Understanding Bear and Bull Markets: The Animals of Wall Street

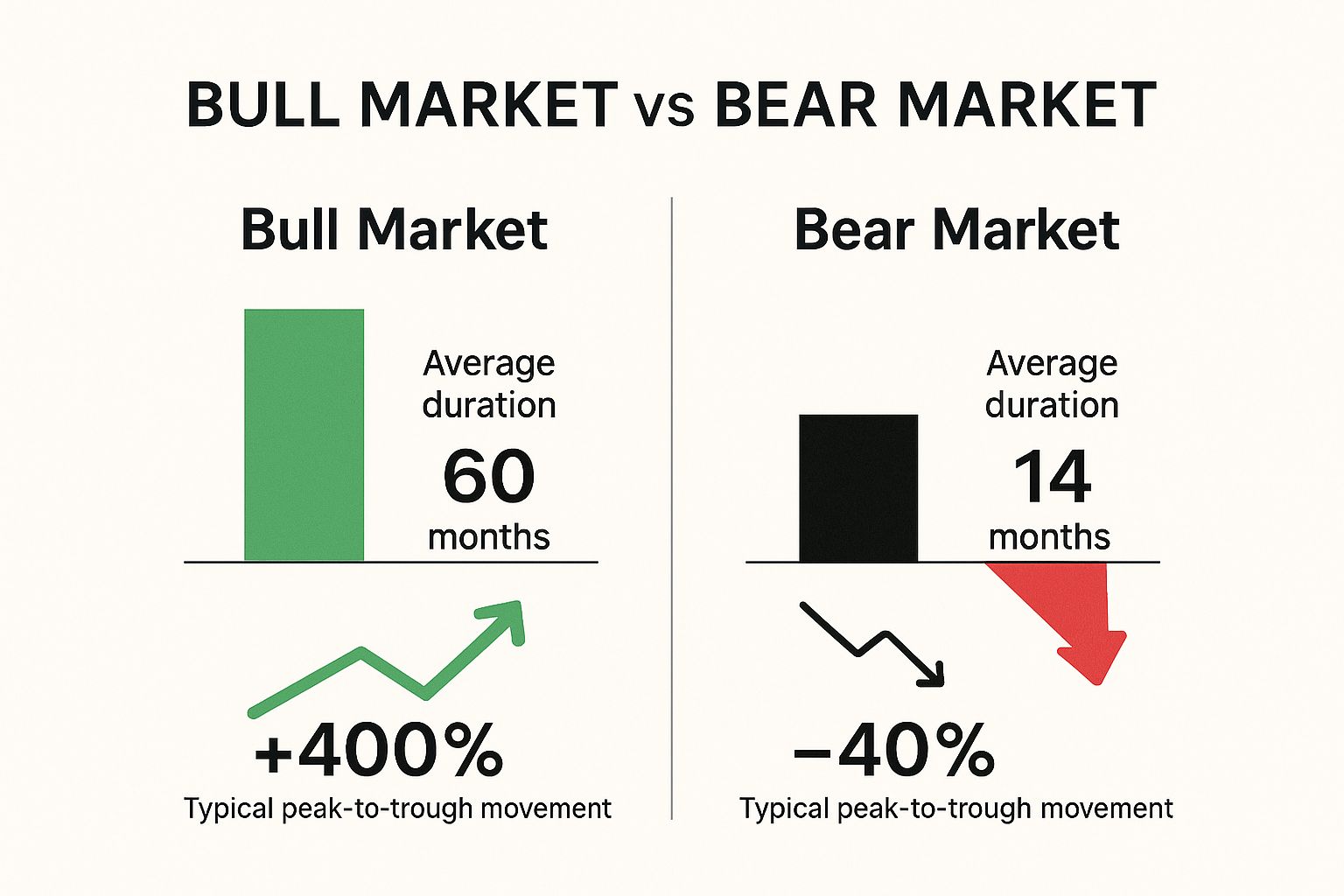

This infographic shows a comparison between bull and bear markets. It explains how long they usually last and their typical price changes from high to low. Bull markets often last about 60 months, growing about +400%. Bear markets are shorter, averaging 14 months, with drops around -40%.

Have you ever wondered why we use animal names for market trends? It comes from how these animals move. A bull market means stock prices are rising. Picture a bull lifting its horns upward. This upward movement shows hope and growth in a strong economy. Investors feel good, and businesses grow.

A bear market means stock prices are falling. Imagine a bear swiping its paw downward. This downward movement can cause fear. Investors sell stocks, companies might slow down, and the economy can get weaker.

How Long Do These Market Moods Last?

Bull and bear markets are like seasons. They come and go. Bull markets usually last longer, sometimes for several years. Bear markets are shorter and more sudden. This pattern is a market cycle. Knowing these cycles helps investors.

One main difference between bull and bear markets is how long they last and their returns. Bull markets have lasted longer and given better returns. Since 1926, bull markets have lasted about 6.6 years with a 339% return. Bear markets last about 1.3 years with drops of around 34%. You can find more about these market cycles.

What Causes These Shifts?

Many things can change bull and bear markets. The economy, good or bad, plays a big role. Big global events like wars or new technology can also cause changes. Investor feelings—how people feel about the market—matter too. Hope leads to buying, which can start a bull market. Fear leads to selling, which can start a bear market.

Knowing about bull and bear markets helps you understand the financial world. Learning these basics helps you see how market cycles work and how they might impact your investments.

The following table summarizes the key differences between these two market types:

Bear vs. Bull Markets: Key Differences

| Characteristic | Bear Market | Bull Market |

|---|---|---|

| Price Trend | Falling | Rising |

| Investor Sentiment | Fear, Pessimism | Optimism, Confidence |

| Economic Outlook | Negative | Positive |

| Average Duration | Shorter (e.g., 14 months or 1.3 years) | Longer (e.g., 60 months or 6.6 years) |

| Typical Return | Negative (e.g., -40% or -34%) | Positive (e.g., +400% or 339%) |

This table clearly illustrates the contrasting characteristics of bear and bull markets, highlighting their opposing trends in price, investor sentiment, and overall economic outlook. Recognizing these differences is fundamental to understanding market dynamics and making informed investment decisions.

When Bears Attack: Famous Market Downturns in History

Let’s talk about the times when the market drops, known as bear markets. These are normal in market cycles. They might seem worrying, but knowing about them helps you become a better investor.

The Great Depression: A Big Market Drop

One famous bear market was during the Great Depression. It started with the 1929 stock crash. The Dow Jones Industrial Average fell 89% over almost three years. This long drop happened because of several reasons, including burst bubbles and strict government rules.

The 2008 Financial Crisis: Another Major Decline

Another big bear market was from 2007-2009, linked to the Financial Crisis. The S&P 500 dropped 51.9% in about 1.3 years. This crisis was due to bad loans and big banks almost failing. The government had to step in to help the economy. Studying these bear markets shows how bad they can get and their link to recessions. For example, the 1929 crash started the Great Depression, and the 2008 decline happened with the Financial Crisis. More data is available here.

Other Important Bear Markets

There were other big bear markets too. The Dot-com bubble in the early 2000s hurt many tech firms. The COVID-19 pandemic in 2020 also led to a quick market drop, but it was shorter. Each of these had different reasons and effects.

Lessons From Bear Markets

Bear markets are tough, but we can learn from them. They show that markets don’t always grow. They remind us to plan ahead and think long-term. They teach us to protect our investments during tough times. Most importantly, they prove that markets can bounce back, even after bad drops.

When Bulls Run: Celebrating the Best Market Booms

The Excitement of Bull Markets

After looking at bear markets, let’s dive into bull markets. These times of rising stock prices bring hope and chances for profit. People often see them as periods of wealth and trust in the market.

The Energy of the Bull Market

Imagine a bull charging ahead with its horns up. That’s the spirit of a bull market. The economy grows, more jobs appear, and companies do well. Investors feel positive, pushing stock prices up.

A well-known example is the Dot-com boom in the late 1990s. The internet was changing everything, and tech stocks went up.

Famous Bull Markets in History

History has many great bull markets. The Roaring Twenties was one such time, with the economy growing and stocks rising. After World War II, there was also growth, helped by rebuilding and new technology.

Let’s look at some recent examples. The Dot-com boom from the early 1990s to early 2000s saw the S&P 500 rise by 582% over 12 years. After the 2008 financial crisis, an 11-year bull market was driven by low interest rates and the growth of big tech companies. This period brought strong returns.

To learn more, check out examples of market cycles in this article: 60 Years of Stock Market Cycles.

Now, let’s explore what causes these growth periods. The table below, “Major Bull Markets and Their Returns,” shows key bull markets, how long they lasted, their gains, and what fueled them.

| Time Period | Duration (Years) | Total Return (%) | Key Drivers |

|---|---|---|---|

| 1949-1956 | 7 | 267% | Post-war reconstruction, consumer spending |

| 1982-2000 | 18 | 1,940% | Technological innovation, declining interest rates |

| 2009-2020 | 11 | 418% | Quantitative easing, tech sector growth |

This table shows how different factors, like recovery after wars and new technology, have led to big bull markets in history. Knowing these trends can help investors.

What Makes a Bull Market?

Many things can lead to a bull market. A strong economy is key. This means people are spending more, and businesses are investing. Low interest rates help, as they make borrowing cheaper for companies. New technology can start new industries and boost growth. Also, when investors believe the market will grow, it can push prices up.

Industries Don’t All Grow the Same

Not all industries grow equally in a bull market. Some, like tech or health, may grow fast. Others, like utilities, might grow slowly. Knowing which sectors will do well can help investors make more money. For example, during the Dot-com boom, tech stocks grew faster than others.

Watching for Market Changes

Want to know when financial markets might change? It’s a bit like watching animals in the wild. This section helps you see signs that show changes between bull and bear markets. Think of it as a safari for your money!

Interest Rates: The Market’s Thermometer

Interest rates are like a thermometer for the market’s health. When rates rise, borrowing money costs more. This can slow down business growth and may even affect the economy, making a bear market more likely. When rates drop, borrowing is cheaper. Businesses can grow, which may lead to a bull market.

News and Headlines: Listening to the Market

News can give hints about where the market is headed. Bad news about job losses or failing companies might mean a bear market is coming. Good news about profits or new technologies can hint at a bull market. It’s like listening to the market talk.

Remember the Dot-com boom? The news was full of stories about new internet companies, showing a strong bull market. But when it ended, the news quickly turned negative.

Investor Sentiment: The Market’s Mood Ring

How people feel about the market—known as investor sentiment—matters a lot. If many people seem worried about their investments, a bear market could be near. If they’re optimistic, a bull market might be on the way. Psychology plays a big role in markets.

Company Announcements: Inside Information

Announcements from companies can also give clues. Warnings about low profits or job cuts can signal a bear market. Positive news, like new products or growth plans, can boost investor confidence and possibly lead to a bull market. During the Dot-com era, tech company news often pointed to bigger market trends.

Putting It All Together: Becoming a Market Whisperer

By learning to recognize these signals—interest rate changes, news headlines, investor sentiment, and company announcements—you can get better at anticipating shifts between bear and bull markets. You’ll gain a deeper understanding of the market’s language and be able to make more informed investment decisions based on your observations. While these signs don’t offer guarantees, they do provide valuable insights into potential market turns. Staying informed is always crucial for successful investing.

Surviving Bear Markets: Strategies For Tough Times

When the stock market drops, it can be worrying. But like bears sleep through winter, smart investors use ways to shield their investments during bear markets. These methods are often simpler than you think.

Diversification: Protecting Your Investments

Imagine all your money is in one company, and its stock falls. Diversification avoids this by spreading your money across different types, like stocks, bonds, and real estate. When one type is down, others might do better, lowering the risk.

Defensive Investments: Staying Strong

Some investments hold up better when the market is down. These are often in important areas like utilities and basic goods. People need these no matter the economy. Having these can help you get through tough times.

Bargain Hunting: Spotting Chances

Many experienced investors see bear markets as a chance to buy good investments at lower prices. It’s not about timing the market perfectly. It’s about seeing that market drops can offer buying opportunities.

Emergency Fund: Your Safety Net

An emergency fund is always crucial, and even more so during a bear market. It covers unexpected costs so you don’t have to sell investments when prices are low. Aim to save 3-6 months’ worth of living expenses.

Adjusting Your Mix: Playing it Safe

In a bear market, you might move some money to safer options, like bonds. This helps keep your money safe while waiting for the market to recover. This is useful for those nearing retirement.

Patience and Consistency: Thinking Long-Term

The most important strategy is to stay calm and not sell in panic. Emotional decisions can lead to mistakes. Bear markets are usually followed by bull markets, times of recovery and growth. By sticking to a long-term plan and keeping up with regular investments, you’re ready to benefit when the market bounces back.

Riding the Bull: Making the Most of Rising Markets

When the market is going up, it can feel exhilarating. Profits are being made, and the temptation is strong to dive in headfirst. However, just like any exciting experience, a bull market is best navigated with a level head. This section explores how to make informed decisions during a market upswing so you can benefit from the growth without getting swept up in the hype.

Steady Wins the Race: Smart Investing in Good Times

A bull market is an opportune time to make investments that will grow over the long term. Instead of investing a large sum all at once, consider a more measured approach. Regularly investing smaller amounts, known as dollar-cost averaging, helps smooth out the market’s natural fluctuations. Think of it as a consistent investment strategy, much like regularly watering a plant to ensure steady growth.

Picking Your Players: Index Funds and Solid Companies

For those new to investing, index funds, which track a specific market index like the S&P 500, offer a diversified way to participate in a bull market. This spreads your investment across numerous companies, reducing the risk associated with any single company’s performance. Alternatively, you can research companies with a strong track record and promising future prospects, focusing on those demonstrating consistent growth and sound management.

Don’t Get Carried Away: Avoiding the “All-In” Trap

When the market is hot, it’s easy to get overly enthusiastic and make impulsive decisions. Remember, markets can change direction unexpectedly. Investing all your resources in one area can lead to significant losses if the market declines. A balanced approach, diversifying your investments, helps mitigate potential losses and weather market fluctuations.

Recognizing the Warning Signs: When Markets Overheat

Even in a bull market, it’s crucial to remain objective. Look for signs that the market might be becoming overheated, such as extremely high stock valuations or rapid price increases that appear unsustainable. These can indicate a potential market correction. Just as you might step back from a situation that’s becoming too intense, so too should you be prepared to adjust your investment strategy when the market shows signs of overheating.

Preparing for the Change of Seasons: Staying Ready for the Shift

Bull markets are cyclical and eventually come to an end. While enjoying the upward trend, start considering how you’ll adjust your strategy when the market shifts. This could involve holding some cash or adding more defensive investments to your portfolio. Much like enjoying the warm weather while keeping a raincoat handy for potential showers, it’s wise to anticipate market changes even during periods of growth. For example, even during the extended bull market of the 1990s, experienced investors like David Rosenberg) were already considering potential market shifts.

By following these strategies, you can navigate a bull market effectively while remaining prepared for the inevitable changes that lie ahead. It’s about enjoying the current market conditions while keeping a watchful eye on the future.

Bear and Bull Markets: Lessons to Remember

We’ve explored the world of market animals—bulls and bears—and their influence on market trends. We’ve seen how bulls represent optimism and growth, pushing prices upward, while bears signify caution and decline, pulling prices down. So, what are the essential lessons we can take away from this journey through the financial landscape?

Market Cycles: They Change Like Seasons

Markets change in cycles, just like seasons. Bull markets, when prices go up and people feel positive, eventually turn into bear markets, where prices drop and caution is needed. Spring always follows winter, and similarly, bull markets will come back after bear markets. Knowing these cycles helps you invest better.

- Bull markets see prices rise and investors feel hopeful.

- Bear markets have falling prices and more worry among investors.

Stay Calm: Don’t Panic!

When markets drop, it can be worrying, but it’s normal. These times are chances to buy good investments cheaply. It’s important to have a clear plan and stick with it, even when things get rocky.

- Don’t make choices based on feelings.

- Being careful is good, but don’t let fear stop you.

Slow and Steady Wins

Investing regularly is smarter than trying to guess the right time to buy or sell. It’s hard to know the perfect moments for this. Patient investors usually do well over time. In a bull market, knowing patterns can help decide when to invest.

- Regular investments help you through market ups and downs.

- Think about long-term goals, not short-term changes.

Learning From the Animals: Markets Reward the Prepared

Bulls and bears offer valuable lessons for investors. By understanding their behavior, we can make more informed investment decisions. We learn to identify opportunities, manage risks, and maintain composure during market fluctuations. Ultimately, we learn that market swings are normal and that patience and consistency are vital for long-term success.

Want to navigate the markets with greater confidence? Stock Decisions provides clear, actionable insights from reliable sources, empowering you to make smarter investment choices, regardless of market conditions. Learn more at https://yourwealthsignal.com.