Are you ready to tap into the market’s potential? A top-notch stock screener app can help. Here is a list of 9 great stock screener apps. They offer useful insights for everyone, from new investors to experts. We’ll break down the noise and give you clear information so you can make better choices. Check out what each app does well, compare the costs, and see the pros and cons to find the one that suits you best.

This guide goes into the features that count most. We’ll look at how these tools can change your investment plan. Using a strong stock screener app can boost your returns. Find the right app to improve your strategy and spot hidden opportunities in the market. We’ll also show how Stock Decisions sets itself apart from others.

1. Finviz

Finviz helps you explore the stock market with ease. This online tool lets you sort stocks in many ways and shows them in simple charts. Both experienced traders and beginners like it. You can use it to find investments that fit your plan, whether you’re chasing fast-moving stocks or looking for undervalued ones. Finviz offers simple and detailed filters, with live data to make decisions clearer.

How Finviz Works

Picture a trader using Finviz to spot stocks with high activity and price changes for quick trades. On the other hand, a value investor might use it to find companies with low price-to-earnings ratios or low debt, aiming for growth. Those interested in growth can search for firms with rising sales and earnings. Finviz can fit different investing styles, offering helpful tools for smart choices.

Tips for Using Finviz

To get started, try Finviz’s ready-made filters before making your own. This helps you learn what the tool can do. Check out the heat map feature to quickly see trends in different sectors. Mix basic and technical filters to narrow down your search and find interesting options. Save your favorite filters as bookmarks for quick access later.

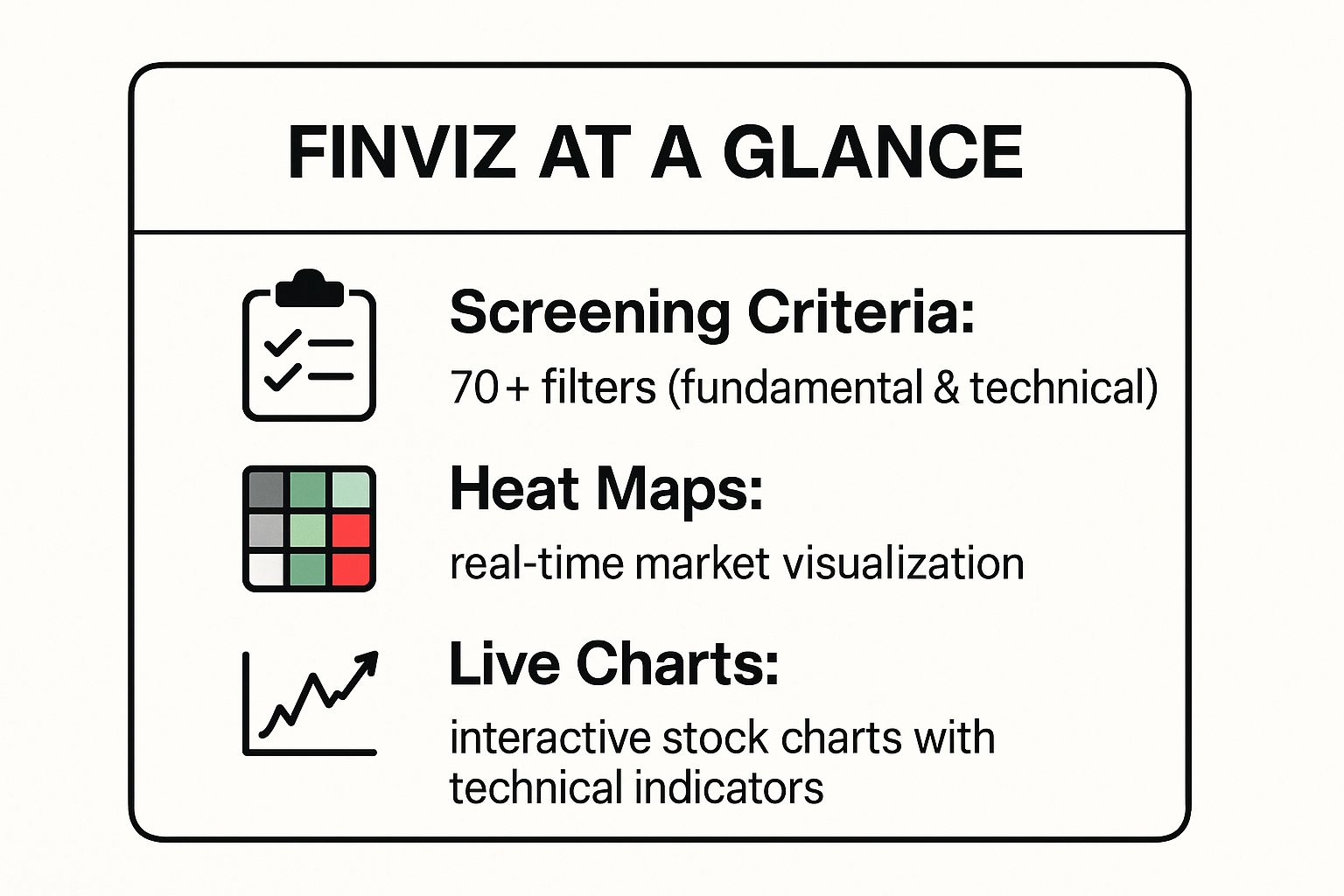

The chart below shows Finviz’s main features, highlighting its strengths in sorting stocks.

Finviz Overview

Finviz is a strong tool with many features. It offers more than 70 filters for both basic and technical analysis. You can see real-time market changes using heat maps. It also has charts that show key technical signs.

Why People Like Finviz

Finviz is popular because it is easy to use. It has lots of features and you can use important tools for free. Many retail traders, finance bloggers, and YouTubers talk about it. They find it very helpful for checking stocks. This app gives you what you need to use market information for smart investing. It helps you on your path to financial success.

2. Thinkorswim by TD Ameritrade

Thinkorswim by TD Ameritrade (www.tdameritrade.com) is a top-notch trading tool. It has one of the best stock screener apps out there. This platform is made for serious traders and investors. It gives you strong tools and real-time data to work with. You can use it to create detailed scans, test strategies, and keep an eye on the market. Whether you are looking at options, tracking patterns, or finding high-dividend stocks, Thinkorswim helps you make smart choices.

Thinkorswim in Action

Picture a professional trader using Thinkorswim to find unusual options activity, spotting triggers for price changes. A swing trader might use the platform’s tools to find the best times to buy and sell. An income investor could search for stocks that pay high dividends and have strong fundamentals, building a steady income portfolio. Thinkorswim suits different investing styles, offering a wide range of tools for success.

Tips for Mastering Thinkorswim

To get the most out of Thinkorswim, use the tutorials and learning center. Begin with easy scans before trying out custom thinkScript. Turn scan results into watchlists to keep track of investment chances. Pair the platform’s screening power with its charting tools for a full view of the market.

Why Thinkorswim Stands Out

Thinkorswim is popular because it has many features and strong analysis tools. Known by TD Ameritrade, traders, and advisors, it is essential for those seeking an edge in the market. This app gives you the tools to look at data, improve strategies, and aim for financial success.

3. Yahoo Finance Stock Screener

Discover Yahoo Finance Stock Screener

Yahoo Finance Stock Screener is a free tool for stock analysis. You can find it on the Yahoo Finance website. It helps both new and experienced investors. You can filter stocks by things like market size and sector. This helps you find good investment chances. With this tool, you can make smart choices about where to invest.

How to Use Yahoo Finance Stock Screener

Picture a new investor. They use the screener to find big companies with low price-to-earnings ratios. This means they look for well-known companies that might be a good buy. People who like dividends can find stocks with high dividend payouts. This ensures steady income. Even students and teachers can use it for school projects. They can learn about market trends and company success. The screener is easy to use and helps many people learn about finance.

Tips for Using Yahoo Finance Stock Screener

Start by checking out the ready-made screening templates. This helps you learn what you can search for. Then, create your own screens. Use Yahoo Finance’s news and analysis to learn more about the companies you find. You can also save your results in a spreadsheet. This way, you can keep track of possible investments. Finally, use the portfolio tracker to watch how your chosen stocks are doing. Stay up-to-date with their progress.

Why Choose Yahoo Finance Stock Screener

Yahoo Finance Stock Screener is easy to use. It is part of a popular finance site. It connects you to lots of market data, news, and analysis. Many people use it to learn about the stock market. This tool is free and simple. It helps you take charge of your money and plan for the future.

4. TradingView Stock Screener

TradingView (www.tradingview.com) offers more than just charts. It has a strong stock screener app. This app mixes easy filtering with community insights. The platform suits many types of investors. It works for both day traders and long-term investors. Whether you want fast-growing tech stocks or undervalued dividend stocks, TradingView helps you find what you need. It allows you to spot good investments and improve your trading.

TradingView Stock Screener in Action

Imagine a trader using TradingView to find stocks that are starting to move in a certain way. They can use the platform to look for chances in markets around the world. TradingView’s social features let users share and talk about their ideas, creating a place where people can learn from each other. These uses show how TradingView can fit different trading styles and work in markets everywhere.

Tips for Using TradingView Stock Screener

To get the most out of TradingView, check out what others in the community are sharing. This can give you new ideas and ways to see the market. Set up alerts so you don’t miss any important updates. Use the screener along with TradingView’s charting tools for a deeper look. Join in the community to learn and improve your strategies.

Why TradingView Stock Screener is Special

TradingView is popular because it mixes strong screening, advanced charting, and a lively community. Many traders and the platform itself have made it a favorite tool. This app gives you the tools and community support to turn your analysis into trading plans, helping you reach your financial goals.

5. Stock Rover

Stock Rover (www.stockrover.com) is an investment research tool known for its detailed stock screening. This app does more than just basic filtering; it includes tools for managing your portfolio and doing in-depth research. It’s great for serious investors, financial advisors, and anyone who wants a strong tool for stock analysis. Use it to boost your investment research and manage your portfolio better.

Stock Rover in Use

Picture a financial advisor using Stock Rover to find the right investments for their clients. These investments match their clients’ risk levels and financial goals. Value investors can use the app’s detailed numbers, like price-to-book and return on equity, to find companies that might be undervalued. Portfolio managers can use Stock Rover’s risk tools to make sure their portfolios are diverse and match market conditions. The app is flexible and meets many investment needs.

Tips for Using Stock Rover

To get the most out of Stock Rover, try the free trial to see all its features. Use the comparison tools to look at potential investments side by side. Make your own screening formulas to find opportunities that fit your strategies. Don’t forget about the portfolio management tools; using them with your screens gives you a complete view of your investments.

Why Stock Rover is Popular

Stock Rover is popular because of its deep research, detailed screening, and portfolio tools. Investors and financial advisors trust it for market analysis. This app gives you the data and tools you need to make smart investment choices and build a strong portfolio.

6. MarketWatch Stock Screener

MarketWatch Stock Screener Overview

MarketWatch Stock Screener offers a simple way to explore the stock market. This tool is part of the MarketWatch platform and lets you filter stocks while keeping up with news. It helps you find good investments and stay updated on important events. Whether you focus on news or prefer basic analysis, the screener makes the process easy.

Using MarketWatch Stock Screener

Picture an investor who loves staying informed using the Stock Screener to find stocks with high trading volume and read the latest news at the same time. A careful investor might use basic filters like dividend yield and price-to-earnings ratio to spot reliable stocks for the long term. Researchers can mix the screener’s findings with MarketWatch’s tools to understand market trends better. The platform supports different strategies, allowing users to link their stock choices with real-world events.

Tips for Using MarketWatch Stock Screener

To get the most out of the screener, use it with the platform’s news feed. This will help you understand your screening results better. Focus on basic screening, using filters like earnings per share and return on equity. Export your results into spreadsheets for more analysis and custom calculations. Make and save watchlists to keep an eye on your chosen stocks and react to market changes.

Why MarketWatch Stock Screener is Special

The special feature of MarketWatch Stock Screener is its link with the MarketWatch platform. This connection between stock filtering and live financial news gives you valuable context for your decisions. Recognized by MarketWatch and Dow Jones, this screener helps those who want to mix basic analysis with current market info. MarketWatch Stock Screener helps you make smart choices by combining stock picking with market updates, guiding you towards financial success.

7. Zacks Stock Screener

Zacks Stock Screener helps investors understand the stock market better. This strong tool mixes old-style stock checking with Zacks’ special ranking system. It uses earnings data to spot good investments. Whether you are an expert or just starting, Zacks Stock Screener gives you what you need to match your investments with your money goals.

Using Zacks Stock Screener

Picture an investor focused on earnings using Zacks Stock Screener to find companies with growing earnings. This could mean they will grow soon. A value investor might use Zacks to find cheap stocks with good basics. Even top money managers can use the Zacks Rank in their checks to stay ahead. The tool is flexible and fits many strategies, making it a great choice for smart decisions.

Tips for Using Zacks Stock Screener

Make the most of Zacks Stock Screener by using its special features. The Zacks Rank, based on earnings changes, gives deep understanding of how a company might do. Look at changes in earnings estimates to find stocks with better chances. Mix Zacks’ set screens with your own rules for a personal touch. Watch industry rankings to find growing sectors and use sector rotation strategies.

Why Choose Zacks Stock Screener

Zacks Stock Screener is special because it uses Zacks’ own research, especially the Zacks Rank. Made famous by Zacks Investment Research, it helps earnings-focused investors and money managers. This tool offers a different way to look at stocks. By using Zacks’ ways, you can find great investment chances and move closer to your financial goals.

8. E*TRADE Stock Screener

ETRADE Stock Screener helps ETRADE users find investment options right in their brokerage account. This tool makes it easy to go from searching for stocks to buying them. It offers both simple and complex filters. Use it to find stocks that fit your trading style. Whether you’re into active trading, options, or managing your portfolio, it helps you place orders easily.

How to Use E*TRADE Stock Screener

Picture an active trader using the E*TRADE Stock Screener. They can quickly find stocks with high volume or breaking resistance levels. They can then make trades fast, taking advantage of market changes. Options traders can use the screener to find stocks for their strategies by checking things like implied volatility. Portfolio managers can find stocks that match their current holdings, boosting variety and meeting their goals.

Tips for Getting the Most from E*TRADE Stock Screener

Boost your trading by using the direct trading feature, which makes order placement easy. Use alerts to track your screening results and get updates when stocks meet your criteria. Pair the screener with E*TRADE’s research tools to learn more about your choices. If you’re new to trading, try paper trading first to practice without risk. This helps you fine-tune your strategies before using real money.

What Makes E*TRADE Stock Screener Unique

The ETRADE Stock Screener is unique because it connects directly with the ETRADE brokerage platform. This connection makes it simple to find and act on investment ideas. Loved by active traders and online brokerage users, this tool links analysis and action. Use this tool to turn market insights into trades, helping you reach financial success quicker.

9. Morningstar Stock Screener

Morningstar Stock Screener helps investors with detailed tools to understand the stock market better. This platform, made by a well-known investment firm, focuses on basic analysis and long-term planning. It combines Morningstar’s unique ratings and methods, helping investors find good investment chances that fit their personal goals. Whether you’re looking for strong companies or eco-friendly investments, Morningstar gives you the tools to make smart choices.

Morningstar Stock Screener in Action

Picture a long-term investor using the economic moat feature to find companies with a lasting edge over others. This helps them focus on businesses likely to do well in the future. An investor interested in ESG can use the platform to look for companies with good environmental, social, and governance practices. Value investors can use Morningstar’s fair value checks to find companies that may grow. The platform fits many investment styles, offering tools for long-term success.

Tips for Mastering Morningstar Stock Screener

To get the most out of it, start with the pre-made screening templates and use the Star Rating as a first filter. This helps you learn about the platform’s features. Look at the economic moat analysis to understand a company’s strengths. Add ESG factors to your screening to find eco-friendly investments. Also, use the screener with Morningstar’s company reports to do thorough research and make smart choices.

Why Morningstar Stock Screener Stands Out

Morningstar Stock Screener is special because it focuses on basic analysis, uses unique research, and plans for the long term. Well-known by Morningstar, long-term investors, and advisors, the platform is a key tool for building wealth. This stock screener app gives you what you need to turn market knowledge into real investment plans, helping you succeed financially.

Top 9 Stock Screener Apps Comparison

|

Platform |

Implementation Complexity 🔄 |

Resource Requirements ⚡ |

Expected Outcomes 📊 |

Ideal Use Cases 💡 |

Key Advantages ⭐ |

|---|---|---|---|---|---|

|

Finviz |

Moderate; intuitive but can overwhelm beginners |

Light; web-based, no app |

Effective screening with visual market insights |

Day trading, value & growth investing |

Extensive filters, heat maps, real-time charts |

|

Thinkorswim by TD Ameritrade |

High; steep learning curve, requires account |

High; resource-intensive, desktop platform |

Powerful, customizable scans with real-time data |

Professional & serious traders, options analysis |

Advanced scripting, backtesting, options screening |

|

Yahoo Finance Stock Screener |

Low; simple and easy to use |

Very low; web and mobile accessible |

Basic screening for casual use |

Beginner investors, casual screening |

Completely free, no registration, mobile-friendly |

|

TradingView Stock Screener |

Moderate; modern interface with social features |

Moderate; web-based, some paid features |

Real-time alerts, community-driven insights |

Technical traders, social & international investors |

Strong chart integration, social trading community |

|

Stock Rover |

High; complex interface and advanced features |

Moderate to high; web-based with deep data |

Detailed fundamental screening & portfolio analysis |

Serious investors, financial advisors |

600+ metrics, portfolio tools, comparative analysis |

|

MarketWatch Stock Screener |

Low; straightforward and news-integrated |

Low; web-based free tool |

Basic screening with news integration |

Beginners, news-focused & conservative investors |

Free, no registration, Dow Jones data |

|

Zacks Stock Screener |

Moderate; focused on research but interface dated |

Moderate; subscription needed for full features |

Earnings and rank-based screening |

Earnings-focused, value investors, professionals |

Unique Zacks Rank, analyst insights |

|

E*TRADE Stock Screener |

Moderate; brokerage account needed, somewhat complex |

Moderate; integrated with trading platform |

Screening plus trading execution |

Active traders, options traders |

Direct trade integration, real-time data |

|

Morningstar Stock Screener |

High; research-heavy focus, subscription required |

Moderate; web-based with premium features |

In-depth fundamental & ESG analysis |

Long-term investors, advisors |

Proprietary ratings, economic moat, ESG focus |

Empowering Your Investment Journey: Choosing the Right Stock Screener App

Finding the right stock screener app can be tough. There are so many choices, each with its own features. This list of top stock screener apps is a good place to start. It shows what each app does well and where it might fall short. Whether you like the detailed data of Finviz, the easy use of TradingView, or the numbers-focused Morningstar, there’s something for every investor.

Tips for Picking a Stock Screener

As you start your investing journey, keep these tips in mind. First, look for apps that are easy to use, especially if you’re new. Check the pricing and make sure it fits your budget. Most importantly, pick a tool that matches your investment style, whether you trade daily or invest for the long run.

Free Trials: Try out free trials to see which app you like best.

Feature Match: Look for features that fit your way of investing.

Reliable Data: Make sure the app gives correct and current market info.

Good Experience: A simple and clear design makes using the app more enjoyable.

Taking Action

This information helps you take real steps toward your money goals. First, figure out what you need. Are you a trader who looks at charts, or do you focus on company numbers? Knowing this will help you choose the best stock screener.

Going Further: Making Investing Easier

Basic stock screeners are helpful, but some apps offer more. Find ones that make hard info easier to understand. This saves you time and lets you make smart decisions.

The Importance of Smart Choices

Getting good at stock screening gives you the knowledge to handle the market’s ups and downs. By using the right app, you can spot chances and avoid mistakes. This gives you better control over your financial future.

Remember, investing is a journey. With the right tools and a clear plan, you can reach your money goals. Take the next step in making your investing process easier. Check out Stock Decisions, a platform that turns complex market data into clear info. See how it can change the way you invest. Stock Decisions