Why Financial Reports Aren’t Actually That Scary

Uncovering the Secrets of Financial Reports

Here’s a little secret about financial reports: they are stories. Yes, stories told with numbers, but still stories. Over time, I’ve talked with many analysts and investors. I’ve learned that the biggest challenge isn’t how complex these reports are; it’s the fear they create. Many think they need to be experts just to look at them. But that’s not true.

These reports follow simple patterns. Once you understand the basics, they seem much less scary. Companies must share these details by law. This openness protects you as an investor and helps them attract funds. It’s like a restaurant showing its health score – it keeps things honest.

Making Sense of the Story

Experienced people don’t see financial reports as tests. They see them like mystery novels. They look for hints about a company’s true health and future. Changing this mindset is important. It turns confusing numbers into interesting stories.

For instance, if accounts receivable is growing fast, it might mean a company is having trouble getting paid. That’s a warning you might miss if you only look at revenue.

There are also many false beliefs about financial analysis that scare people. One big myth is that you need fancy tools or expensive data. That’s not true. You can find a lot of information for free on company websites and the SEC’s EDGAR database.

Another myth is that financial statements hide the truth. While there is some flexibility, strict rules and audits ensure accuracy and prevent fraud. Knowing these standards helps you read reports with confidence.

Groups like the IASB improve the trustworthiness of financial reports globally. The International Financial Reporting Standards (IFRS) are used in over 140 countries. This includes major areas like the European Union, Canada, and Australia. They make reports more consistent across borders. With practice, anyone can learn to read these important documents.

Reading Balance Sheets Like a Financial Detective

A company’s balance sheet is like its financial fingerprint. It’s a snapshot showing what the company owns (assets), owes (liabilities), and what belongs to the owners (equity). The basic formula is easy: Assets = Liabilities + Equity. But the real insight comes when you look beyond the numbers to find their story.

For instance, a company might have a large amount listed under assets. That sounds great, right? Maybe not. What if those assets are mostly inventory? Having a lot of unsold products isn’t always good. It might mean sales are slow and losses could happen soon. This is why understanding financial reports is important for anyone in business, whether you’re an investor, analyst, or manager.

Take Apple Inc. for example. At the end of 2023, their balance sheet showed total assets of about $351 billion and total liabilities of around $287 billion. So, shareholders had around $64 billion in equity. Learn more about financial statement analysis. This equity is what’s left after paying all debts.

Cash, Debt, and Future Clues

Is cash really the best? Most of the time, yes. Having a lot of cash is usually a good thing. But too much can make people wonder. It might mean the company can’t find good places to invest. Or maybe they are worried about the future and keeping money instead of using it to grow. It’s not a big problem by itself, but it’s worth checking out.

The liabilities section of the balance sheet is full of clues. It shows short-term and long-term debt. This tells us how the company is funded and what they think about the future. If they rely on short-term debt, it could mean they can’t get long-term loans. Maybe lenders are unsure about the company’s future.

On the other hand, using long-term debt wisely can show they are confident. Taking on these debts often means management believes they can earn enough money to pay them back later.

By looking closely at the balance sheet, you can see beyond the obvious. You start to really understand a company’s finances. It’s like being a detective, putting pieces together to see the whole story. This is what makes some investors more informed than others.

Income Statements: Where the Real Story Lives

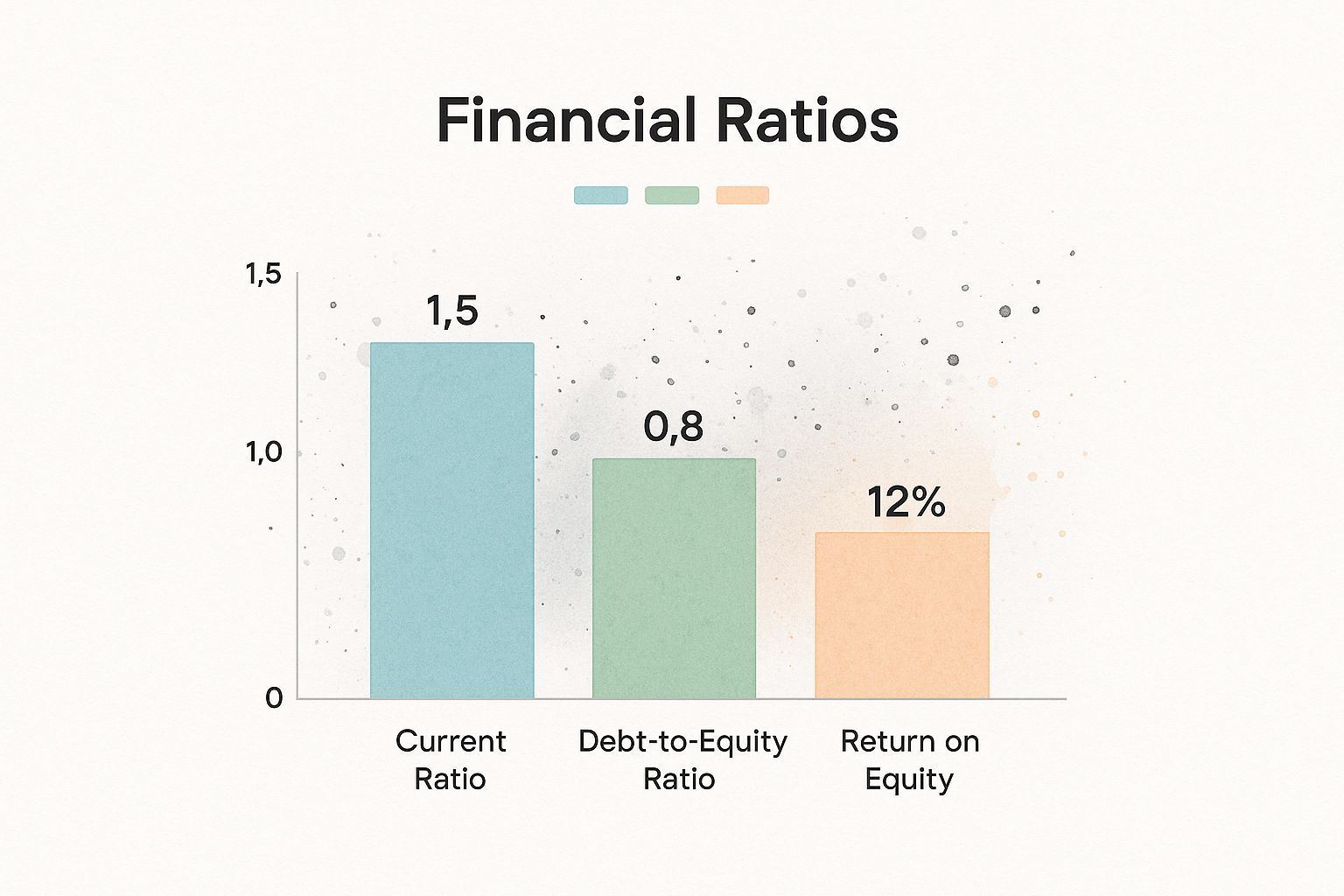

This infographic provides a quick look at three key financial ratios: Current Ratio, Debt-to-Equity Ratio, and Return on Equity. Think of these as a company’s vital signs. A current ratio of 1.5 is often healthy. It means the company can pay its short-term debts with its assets. A debt-to-equity ratio of 0.8 shows a good balance between borrowed money and shareholder funds. A 12% return on equity means investors are getting a solid return.

While revenue often grabs attention, the real details are in the income statement. This important document shows how a company makes profit. Knowing how to read it is crucial. It explains why two companies with the same revenue can have different futures. One might have regular income, while the other relies on one-time deals. This makes a big difference when judging future success.

Beyond the Headlines: Regular Income vs. One-Time Gains

On an income statement, look for the difference between regular income and one-time gains. Imagine two software companies, each with $10 million in revenue. Company A earns its money steadily from software subscriptions. This gives a steady income. Company B got a one-time $10 million government contract. Both have the same revenue, but Company A’s model is more stable. This shows why knowing where revenue comes from is as important as how much there is. It’s like comparing a steady paycheck to a lottery win—one gives long-term security, the other just brief excitement.

The Paradox of Growth and Declining Profits

The income statement gives us important information. It shows how growth and making money are connected. Sometimes, fast-growing companies show less profit. This might seem odd. But it’s not always bad. If a company spends money on new ideas or new markets, their profits might drop for a while. These expenses can lead to big growth later. It’s like growing plants – you have to put in effort before you see results. Knowing the company’s plan and future goals helps in understanding this.

Let’s stop here and look at parts of the Income Statement. The table below explains what each item shows, possible warning signs, and how these differ between industries.

|

Line Item |

What It Measures |

Red Flags to Watch |

Industry Variations |

|---|---|---|---|

|

Revenue |

Total sales generated |

Sudden drops, inconsistent growth |

Seasonal businesses may have predictable fluctuations |

|

Cost of Goods Sold (COGS) |

Direct costs associated with producing goods or services |

Unexpected increases, disproportionate to revenue growth |

Manufacturing vs. service industries have very different COGS structures |

|

Gross Profit |

Revenue – COGS |

Declining gross profit margin |

High-margin vs. low-margin industries |

|

Operating Expenses |

Costs of running the business (e.g., salaries, rent, marketing) |

Uncontrolled increases, especially in relation to revenue |

Software companies may have high R&D expenses |

|

Operating Income |

Gross Profit – Operating Expenses |

Declining operating income, consistently negative operating income |

Highly competitive industries may have lower operating margins |

|

Net Income |

Profit after all expenses, including taxes and interest |

Declining net income, inconsistent profitability |

Highly regulated industries may face unique tax implications |

This table helps you quickly check how a company is doing. It’s important to look at more than just the numbers. Look at how the numbers change over time and compare them to others in the industry.

Watch Out for Accounting Tricks

Be careful: some accounting methods can hide the real financial state of a company. Though accounting rules allow some flexibility, they can be used to make things look better than they are. This is why knowing basic accounting is important. Don’t just trust the numbers. Ask how they were made. Being a bit skeptical, along with understanding financial reports, helps you spot truly good companies from those that just look good. Think of it like peeling an onion – you need to look deeper to find the truth.

Cash Flow: The Truth Behind the Profits

Financial reports can be confusing. A company might seem profitable, but still be close to bankruptcy. This is because profit is not the same as cash. The cash flow statement shows how money really moves in a business. Trust me, it can tell a very different story than the income statement. Understanding financial reports means knowing this important difference.

I’ve seen this happen. I once looked at a company with high sales and good profits. But their cash flow statement told a hard truth: they weren’t getting cash from customers fast enough. They were borrowing from the future to look successful. This kind of plan never ends well.

Operating Cash Flow: More Than Just Profits

The main part of the cash flow statement is operating cash flow. It shows the cash made from the main business. It’s a better sign of financial health than net income. Accounting rules can be tricky. They let companies count revenue before they get the cash, which can make profits look better. Operating cash flow shows how much cash the business is actually making.

Want to see how stable a business is? Check the operating cash flow. It’s like looking at a car’s engine – it doesn’t matter how nice the car looks if the engine is not working well.

Burning Cash and Investor Dreams

Seeing a negative operating cash flow on a cash flow statement is a big warning. This is especially true for growing companies. It often means the company is using up investor money to grow. While new businesses might have negative cash flow at first, if it stays negative, it’s a bad sign. It shows the business can’t survive without constant outside money.

Think of a car with a leaky gas tank. You can keep adding fuel, but sooner or later, you will run out of money, or in this case, investors.

Capital Expenditures: Hints About the Future

Capital expenditures (CapEx) are found on the cash flow statement too. This is money spent on things like equipment and buildings. Looking at CapEx can show what the company expects for the future. If CapEx goes up, it might mean the company plans to grow. If CapEx goes down, it might mean they are worried and cutting back.

CapEx also shows if the company wants to expand and be more efficient. These numbers help us understand the company’s plans.

Knowing how to read a cash flow statement is key to understanding a financial report. It helps you see problems others might not notice. You can also find hidden chances that are not obvious from profits. It’s like reading between the lines of a good story—the true details are often in what is not easily seen.

Financial Ratios That Actually Matter

Cash flow, income statements, balance sheets—we’ve talked about a lot. But looking at raw financial data is like having all the pieces of a puzzle without the picture. Financial ratios help put these pieces together to see the whole picture. But not all ratios are equally helpful. Some are better than others, and some popular ones can even be tricky! Let’s focus on the metrics that financial analysts use every day, from checking short-term survival to finding hidden value.

Liquidity: Can They Keep the Lights On?

Liquidity ratios show how easily a company can pay its short-term bills. It’s like checking if they have enough money to keep the lights on. The current ratio (current assets / current liabilities) is a good place to start. A ratio of 1.5 or higher is usually a good sign. This means they have enough easy-to-access assets to pay their immediate debts. But remember, context matters! A grocery store, which sells items quickly, might be okay with a lower current ratio than a furniture maker.

Another useful liquidity measure is the quick ratio (current assets – inventory / current liabilities). This one is more careful because it leaves out inventory. Inventory can be hard to sell fast, so the quick ratio focuses on the most liquid assets—the things that can quickly turn into cash. A quick ratio of 1 or higher usually shows good financial health.

Leverage: Walking the Debt Tightrope

Leverage ratios show how much a company relies on borrowed money. It’s like walking a tightrope. A little borrowing can help you move forward, but too much can be risky. The debt-to-equity ratio (total liabilities / shareholders’ equity) is important. It shows the amount of debt a company uses compared to its equity. For instance, in 2024, S&P 500 companies had an average debt-to-equity ratio of about 1.5. This suggests a moderate level of borrowing. Find more about financial statements. A higher ratio means more debt, which can increase profits when things go well. However, it can also increase losses during tough times.

Profitability: Are They Making Money?

Profitability ratios measure how well a company makes money. Return on equity (ROE) (net income / shareholders’ equity) is popular with investors. It shows how much profit the company makes for each dollar invested by shareholders. A higher ROE usually means strong profits and good management. But, always compare it to industry averages and watch trends over time. A sudden jump in ROE might be a one-time event and not a sign of long-term growth.

Another key profitability measure is the gross profit margin (gross profit / revenue). This tells us what percentage of revenue is left after paying the direct costs of making a product or service. A higher margin often means better pricing or more efficient operations. Again, comparing across industries is essential. For example, software companies often have higher margins than retail businesses.

Efficiency: Making the Most of What They Have

Efficiency ratios show how a company uses its resources. They tell us how well the company uses what it has. The inventory turnover ratio (cost of goods sold divided by average inventory) shows how well a company sells its stock. A high number means they sell items fast. This reduces storage costs and the chance of items becoming outdated. But, always compare this to industry standards. For example, a grocery store will have a higher inventory turnover than a car dealership.

Let’s check some common standards for these important ratios:

|

Ratio Category |

Key Ratios |

Healthy Range |

What It Tells You |

|---|---|---|---|

|

Liquidity |

Current Ratio |

1.5 – 2.0 |

Ability to meet short-term obligations |

|

Liquidity |

Quick Ratio |

1.0 or higher |

Ability to meet short-term obligations with most liquid assets |

|

Leverage |

Debt-to-Equity Ratio |

Industry specific, often < 2.0 |

Reliance on borrowed funds |

|

Profitability |

Return on Equity (ROE) |

Industry specific, higher is generally better |

Profit generated per dollar of shareholder investment |

|

Profitability |

Gross Profit Margin |

Industry specific, higher is generally better |

Profit after direct costs |

|

Efficiency |

Inventory Turnover Ratio |

Industry specific, higher is generally better |

Efficiency of inventory management |

This table gives you a quick reference, but remember these are just basic guidelines. The “healthy” range can change a lot between industries. A high debt-to-equity ratio might be okay in a capital-heavy industry but worrying in one that isn’t.

By looking at these key ratios and knowing their details, you’ll get a clearer picture of a company’s financial state. But the ratios aren’t everything. Real insight comes from mixing this analysis with things like industry trends, competition, and how good the company’s management is. Think of these ratios as your guide, helping you understand a company’s performance and potential better.

Spotting Trouble Before Others

The best skill in financial analysis isn’t just knowing ratios or being good with numbers. It’s about seeing small, hidden signs that show trouble might be coming. It’s like a detective finding a tiny clue that solves the case. I learned this from talking to experienced analysts. They have shared their tips for reading between the lines of reports and spotting warning signs before companies make bad headlines.

The Footnotes: Where Secrets Lie

Here’s a big secret: everyone skips the footnotes. But that’s where the real story often is. Footnotes can show important details about a company’s accounting, any lawsuits, or hidden debts. It’s like the fine print in a contract—the place where the most important information is buried. A company might look healthy but have a footnote about a big lawsuit that could ruin profits. Or, they might use tricky accounting to make earnings look better, which isn’t sustainable. Ignoring the footnotes is like ignoring a ticking time bomb.

Rapid Growth: A Double-Edged Sword

Another thing to watch out for? Fast growth can be a tricky beast. While skyrocketing revenue might seem fantastic, it can sometimes mask some serious underlying problems. For example, a company could be achieving rapid growth by offering incredibly generous credit terms to customers. This pumps up sales in the short term, but it also dramatically increases the risk of those customers not paying up. This leads to a growing accounts receivable balance, a key warning sign we talked about earlier when looking at balance sheets. So, while the company looks like it’s booming, it might actually be building a house of cards.

Accounting Tricks: Turning Bad News Into Good

Watch out for tricks some companies use to make their results look better. Accounting rules allow some leeway, but companies can sometimes stretch these rules to make things look good. For instance, they might move expenses to the balance sheet, making profits seem higher. This can make the company look more successful than it is. Spotting these tricks is important for seeing a company’s real financial state. By reading reports carefully and questioning the numbers, you can see through the illusions. This skill helps you avoid mistakes and find chances others might miss. It’s like having a special tool to understand hidden messages in financial reports and make better decisions.

Your Guide to Financial Reports

Let’s learn how to use financial reports. Forget about memorizing formulas. It’s about having a system to find useful details. I’ll give real examples and help you focus on what matters for your goals. This skill gets better with practice.

Creating Your System

Start with a regular process. At first, I jumped from one report to another and got confused. Now, I stick to a sequence: income statement, balance sheet, then cash flow. This keeps me organized and helps me see connections. It’s like reading a story—you wouldn’t skip to the end first, right?

Moving through the reports shows how profits, assets, liabilities, and cash flow connect. This makes the numbers tell a clear story.

Tracking the Right Metrics

Next up, pick the right metrics. Seriously, don’t get bogged down trying to analyze every single number. Instead, zero in on the key performance indicators (KPIs) that align with your investment objectives.

Let’s say you’re thinking about investing in a company. You’ll want to look at profitability ratios like return on equity (ROE) and leverage ratios like debt-to-equity. These will give you a good sense of how efficiently the company is using its resources and how much debt it’s carrying.

On the other hand, if you’re evaluating a potential supplier, you’ll want to focus on liquidity ratios like the current ratio and the quick ratio. These will tell you how easily the company can cover its short-term debts. You don’t want to depend on a supplier who might have trouble paying their bills!

Organizing Your Findings

Here is a screenshot of the EDGAR database. It’s full of company filings. You can find annual reports (10-Ks) and quarterly reports (10-Qs) there. It’s like getting information straight from the source. This is very useful when you want to make smart investment choices. You don’t have to depend on second-hand info anymore!

I use a simple spreadsheet to track important numbers and notes. This helps me see trends, catch any warning signs, and compare how things change over time. Financial analysis is not something you do just once. It’s something you keep doing. By keeping track of your findings, you will gather a lot of useful knowledge. This will help you become a better analyst over time.

Want to make your investment analysis easier and feel more sure about your choices? Check out Stock Decisions. Many investors trust it for clear insights on stocks like GOOGL, MSFT, AMZN, AAPL, META, and NVDA. Visit Stock Decisions today!