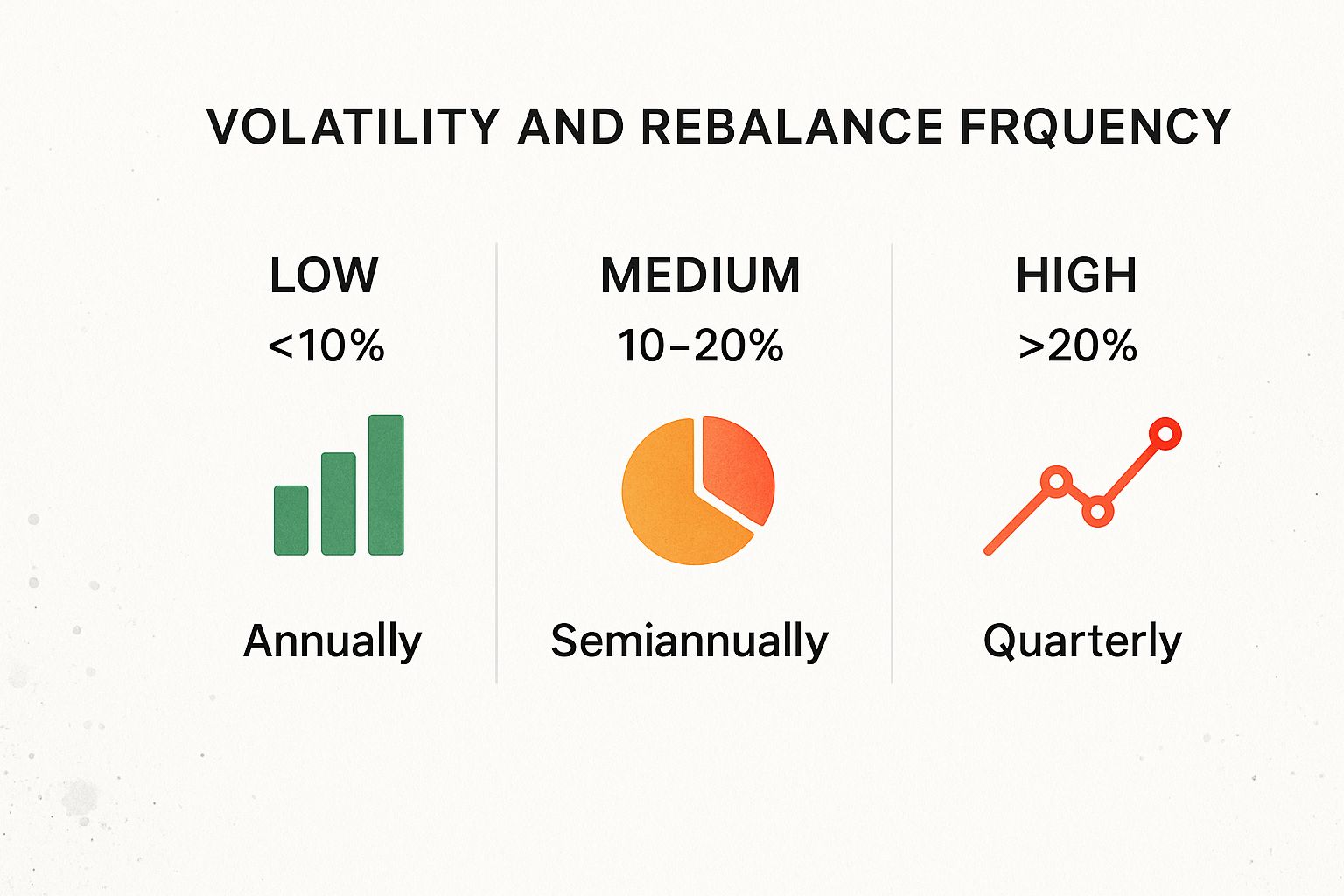

The infographic shows how market changes affect how often you should rebalance. As the market gets more unpredictable, the suggested rebalancing goes from yearly for calm markets to every three months for more active ones. This shows why it’s important to adjust your rebalancing plan based on the current market.

Setting Tolerance Bands for Different Investments

Just like each investment is unique, so should your tolerance bands be. A 5% band for stocks might not work for bonds. Bonds are usually steadier, so their prices don’t change as much as stocks. They might handle a wider band, maybe 10%, because they are less likely to change a lot.

Even in the same type of investment, the ups and downs can vary. Small company stocks often change more than big company stocks, so they might need stricter limits. Likewise, bonds from growing markets are usually more unpredictable than U.S. government bonds.

By considering these factors, you can create a specific tolerance band system that suits your investments and comfort with risk. This focused method helps manage risk better and can cut down on unneeded trades. You only rebalance when it really matters.

To make this clearer, here are some suggested limits:

Tolerance Band Limits by Investment Type

Suggested limits for different investments before rebalancing

|

Asset Class |

Conservative Threshold |

Moderate Threshold |

Aggressive Threshold |

Typical Range |

|---|---|---|---|---|

|

Stocks (Large Cap) |

5% |

7.5% |

10% |

5%-10% |

|

Stocks (Small Cap) |

3% |

5% |

7% |

3%-7% |

|

Bonds (U.S. Government) |

10% |

12.5% |

15% |

10%-15% |

|

Bonds (Emerging Market) |

5% |

7.5% |

10% |

5%-10% |

This chart gives a basic guide. You can change these limits based on how much risk you can handle and what you have in your investments. Remember, it’s important to think about how much each asset can change in value. This helps you set your risk levels. This personal method is key for a good rebalancing plan.

Staying Cool When Markets Go Crazy

Market downturns can shake even the most confident investor. They might turn calm planners into panic sellers. But sticking to your rebalancing plan is important during these times.

Why?

Because market changes can upset your portfolio’s balance, affecting your long-term goals. Knowing when to rebalance during these times is key to staying on track.

The Psychology of Panic

Picture your portfolio as a ship in a storm. Logic tells you to adjust (rebalance) to get through the rough waters. But fear might say, “Abandon ship!” (sell everything).

This feeling is natural but can hurt your finances. Selling during a downturn means losses, making it harder to recover when the market goes up again.

Think back to the 2020 crash from COVID-19. News reports increased fear, and portfolios fell. Many sold in panic, fixing their losses.

Those who stayed with their rebalancing plans, or even bought more at low prices, gained when the market improved.

Learning From the Past

Looking at past markets teaches valuable lessons. During the 2018 and 2020 drops, frequent rebalancing helped reduce losses and gain during recoveries.

A study showed that portfolios rebalanced often did better in volatile times. Daily rebalancing, especially, helped limit losses and gain during upswings.

This shows the need to adjust your plan to market conditions. More frequent rebalancing can help in shaky times, but it’s important to weigh this against higher transaction costs. Explore more about rebalancing and market changes.

Strategies for Staying Calm

How do you keep calm and avoid making emotional choices during wild market times? Being ready is crucial. Having a clear plan before a market crash can guide you when emotions are high.

You might set limits, which tell you when to adjust your investments if they move too far. Or, you might stick to a regular schedule for changes.

Another good idea is to imagine different market situations and how you would react. This mental practice can help you stay calm and think clearly when things get real.

Remember, market drops will happen. They are just part of the cycle. By getting ready in your mind and with a plan, you can handle these times with confidence and maybe even benefit from them.

Turning market mess into a chance takes discipline and a clear plan. It means being brave enough to buy when others are selling and sticking to your plan, even if it feels tough.

Finding Your Own Rebalancing Style

Your rebalancing plan should suit you well. Are you an investor who likes to track everything, or do you prefer watching from afar? Do small fees matter to you, or are they not a big deal? Let’s find the best time for your rebalancing.

Life Stages and Investment Styles

Consider different investors at various life stages. A young professional starting out might take more risks and think long-term, like a beginner with everything to gain. They could rebalance less often, maybe once a year, giving their investments time to grow.

On the other hand, someone close to retirement may want to protect their savings and earn income. They might check their portfolio more often, maybe every few months, to stay on track with their goals.

Life events can also prompt a rebalancing checkup. A new job, marriage, buying a house, or having children can change your financial situation. These are good times to review your rebalancing plan and adjust as needed.

Risk Tolerance and Time Horizon

How do you handle market ups and downs? If market changes make you nervous, you’re likely a more careful investor. You might prefer to rebalance more often, maybe every few months, to keep your portfolio comfortable and avoid big losses during market drops. This gives peace of mind, even if it means missing some gains when the market rises.

If you have a long time before retirement, you can handle more risk. You have time to recover from any losses. A long time frame lets you ride out market changes. This might allow for rebalancing less often, maybe once a year.

The Cost Factor

For investors with smaller portfolios, transaction costs can feel like paying for every move. Each trade reduces your potential profits. If you have limited funds, minimizing trades is key. Less frequent rebalancing, maybe once a year, might be more cost-effective.

For investors with larger portfolios, transaction costs are less of a worry. They have more freedom to rebalance more often without greatly affecting their returns.

Remember, finding the right rebalancing schedule is a personal journey. Your ideal plan depends on your situation, risk comfort, goals, and even your personality. It’s about finding the balance that works best for you, setting you up for success in the long run.

The Hidden Costs of Getting Rebalancing Wrong

Getting your portfolio balance wrong can affect your long-term finances. It’s not just about fees; hidden costs can slowly reduce your returns.

The Danger of Drift

Think of planning a road trip. You’ve picked your route and must-see spots. But if you take detours without updating your GPS, you might reach your destination, but it’ll take longer, cost more in gas, and you’ll miss planned sights.

Your investments are similar. Letting your portfolio drift from your plan is like taking those detours. A mix of 60% stocks and 40% bonds can become 80/20 in a bull market. If the market drops, losses grow because you have more risk than intended. Or, a careful saver can end up buying high if they don’t rebalance.

Emotional Decisions During Market Extremes

Market crashes are tough. Even steady investors might want to sell in panic, which makes it harder to recover when the market goes up again. A booming market can lead to buying hot stocks, forgetting about diversification. Trying to perfectly time the market is risky. A good rebalancing plan helps you avoid these emotional traps. Rebalance often enough to match your goals for success.

Over-Rebalancing and Under-Rebalancing

Rebalancing is like steering a car. Over-rebalancing in calm markets is like adjusting the wheel too much. You waste energy (and money on trades) and miss smooth progress. You might sell good investments just to follow a strict schedule, only to see them continue doing well.

Under-rebalancing is like not adjusting sails in a storm. You might get through, but the trip will be rougher, and you’ll get to your destination later. You miss chances to buy low and sell high when markets change.

Perfectionism as the Enemy of Good

Don’t aim for perfect balance every time you rebalance. Getting close enough is usually fine. Constantly changing your portfolio for perfect balance adds trading costs and can lead to emotional decisions.

Measuring Your Rebalancing Success

How can you tell if your method is working? Compare your portfolio’s results to a standard that matches your goals. Also, keep an eye on how closely your portfolio sticks to your risk comfort level over time. If your portfolio is more risky than you like, or if your returns are below expectations, it may be time to adjust your strategy. Regularly checking how often you adjust your portfolio against your results helps you stay on track with your financial goals.

Your Personal Rebalancing Game Plan

Now that we’ve looked at different ways to adjust a portfolio, let’s discuss making a plan you can stick to. Think of it as your own roadmap, guiding you through picking the right schedule for changes, automating the process, and dealing with market ups and downs.

Building Your Rebalancing System

The first step is deciding how often you want to make changes. For many, checking once a year is a good start. Pick a date that means something to you, like your birthday or the start of the year. This helps set a routine and stops you from reacting to short-term market changes. It’s like getting an annual check-up for your investments.

Or, you could use limits, like 5% or 10%. These act like guardrails, triggering a change only when your portfolio drifts outside your comfort zone.

Let’s say you want 60% of your portfolio in stocks. A 5% limit means you’d adjust if stocks reach 65% (too much risk) or drop to 55% (not enough risk). It’s about staying on track, not making constant changes.

Check out this screenshot from the Portfolio Performance software. It shows a sample portfolio. You can clearly see the current holdings against the target allocations. This helps you spot any drift and make smart decisions.

Next, set up a system to make changes easy. Use calendar reminders or alerts from your brokerage account. A simple checklist can also help you avoid missing any steps. And remember to keep records of your choices—it’s helpful for future reference and taxes.

Getting Ready for Surprises

Life doesn’t always go as planned. Changes like a new job, getting married, buying a home, or having kids can affect your money and investment goals. Be ready to adjust your plans for these changes. After big life events, check and change your strategy to keep it in line with your current needs.

Also, get yourself ready for ups and downs in the market. Remember, rebalancing means selling some investments that did well and buying some that didn’t do as well. This might feel strange, especially when the market is down. But having a plan helps you stay focused and avoid acting on feelings when things get tough.

Want to manage your investments better and make smart choices? Stock Decisions gives you clear tips from trusted sources. Visit Stock Decisions now to find out more.