Imagine inflation as a quiet yet strong ocean current. For investors, ignoring it can lead you astray before you know it. This force silently alters the rules for your investments. Understanding how rising prices affect stocks is not just for experts; it’s key to protecting your money from losing value.

Inflation eats away at cash. A dollar today buys more than a dollar tomorrow. So, every investor must ask: Is my money growing faster than it loses buying power? When prices rise, the goal for returns gets higher. A 5% return seems good when inflation is 1%, but it’s a loss if inflation hits 7%. This is the main challenge between inflation and stocks.

Effects on Companies

Inflation doesn’t only impact what you can buy; it also affects the companies you invest in. Think of a business as a well-oiled machine. Inflation is like sand in the gears, causing problems and slowing progress.

Rising Costs: Companies face higher bills for materials, energy, and wages. This reduces their profits.

Changing Consumer Habits: As things get pricier, people often spend less on extras. This can hurt sales in luxury, travel, or entertainment.

Higher Borrowing Costs: To fight inflation, central banks raise interest rates. This makes borrowing money more costly for companies, slowing their growth.

This chain of events—from rising costs to careful consumers to pricier loans—can lower a company’s stock price.

Valuations and Investor Feelings

Inflation also affects the stock market through feelings. As prices rise, so does uncertainty. Investors get more careful and want higher returns to cover the risk and lower value of future earnings. They pay less for a dollar of future profits, which can lower stock prices. This is especially true for growth companies that rely on long-term profits.

To understand this better, we can look at past times of inflation and how the S&P 500 did during those years.

|

Time Period |

Average Inflation Rate |

S&P 500 Real Return |

Market Conditions |

|---|---|---|---|

|

1973–1982 |

9.2% |

-4.9% |

“The Great Inflation” era with oil shocks, stagflation, and high interest rates. |

|

1983–2000 |

3.1% |

14.1% |

Post-inflation boom, tech revolution, and strong economic growth. |

|

2000–2009 |

2.6% |

-5.7% |

Dot-com bubble burst, 9/11 attacks, and the 2008 financial crisis. |

|

2010–2019 |

1.8% |

11.2% |

Post-recession recovery with low inflation and historically low interest rates. |

|

2021–2022 |

6.8% |

-8.8% |

Post-pandemic supply chain issues and soaring energy prices led to high inflation. |

High inflation times, like the 1970s, were tough for investors. They often saw negative returns after inflation. But when inflation was low and steady, like in the 1980s, 1990s, and 2010s, the stock market did much better. Data shows that real returns, which are gains after taking out inflation, are best when inflation is around 2% to 3%. You can find more historical data on how inflation affects stock returns on Investopedia. It’s important to think about inflation when looking at true investment results.

The Inflation Sweet Spot That Most Investors Miss

High inflation can often feel like a storm hitting your investments. But here’s something many miss: not all inflation is bad for stocks. There is a “sweet spot” where prices rise, but not too fast. In this zone, inflation can help company profits and stock prices grow.

Think of it like flying a kite. With no wind (deflation), the kite stays on the ground. In a hurricane (hyperinflation), the string breaks, and you lose it. But with a steady breeze, the kite flies high. In the same way, moderate inflation—usually 2% to 3%—shows a healthy economy. Demand is strong, wages are going up, and businesses can adjust prices. This gentle rise in prices helps companies make more money without costs getting out of hand. This can lead to more earnings, which boosts stock values.

From Helpful to Harmful: Spotting the Change

The key is to know when this gentle wind turns into a strong storm. This change happens when people and businesses start thinking high inflation will stay. They might change how they spend. This can make central banks raise interest rates a lot, slowing down economic growth. For investors, it’s important to see the signs of this shift.

The image below shows past inflation rates, giving an idea of different economic times.

This chart shows that while big inflation spikes grab headlines, economies often go through long times with small price changes. It’s during these calm periods that stock markets often see steady gains.

For example, some of the market’s best years happened when inflation was there but steady. Data shows that good stock market years often came when inflation was a bit above the Federal Reserve’s target. The first Trump administration started with a 1.8% inflation rate and saw strong stock growth. The next had a higher 2.7% rate but still had a fast 28.8% real stock growth the year before. This suggests that a slightly warmer economy can be a good place for stock returns.

For those curious about the numbers, you can explore detailed economic data on the EPI website to see these trends yourself. The challenge for investors isn’t to avoid inflation completely, but to set up their portfolios to do well within its best range.

Where Smart Money Goes When Prices Start Rising

When inflation rises, the stock market doesn’t move as one big wave. Instead, it splits into two parts, creating a gap between sectors that do well and those that don’t. For a prepared investor, this isn’t a time to worry; it’s a sign to change your strategy. Knowing where money moves during these times is key to keeping your portfolio safe and finding new chances. The inflation and stock market relationship leads to a shift from some assets to others.

This shift happens for a simple reason: not all businesses are hurt by rising costs. Some companies can pass their increased expenses to customers, while others see their profits shrink. This creates a clear pattern of winners and losers.

Inflation’s Winners and Losers

During high inflation, investors often turn to companies that own physical assets or sell must-have goods and services. These businesses usually have strong pricing power, or the ability to raise prices without losing many customers.

Energy: Companies in the oil and gas industry often see their revenues and profits rise. Since the price of energy is a big part of inflation, these firms benefit directly as prices for crude oil or natural gas go up.

Materials: Like energy, companies that make raw materials such as steel, copper, and chemicals tend to do well. The value of their physical products goes up with inflation, making their existing inventory more valuable.

Consumer Staples: These are the companies selling things we buy no matter what—food, drinks, and household products. Because people need these items regardless of the economic climate, these companies can raise prices to match their own rising costs without a big drop in sales.

On the other hand, some areas face big problems when prices and interest rates go up.

Technology: Many tech companies are valued for their future profit potential. But when the central bank raises interest rates to fight inflation, these future earnings are worth less now. This makes their stocks less attractive.

Consumer Discretionary: This area includes businesses selling non-essential items like luxury cars, high-end electronics, and fancy vacations. When inflation tightens budgets, these are often the first things people stop buying.

To see how these changes affect different areas, the table below shows how sectors perform in various inflation situations.

|

Sector |

High Inflation Performance |

Low Inflation Performance |

Key Drivers |

|---|---|---|---|

|

Energy |

Strong |

Moderate to Weak |

Directly benefits from rising commodity prices, which are a component of inflation. |

|

Materials |

Strong |

Moderate |

Pricing power tied to the rising cost of raw materials and physical assets. |

|

Consumer Staples |

Defensive/Stable |

Stable |

Inelastic demand for essential goods allows companies to pass on costs. |

|

Technology |

Weak |

Strong |

Valuations are sensitive to rising interest rates, which discount future earnings. |

|

Consumer Discretionary |

Weak |

Strong |

Reduced consumer spending on non-essential items as household budgets tighten. |

|

Real Estate (REITs) |

Mixed to Strong |

Moderate |

Can benefit from rising property values and rental income, acting as an inflation hedge. |

This table shows a clear pattern: sectors tied to physical assets and essential needs tend to outperform when inflation is high. In contrast, sectors that rely on future growth or consumer confidence often perform better when inflation is low and stable.

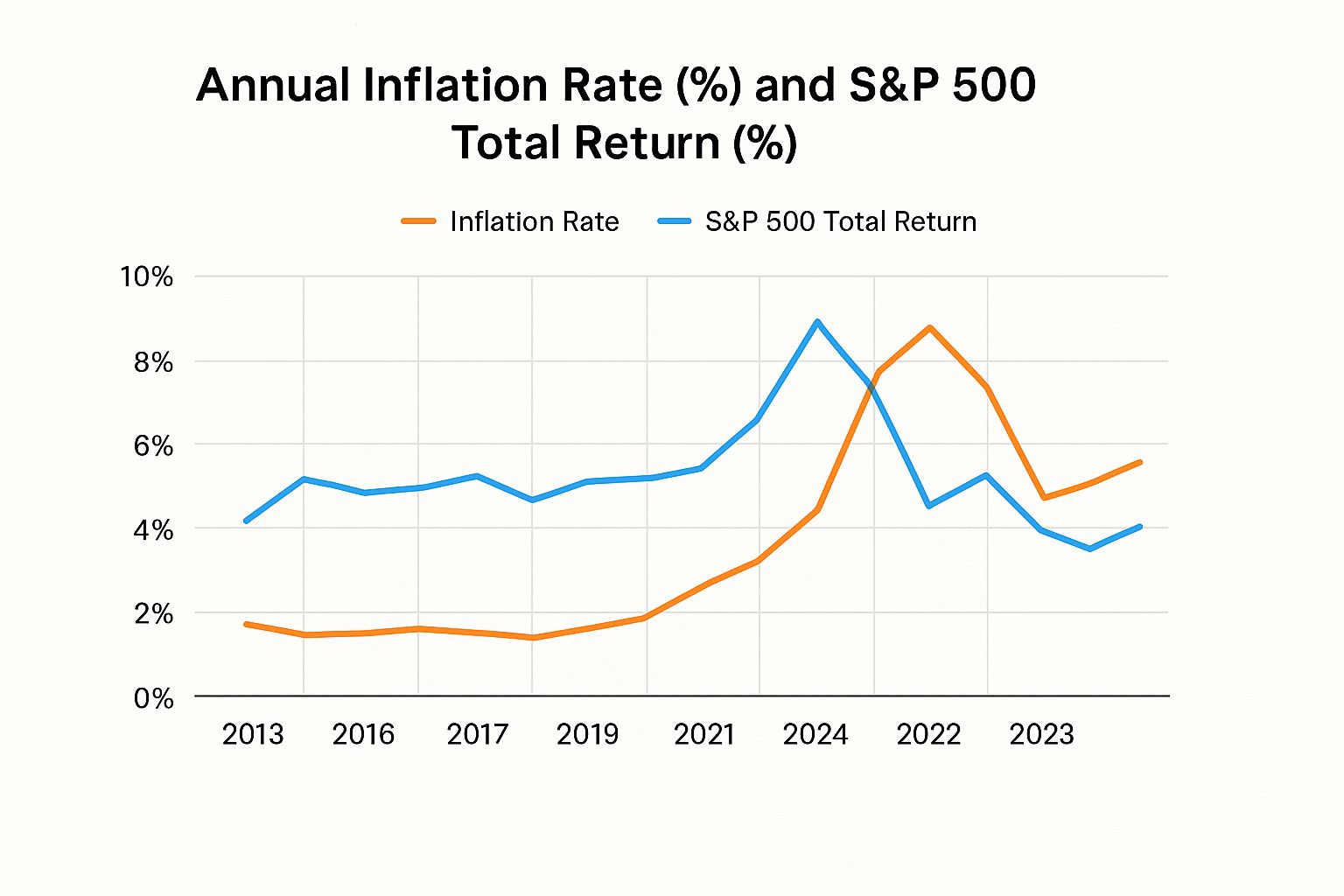

The infographic below highlights the sometimes-unpredictable relationship between the annual inflation rate and S&P 500 returns over the past decade.

The chart shows that the link between inflation and market returns is not always clear. Some years with moderate inflation had good returns, but in 2022, the inflation spike led to a sharp market drop. Research shows that inflation impacts stock market areas differently. This creates both challenges and chances. You can learn more about which areas are impacted at pattersonandrews.nm.com. This helps in building a strong portfolio. Knowing which areas might do well can help you make better choices in changing times.

How Stocks Have Fared During Inflation Over the Years

While the news often talks about the pain of rising prices, there’s a brighter side to the story about inflation and the stock market. It can be scary when prices go up in the short-term, but over many years, stocks have helped people beat inflation. Building wealth isn’t about one fiscal quarter; it’s about the entire investment journey.

Think of inflation as a steady wind pushing against your money’s value. If you only hold cash, you lose ground. But if you invest in the stock market, it’s like flying a strong plane. You’ll face bumps, and some flights will be rough, but the power of company earnings and new ideas helps push through and climb higher over time.

The Magic of Growing Returns

The stock market’s secret is compounding. When you have a share in a company, your gains aren’t just from the stock price rising. You also earn dividends, which you can use to buy more shares. These new shares give more dividends, creating a snowball effect that can beat even high inflation over the years.

It’s easy to feel down when inflation is high and markets drop, like in 2022. But these times are often just small dips in a longer, upward path. The market has faced oil shocks, recessions, and global crises, yet it always bounces back, rewarding those who wait.

This long-term success isn’t just an idea; history proves it. Over 30 years, the U.S. dollar lost about 50% of its buying power because of inflation. Despite this, U.S. stocks have outpaced the loss. The S&P 500, a key measure of the market, gave an average annual real return of about 8.5% from 1993 to 2022. This shows that having a mix of stocks is not just a way to protect money but also to grow it. Learn more about inflation and stocks at crews.bank.

What History Teaches Us About Patience

Ultimately, history demonstrates that while inflation is a tough adversary, the combination of corporate earnings, innovation, and compounding has made the stock market a long-term champion. The most important lesson for investors is to maintain perspective. Short-term anxiety often presents the best long-term buying opportunities for those who understand that the true story of the inflation and stock market dynamic plays out over decades, not days.

Growth Versus Value: The Inflation Challenge

When inflation rises, not all stocks feel it the same way. It often creates a split between two main investing styles: growth and value. Knowing which one usually does better during such times is important, yet many investors miss this point and pay the price. The relationship between inflation and the stock market often hinges on this classic battle.

Picture it like this: growth stocks are like a new tech company with big dreams that might pay off in the future. Their worth is tied to expected big profits down the line. On the other hand, value stocks resemble a trusty utility company, making steady profits regularly. When the economy is booming and loans are cheap, investors happily gamble on the tech company’s big future rewards.

However, when inflation spikes and interest rates rise, the lure of future earnings wanes. Instead, the steady utility company suddenly seems more appealing.

Why Value Stocks Often Succeed During Inflation

Value stocks usually belong to established, stable companies. They trade at prices that seem low compared to their earnings and assets. Their success during inflation stems from a few key features:

Strong Current Cash Flows: These businesses make money now. This cash becomes more valuable when money’s future buying power weakens.

Pricing Power: Many value companies work in essential fields like energy or basic goods. They can raise prices when costs increase without losing many customers.

Tangible Assets: Their value often relies on real things like factories and land. These assets tend to keep or gain value when inflation is high.

The main lesson is to focus on present value. This becomes a strong defense when future growth promises are heavily cut by the market.

The Fragility of Growth Stocks

On the flip side, growth stocks—often found in technology and consumer sectors—can be quite fragile. Their high prices depend mostly on future profits, which might not appear for many years.

When central banks raise interest rates to manage inflation, it affects a key money calculation. The “discount rate” used to find the current value of future profits goes up. This simple change means a company’s planned earnings for ten years from now are worth a lot less today. Because of this, their stock prices can drop a lot, even if their long-term plans are still good.

For example, a fast-growing software company that isn’t making money yet might see its stock price drop. Meanwhile, a company that pays dividends, like an industrial firm, might stay strong or even benefit. This doesn’t mean the software company is bad; it’s just a new economic situation. That’s why inflation often benefits stable, cash-rich value stocks over the exciting promises of growth stocks.

Creating Your Personal Inflation Defense Plan

Understanding how inflation affects the stock market is one thing. Using that knowledge to protect and grow your money is another challenge. Building a personal defense plan isn’t about trying to predict the market—it’s almost impossible. Instead, it’s about making a strong portfolio that can handle tough times. Think of it as having a good offense (for growth) and defense (against rising prices).

A smart plan starts with a close look at your current investments. Then, adjust them for times of inflation. This means going beyond just “buying and holding” and being more careful with where you put your money.

Offensive and Defensive Portfolio Tilts

In a world of rising inflation, a strong portfolio needs both offensive and defensive moves. It’s like managing a sports team: you need players who can score points and players who can stop the other team from scoring.

Offensive Plays (Capitalizing on Inflation):

Lean into Value Stocks: As we’ve covered, value companies with healthy cash flow and the ability to raise prices often do well. You might consider increasing your holdings in sectors like energy, materials, and industrials.

Invest in Real Assets: Tangible assets tend to keep their value when the dollar buys less. This includes commodities (like gold or oil through ETFs), real estate (via REITs), and infrastructure funds. The prices of these assets often climb right along with inflation.

Defensive Plays (Protecting Your Downside):

Focus on Quality and Dividends: Companies with strong financial health and a reliable history of paying and increasing dividends can act as a cushion. The dividend income provides a steady return, even if the stock’s price is jumping around.

Inflation-Protected Bonds: Treasury Inflation-Protected Securities (TIPS) are a type of government bond where the principal value increases with the Consumer Price Index (CPI). They are built specifically to shield investors from inflation, offering a safe-haven component for your portfolio.

This screenshot from Investopedia shows the key elements of portfolio management, which is the practice of choosing and managing investments to meet your long-term financial goals.

The main point is that successful investing is an active process of balancing risk and return with your personal goals. This process becomes even more important when inflation starts changing the rules of the game.

Simple Steps for Balancing and Upkeep

After setting your target allocation, it’s time to make it happen and keep it steady. This requires sticking to your plan.

Check and Adjust: Look at your investments. Are you too focused on growth stocks? Are you lacking in real assets? Set a regular time—like every three or six months—to adjust your portfolio back to your goals. This helps you sell high and buy low.

Stay Calm: When prices rise, the market can be unpredictable, and the news can seem scary. It’s important to stick to your plan. Acting out of fear can quickly lead to losses.

Think Long-Term: While rising prices can cause short-term problems, good companies usually find ways to succeed over time. Your plan should work through all economic changes, not just react to the latest news.

Building a strong portfolio won’t stop market ups and downs, but it will give you a good base to make confident decisions. By wisely mixing different types of assets, you can better face the challenges of rising prices and market changes, and come out ahead.

From Learning to Doing

Knowing about the link between rising prices and the stock market is one thing, but using that knowledge to make a real plan is how you start protecting your money. Insights are only helpful if they lead to smart and careful choices. This last step is about making a clear system to manage your investments, so you can deal with economic changes without getting caught up in daily news. It’s time to move from ideas to action and get your portfolio ready for the future.

Your Inflation-Ready Checklist

First, find an easy way to check your investments with rising prices in mind. This isn’t about selling everything and starting over. It’s about making smart adjustments. Use this checklist to help you:

Check Sector Exposure: Do you own stocks in areas that do well when prices go up, like energy, materials, or consumer staples? Do you have too much in areas that don’t do well with interest rate changes, like technology?

Assess Company Pricing Power: For each company you invest in, ask if they can raise prices without losing buyers. Look for companies with strong brands, key products, and steady profits.

Review Real Asset Allocation: Does your portfolio have assets that guard against rising prices? This could include real estate through Real Estate Investment Trusts (REITs), commodity-based ETFs, or even Treasury Inflation-Protected Securities (TIPS).

Focusing on What Matters

It’s crucial to stay informed, but worrying about every economic report can cause stress. Instead of reacting to daily market swings, pay attention to a few key indicators that show real changes in the economy.

|

Key Metric to Monitor |

What It Tells You |

Why It Matters for Your Portfolio |

|---|---|---|

|

Core CPI (YoY Change) |

The underlying inflation trend, minus the unpredictable costs of food and energy. |

A steady rise here suggests inflation is becoming a long-term issue, which could prompt the central bank to act more forcefully. |

|

Fed Funds Rate Projections |

The Federal Reserve’s forecast for future interest rate changes. |

This gives you a hint about the future cost of borrowing, which directly affects company profits and how stocks are valued. |

|

10-Year Treasury Yield |

A reflection of what the market expects for future economic growth and inflation. |

When this yield goes up, it often means investors want higher returns to offset inflation, which can put downward pressure on stock prices. |

By watching these key numbers, you can notice big changes that might need a shift in your investments. This way, you won’t react to every news report. Real confidence comes from having a plan. Make your strategy, set rules for when to change things, and practice patience for long-term success.

The aim is to ignore distractions and focus on what matters. Instead of piecing together confusing information, a tool that sorts this data can really help. Stock Decisions gives clear advice by looking at financial info and market trends all in one place, helping you follow a plan with confidence. Are you ready to use what you know and take action? Find out how Stock Decisions can make investing easier and help you do well in any market.

- Inflation and Stock Market: Your Complete Survival Guide

- How to Rebalance Portfolio Like a Pro: Real-World Strategies

- 8 Financial Modeling Best Practices to Master in 2025

- Get Your Example Risk Assessment Report – Professional & Editable Templates

- 8 Powerful Investment Analysis Methods to Master in 2025