Let’s discuss diversification. It might seem like a complex idea, but it’s very important. It’s the foundation of a smart investment plan. Imagine putting all your savings on one bet in roulette – seems risky, right? Your stock portfolio needs the same care.

Chasing hot stocks is tempting, but focusing too much on them is risky. I’ve seen markets change quickly, from the dot-com crash to the recent crypto slump. These events show that even strong investments can fail. Diversification acts like a safety net, easing the blow when one investment suffers.

So, what is diversification? It’s about spreading your money across different types of investments, like stocks, bonds, and real estate. In stocks, spread your money across various fields like tech, healthcare, and energy. Also, invest in different countries to benefit from global growth. This way, if one investment fails, others might do well and cover the loss. That’s how diversification works.

But it’s not just about avoiding losses. Diversifying can actually increase your long-term gains. Looking at past data since 1926, diversified portfolios have done better than focused ones over time. For example, one dollar invested in a diversified portfolio in 1926 could grow to $12,930 today. The same dollar in a small group of top stocks? Only about $9,855. That’s a 24% difference! Over ten-year periods, diversified portfolios won 66% of the time. Want to learn more about diversification? Check this out. This shows the power of slow and steady growth. So remember, diversification isn’t just about avoiding risk. It’s about setting up your portfolio for steady growth over the long run.

Finding Your Investment Sweet Spot and Timeline

Before we get into how to mix up your stock portfolio, let’s focus on something really important: your own money situation. Forget those boring risk quizzes. You need to think about how okay you are with losing money and how that loss would really affect you.

Understanding Risk Capacity vs. Risk Tolerance

Here’s the deal: risk capacity is about how much risk you can handle with your finances. A 25-year-old with a steady job and many years before retirement can take more risks. They have time to recover from market drops.

Risk tolerance is about how much market ups and downs you can handle emotionally. Even if you can handle a lot of risk, you might panic if your portfolio goes down by 10%. That means your true risk tolerance is lower.

For example, think about Sarah, a young professional, and Mark, who is close to retirement. Both have money in stocks and bonds. If the market drops 15%, Sarah has time to wait it out. She knows markets usually bounce back. But Mark might worry about losing money so close to retirement. He might make decisions based on fear. This shows how your timeline affects your investment choices.

Check out the table below. It shows different risk types and how they relate to time and asset choices.

Here’s a real-world example. I once helped a friend who was scared of losing money. He could afford some risk, but he didn’t like it. We made a plan that balanced safety with his long-term goals. It wasn’t the fastest way to grow money, but it made him feel safe, and that’s worth a lot.

Matching Your Portfolio to Your Timeline

Your investment timeline, linked to your goals, is key to your diversification plan. If your goal is long-term, like saving for retirement, you can take more risks and invest more in stocks. But for short-term goals, like saving for a house in a few years, it’s better to play it safe.

Imagine choosing transportation: a long trip needs a strong car, while a short trip to the store might just need a bike. It’s the same idea. Pick your investment style based on your journey.

Risk Tolerance Guide

Compare different risk levels with asset suggestions and timeframes.

|

Risk Level |

Stock % |

Bond % |

Time Frame |

Investor Type |

|---|---|---|---|---|

|

Conservative |

20-40% |

60-80% |

Short-term (0-5 years) |

Investors who want to protect their money and get steady returns with little change. |

|

Moderate |

50-60% |

40-50% |

Medium-term (5-10 years) |

Investors looking for growth and safety, ready for some market changes. |

|

Aggressive |

70-90% |

10-30% |

Long-term (10+ years) |

Investors aiming for high returns and okay with more market ups and downs. |

This table is just a guide. It’s a starting point. Your situation is special, so your investments should match that. It’s very important.

Life changes. Marriage, kids, job shifts, health matters—all affect your money goals and risk comfort. Like a ship changing course in a storm, your investments should change with your life. Regular check-ins and tweaks are vital. Finding your best investment mix is ongoing, making sure your investments help you, not hurt you.

Building Your Bulletproof Portfolio Foundation

So, we’ve learned about your risk comfort level and your financial goals. Now, let’s dive into building a varied portfolio. Skip the hottest stock tips – smart investors know it begins with a strong core portfolio. This is your investment base, offering stability and steady growth over time.

Think of it like building a house. You wouldn’t start with fancy lights before laying a solid foundation, right? Your portfolio is the same. The core is built using broad market index funds and ETFs (Exchange Traded Funds). These track whole market sections, like the S&P 500 or the total US stock market. They spread your investments across many companies, so you’re not risking everything on one.

Core and Satellite Investing

This method is called core and satellite investing. Around 80-90% of your portfolio is the core, made up of these low-cost index funds. The “satellite” part adds a bit of excitement. You might invest a small amount in areas you’re hopeful about or individual stocks you’ve studied well. The core offers stability; the satellite provides a chance for higher gains (with more risk). Think of the core as your portfolio’s steady engine and the satellite as the boost!

Picking Your Index Funds

Choosing index funds can feel overwhelming – there are many choices! My tip? Look at expense ratios. These small fees can greatly affect your returns over time. A 0.1% expense ratio seems small, but over 30 years, it can take a big chunk of your profits. Also, check your investment platform; some offer free trading on certain funds, saving you more. Don’t get lost comparing hundreds of similar funds. Just keep costs low and spread your investments.

A basic core portfolio might have a Total US Stock Market Index Fund and a Total International Stock Market Index Fund. This gives you access to companies both locally and globally without picking individual stocks.

Diversification: Your Portfolio’s Safety Net

Diversification is key for long-term success. It’s about spreading risk and using more market chances. Diversification can help during hard market times. Even in tough years like 2022, it helped lessen losses. A simple 60/40 portfolio (stocks and bonds) has often done better than an all-stock portfolio. That’s the power of diversification! Building a strong, varied foundation is the best path to reaching your financial goals. Remember, slow and steady wins, especially in investing.

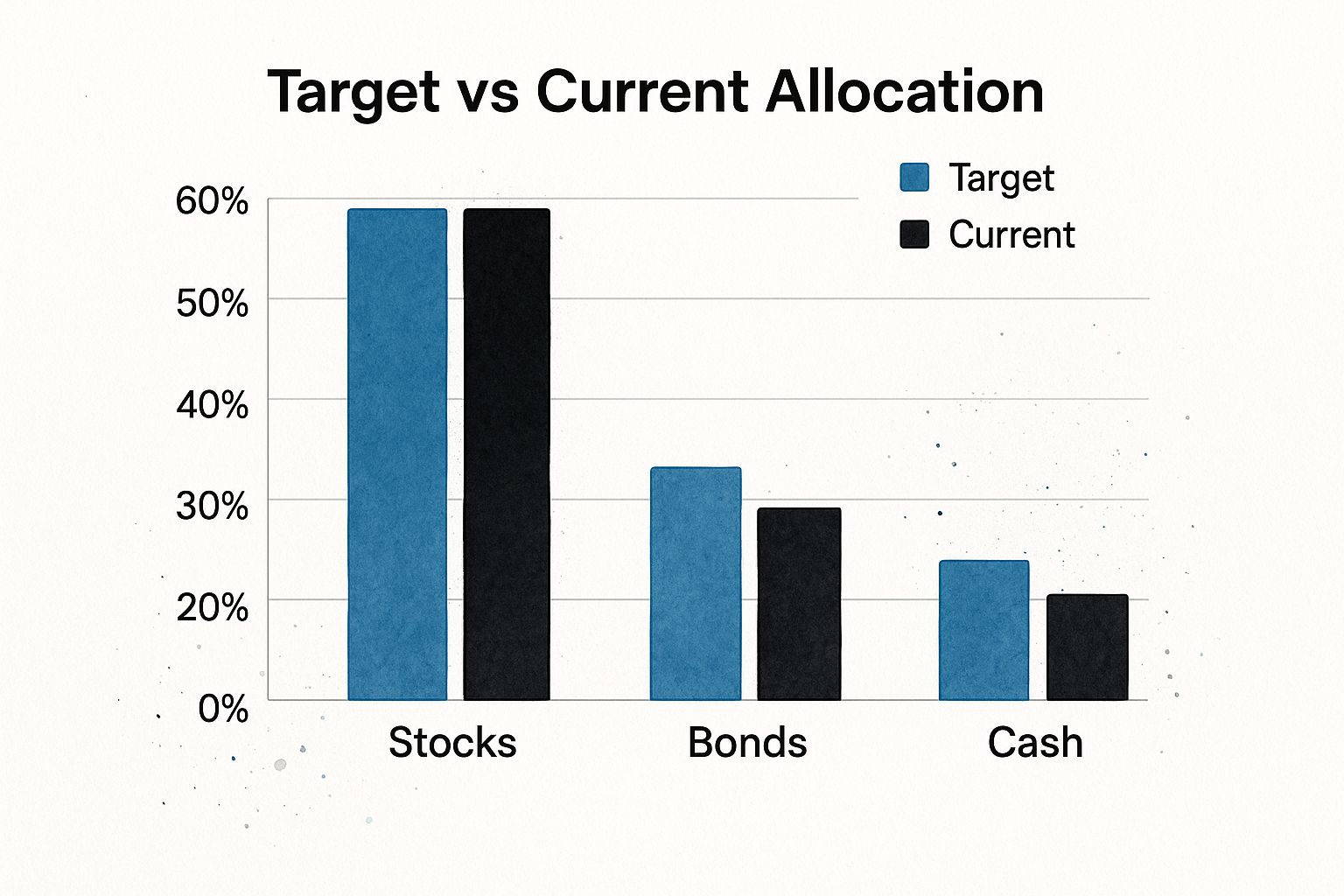

Master Asset Allocation Like a Seasoned Pro

This infographic gives a quick look at a portfolio’s target asset mix and its current status. See how it’s more focused on stocks and less on bonds than it should be? This shows why it’s important to watch your portfolio and adjust it often. It’s like making sure your car runs well – you need to check it regularly!

Asset allocation is the base of a good stock portfolio. It’s about spreading your money into different things like stocks, bonds, real estate, and maybe even gold or other metals. Think of it as building a smart investment plan, not just choosing random stocks.

Balancing Act: Growth vs. Stability

Picture your portfolio as a car. Stocks are the engine, boosting your growth, but causing some bumps. Bonds are the brakes, keeping things steady when the market gets rough. Real estate is the frame, providing a strong base and extra income. The key is finding the right mix for your needs.

A young investor, just out of school, might lean towards more stocks. They have time and aim for growth. But as you near retirement, keeping your money safe is crucial. That’s when more bonds make sense to protect what you’ve saved.

For example, a 60/40 portfolio (60% stocks, 40% bonds) is seen as a good mix of growth and stability. But remember, diversification means more than just stocks and bonds. Even within stocks, spread your investments. Don’t put all your money in one basket or one country! Looking abroad offers more growth and can protect you if the local market falls.

The Importance of Rebalancing and Adjusting

Markets, like the weather, are always changing. Your perfect mix of investments can shift as some do well and others fall behind. This is where rebalancing helps. Think of it as tidying up your portfolio. You sell some of your best performers and buy more of the ones that have not done as well. It might seem odd, but it’s a great way to succeed in the long run. Learn about spreading out your investments.

A mix of investments can often stand strong against even the most successful single investments over time. By spreading your money, you don’t need to guess the next big winner.

Life changes too. Marriage, having kids, or changing jobs can change your financial goals and how much risk you want. Checking and changing your investments is like a financial check-up. It ensures your investments still aim to meet your goals, no matter what happens. It’s not about being perfect, but about having a plan that can handle the ups and downs and help you reach your goals.

Now, let’s look at some example investment plans based on age and how much risk you can take:

Asset Allocation Models by Age and Risk Profile

|

Age Range |

Stocks |

Bonds |

REITs |

International |

Risk Level |

|---|---|---|---|---|---|

|

25-35 |

80% |

10% |

5% |

5% |

High |

|

35-45 |

70% |

20% |

5% |

5% |

Medium-High |

|

45-55 |

60% |

30% |

5% |

5% |

Medium |

|

55-65 |

50% |

40% |

5% |

5% |

Medium-Low |

|

65+ |

30% |

60% |

5% |

5% |

Low |

This table gives a basic guide. Your own plan should fit your needs and goals. It’s a good place to start when deciding how to set up your investments. Remember, these are just ideas. A financial advisor can help you make a plan that suits you.

Spreading Your Investments

Diversifying your stock investments means more than buying many stocks. It’s about choosing stocks from different industries, company sizes, and regions. Think of it like having a balanced meal – you need different foods, not just one type. This helps you find growth chances and manage risk.

Diversifying Across Industries

If you invest mostly in tech stocks, a drop in the tech market could hurt your investments. So, it’s important to spread out. Look into areas like healthcare, consumer staples, energy, and financials. Each area acts differently when the economy changes, which can help protect your investments. For example, when the economy is down, things like food and household items usually do better than tech or other areas.

Exploring Market Capitalization

Understanding Market Capitalization

Market capitalization, or market cap, is how much a company is worth based on its shares. Mixing different market caps means putting money into a range of big, medium, and small companies. Big companies are often steady, like old oak trees, while small companies can grow fast, like young saplings, but they can be shaky too.

Why Look Beyond Your Borders

Investing in other countries can open up new chances. It can protect you if your home market drops and let you tap into growth elsewhere. Think about putting money into both developed places, like Europe and Japan, and fast-growing spots, like India and Brazil. Each has its own risks and rewards. Starting with an international index fund is one option, but looking deeper can be even better.

I used to focus just on US stocks. Then, I explored other markets and began investing in places like Southeast Asia and Latin America. I found great growth ideas there. This not only expanded my investments but also taught me about markets around the world.

Finding the Right Mix

Striking a good balance is crucial. There isn’t a magic number for how much to invest abroad, but a common suggestion is to keep about 20-40% of your stocks in other countries. In that, think about how much to put in developed versus emerging markets. Fast-growing markets can offer more growth but also more risk.

A common concern with investing abroad is currency risk. Yet, over time, these ups and downs tend to level out. Also, some foreign companies earn money in US dollars, which can help. While currency changes can cause short-term bumps, they shouldn’t stop you from looking at global markets.

Remember, geographic diversification isn’t a foolproof shield against global market movements. During a global crisis, correlations between markets often increase. However, over the long run, a geographically diverse portfolio offers valuable protection and access to growth you might otherwise miss.

Rebalancing Your Portfolio Without Losing Your Mind

Building a varied stock portfolio is like solving a jigsaw puzzle. You pick each piece carefully to fit the whole picture. But what if some pieces suddenly change? That’s when rebalancing is important. It keeps your portfolio in line with your long-term goals by adjusting your asset allocation back to your targets.

You don’t need to watch your portfolio every day. In fact, checking too much can harm you. Imagine a gardener always digging up plants to see the roots—it stops them from growing! Similarly, trading too much on short-term market changes can reduce your returns and raise your taxes. So, when should you rebalance?

Most experts suggest doing it twice a year or once a year. Another way is threshold rebalancing, adjusting only when an asset class moves far from its target, maybe 5% or 10%.

Smart Rebalancing Tips

Rebalancing often means selling some winners and buying some losers, which feels odd and can be hard mentally. Yet, it’s a strong strategy for growth over time. It makes you “buy low, sell high,” even if it feels wrong.

One way to make it easier and lower taxes is to use new contributions. Instead of selling high-performing assets, put new money into the ones doing poorly. This slowly balances your portfolio. For example, if your stocks have climbed past their target, use your next paycheck to buy bonds or real estate. This avoids taxes from selling those stocks.

Using tax-friendly accounts like 401(k)s and IRAs also helps. You can buy and sell in these accounts without immediate tax effects, making rebalancing simpler.

This picture shows a typical portfolio tracking tool. See how it clearly shows asset allocation, performance, and transaction history? This type of tool makes it easier to watch and rebalance your portfolio. The main point is that easy access to information lets investors quickly check their portfolio’s status and spot any drift from their target asset allocation.

Tools and Techniques for Streamlined Rebalancing

There are helpful tools and apps that make rebalancing easier. Many brokerage sites have automatic rebalancing. This means the system changes your portfolio based on your goals. It’s like setting your thermostat—you choose the temperature, and the system does the rest. This method removes emotional choices and keeps your portfolio in line without effort.

If your brokerage doesn’t have automatic rebalancing, there are many websites and apps that can help. These tools show your asset distribution and highlight where you need to make changes.

Rebalancing isn’t about guessing the market or always picking the best stocks. It’s about keeping your portfolio steady. This ensures your investments match your goals, risk level, and time frame. By using rebalancing tools and knowing the basics, you can stay invested over time, even when the market is tough. This calm and steady way to manage your portfolio is what successful investors do.

Your Guide to Building Wealth for the Long Term

Creating a strong and varied investment portfolio isn’t about finding the perfect assets or beating the stock market. It’s about growing your wealth steadily over many years and being able to rest easy at night. Whether you’re new to investing or have some experience and want to improve, let’s outline a plan you can start using today.

Avoiding Common Mistakes in Diversification

Think of a varied portfolio like a balanced diet. You need different nutrients for good health, and the same goes for your investments. Having too much of one thing can be risky. A common mistake is focusing too much on one industry, like technology. If that industry struggles, your investments will suffer too.

Another error is ignoring investments in other countries. The US market has done well in the past, but investing globally can help protect against losses and offer growth in other places. Also, if you only invest in big companies, you might miss out on gains from smaller ones.

Adjusting to Life’s Changes and Staying Committed

Diversification isn’t something you do once and forget. Life changes – getting married, having kids, changing jobs – can affect your risk level and goals. It’s like steering a boat; you have to adjust as the winds change. Regularly checking and updating your investment strategy keeps you on course.

Your mindset is important in diversification. Markets go up and down – it’s normal. When things get rough, it’s easy to worry. But selling everything in panic can hurt your growth over time. It’s crucial to stay calm and stick to your plan during these times.

Building Wealth with Patient Diversification: True Stories and Simple Tips

I’ve seen how ordinary people have built wealth by being patient and diversifying. I know someone who invested in a mix of low-cost index funds for over 30 years. They ended up with a million-dollar savings, without trying to find the next big stock.

You don’t need to be a financial expert to make diversification work. Simple actions like checking your asset mix and rebalancing occasionally keep your investments on track. Tools like portfolio tracking software can make this even easier.

The choices you make today are an investment in your future. By avoiding common mistakes, adapting to changes, and keeping a long-term view, you can build a strong portfolio that handles market ups and downs. Take that first step with confidence – the benefits are worth it.

Ready to take control of your financial future and create a well-rounded portfolio? Stock Decisions gives you the tools and information you need to navigate the market with confidence. Our platform takes complex data and turns it into easy-to-understand advice, so you can make smart investment choices. Visit Stock Decisions today and start building your path to lasting wealth.

- Inflation and Stock Market: Your Complete Survival Guide

- How to Rebalance Portfolio Like a Pro: Real-World Strategies

- 8 Financial Modeling Best Practices to Master in 2025

- Get Your Example Risk Assessment Report – Professional & Editable Templates

- 8 Powerful Investment Analysis Methods to Master in 2025