Why Fundamental Analysis Matters for New Investors

Smart investing means knowing what you’re putting your money into, not just guessing. Fundamental analysis helps new investors understand a company before investing. It’s similar to checking a car’s engine before buying it. You want to know if it’s in good shape.

Basics of Fundamental Analysis

Fundamental analysis helps find a company’s real value. This real value can differ from its stock price. To find this, look at the company’s financial reports, the industry, and the economy. This helps spot good companies at fair prices.

Fundamental vs. Technical Analysis

Fundamental analysis looks at a company’s value, while technical analysis examines stock charts and past trends. Fundamental analysis is useful for long-term investing. Technical analysis helps with short-term trading. Both methods can assist investors.

Benefits for Beginners

For beginners, fundamental analysis has many benefits. It helps find companies with growth potential and avoid those with hidden problems. With this knowledge, new investors can make better choices.

History of Fundamental Analysis

Benjamin Graham and David Dodd wrote Security Analysis, which started modern fundamental analysis. It stresses finding a company’s value and using a “margin of safety.” Fundamental analysis has changed over time, with technology making data more accessible. Today, investors have more information than before.

Decoding Financial Statements Without the Headaches

Financial statements may seem complicated, but they are simply stories about a company’s money matters. Understanding these stories is important for basic analysis, especially for those new to investing. Let’s look at the three main financial statements: income statements, balance sheets, and cash flow statements.

Income Statement: Earnings and Expenses

The income statement shows a company’s money coming in (revenue) and money going out (expenses) over a certain period. It’s like a report card for the company’s performance. The last number tells us the net income or profit, which is what’s left after paying all expenses.

Balance Sheet: Assets, Liabilities, and Equity

The balance sheet gives a snapshot of a company’s financial position at a specific time. It lists what the company owns (assets), what it owes (liabilities), and the difference between them (equity). Think of it like a picture of the company’s finances taken on one day. Assets include things like cash and property. Liabilities cover loans and debts. Equity is the owners’ share in the company.

Cash Flow Statement: Cash Movements

The cash flow statement tracks how money moves in and out of the company. It shows where the cash comes from and how it is used. This is important to see if the company is making money from its activities or if it depends on borrowing. Knowing about cash flow helps in judging financial health. For more on understanding financial data, you can check key financial metrics.

To see how these statements relate to each other, check the table below:

Key Financial Statements at a Glance

This table compares the three main financial statements to help beginners understand their purpose and key components.

|

Financial Statement |

What It Shows |

Key Components |

Why It Matters |

|---|---|---|---|

|

Income Statement |

Profitability over a period |

Revenue, Expenses, Net Income |

Shows if the company is making money |

|

Balance Sheet |

Financial position at a point in time |

Assets, Liabilities, Equity |

Reveals what the company owns and owes |

|

Cash Flow Statement |

Cash movement over a period |

Operating, Investing, and Financing Activities |

Indicates how the company generates and uses cash |

This overview compares the main financial statements and why they matter for understanding a company’s finances. By looking at them together, investors get a full view of financial health.

Why These Statements Matter

These three financial statements are key to knowing a company. They give a complete look at financial health and performance. The balance sheet and income statement help figure out important ratios like Debt-to-Equity and Price-to-Earnings (P/E). These ratios show how steady a company is and how its stock is priced. You can learn more about this topic.

Understanding the Big Picture

Knowing these statements helps you see how a company is doing with its money. You can find problems or strengths, helping you make smart investment choices. This helps you find companies that are growing, earning well, and handling money wisely.

Five Financial Ratios That Tell You Everything You Need

Now that we understand financial statements, let’s look at five important ratios. These help us see how a company is doing. They make complex data easier to understand and show us a company’s financial health clearly.

Understanding Key Financial Ratios

Financial ratios are useful for checking a company’s performance. They help investors compare businesses in the same field and see how a company does over time. They are like a simple health check for a business.

Five Important Ratios for Beginners

Here are five key ratios that every new investor should know:

Price-to-Earnings (P/E) Ratio: This shows how much people are willing to pay for each dollar a company earns. A high P/E may mean people expect the company to grow. A low P/E might mean the stock is cheap.

Earnings Per Share (EPS): This tells us how much profit is given to each share. A higher EPS usually means the company is making more money.

Return on Equity (ROE): This measures how well a company uses investors’ money to make a profit. A higher ROE often means the company is doing a good job.

Debt-to-Equity (D/E) Ratio: This shows how much debt a company has compared to its equity. A high D/E may mean the company borrows a lot.

Current Ratio: This shows if a company can pay its short-term debts. A ratio over 1 usually means the company can handle its short-term bills.

Calculating and Understanding Ratios

To calculate these ratios, use simple math with numbers from financial statements. For example, to find the P/E ratio, divide the current stock price by the earnings per share. If the P/E is 20, it means investors pay $20 for each $1 of earnings.

Understanding Ratio Analysis

Imagine Company A has a P/E of 15 and Company B has a P/E of 25. They both are part of the same industry. A higher P/E for Company B may mean investors think it will grow more. But, it could also mean Company B is priced too high. It’s important to compare ratios in the same field.

Below is a table with important ratios and tips on what they mean.

Key Financial Ratios for Beginners: A simple guide to important ratios, how to figure them out, and what they reveal about a company.

|

Ratio |

What It Measures |

How to Calculate |

Ideal Range/Considerations |

Warning Signs |

|---|---|---|---|---|

|

P/E Ratio |

Market value relative to earnings |

Stock Price / Earnings per Share |

Varies by industry |

Extremely high or negative P/E |

|

EPS |

Profitability per share |

Net Income / Outstanding Shares |

Higher is generally better |

Declining EPS over time |

|

ROE |

How efficiently a company uses shareholder investments |

Net Income / Shareholder Equity |

15-20% considered good |

Consistently low ROE |

|

Debt-to-Equity Ratio |

Proportion of debt to equity financing |

Total Debt / Total Equity |

Below 1 generally preferred |

High and increasing D/E |

|

Current Ratio |

Short-term liquidity and ability to cover short-term obligations |

Current Assets / Current Liabilities |

Above 1 indicates liquidity |

Consistently below 1 or a sudden drop |

As you can see, understanding these ratios can offer a quick yet powerful way to analyze a company’s financial health.

Using Ratios Wisely

While these ratios are powerful tools, it’s important to remember that no single ratio tells the complete story. A comprehensive analysis involves examining multiple ratios in conjunction to develop a more well-rounded perspective. Furthermore, these ratios are based on past performance, which doesn’t guarantee future results.

What Makes Great Companies Successful

Learning about financial statements and ratios is important, but they only tell part of the story. To truly understand a company, you need to look beyond the numbers. This section focuses on the main factors that lead to long-term success: leadership, advantages over competitors, and industry trends.

Looking at Leadership and Management

Good leaders can guide a company through tough times. But how can you, as a new investor, judge the quality of a company’s leadership? Start by visiting the company’s website. Check out the management team’s experience and background.

Then, read the CEO’s letter in the annual report. This letter often shows the management’s vision and plans. Look for messages that are clear, direct, and truthful.

Finding Competitive Advantages

Some companies have special strengths that give them an edge over others. These strengths, often called moats, help keep profits up and support growth. Take a company like Coca-Cola. Its well-known brand is a strong moat.

Other examples of moats are unique technology, patents, or loyal customers. When you research a company, ask yourself: what makes this company stand out from its rivals?

Watching Industry Trends

Even top companies can struggle if their industry is shrinking. That’s why knowing industry trends is key. You want to invest in businesses in growing industries with a bright future.

For example, the e-commerce industry has grown a lot in recent years, benefiting companies like Amazon. To stay up-to-date on industry trends, follow financial news and read industry reports.

Putting It All Together: A Simple Framework

Professional investors frequently use frameworks to structure their research. Here’s a simplified version:

Management: Is the leadership team experienced and trustworthy?

Moat: Does the company possess any distinct advantages that protect its profits?

Market: Is the company operating in a growing industry with favorable trends?

This straightforward framework can assist you in evaluating a company’s long-term potential. Think of it as a three-legged stool. If one leg is missing, the entire structure collapses.

Real-World Examples: Qualitative Factors in Action

Sometimes, qualitative factors can offer predictive insights into a company’s performance, even when the financial numbers appear strong. Imagine a company with solid financials but a newly appointed, untested CEO. This uncertainty surrounding management could be a warning sign not readily apparent in financial ratios.

On the other hand, a company with groundbreaking technology might not yet be profitable. However, its competitive advantage could position it as a compelling investment for the future.

By considering these qualitative factors alongside financial data, you’ll develop a more comprehensive understanding of a company’s potential. This approach will enable you to make more informed investment decisions and identify tomorrow’s winning companies. This concludes the fourth section of this beginner’s guide to fundamental analysis. The next section will cover developing a step-by-step investing process based on what we’ve learned.

Your Step-by-Step Roadmap to Analyzing Any Company

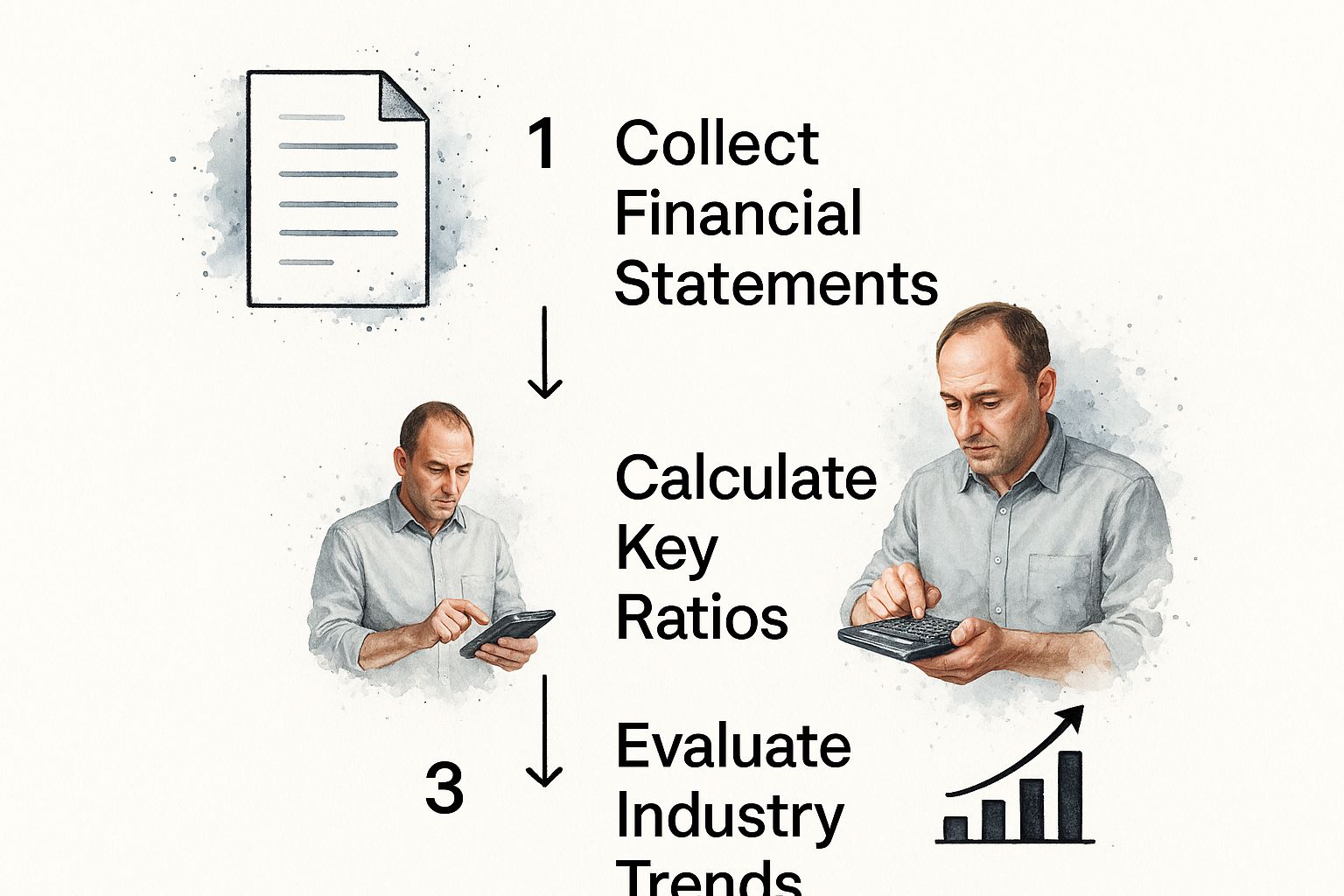

This infographic shows the three basic steps of analyzing a company: collecting financial reports, figuring out key ratios, and looking at industry trends. Each step builds on the last, helping beginners understand a company’s potential.

Step 1: Collect Financial Statements

Start by gathering the company’s financial papers. These include the income statement, balance sheet, and cash flow statement. You can usually find these on the company’s website. Websites like Stock Decisions can help by collecting these reports for you. This makes it easy to start your research.

Step 2: Figure Out Key Ratios

Once you have the financial papers, calculate key ratios. These show important things about the business, like how much money it makes and how much it owes. For example, the price-to-earnings (P/E) ratio shows how much people are willing to pay for its earnings. The return on equity (ROE) measures how well the company uses money from investors to make a profit. You can easily calculate these ratios using the financial papers.

Step 3: Look at the Bigger Picture

Besides numbers, look at other factors. Think about the company’s leaders, its competitors, and how its industry is doing. Ask yourself: Does the company have a strong brand? Is the industry growing? These factors can affect how well the company does in the long run and give investors useful information.

Step 4: Compare with Competitors

After analyzing a company, look at its rivals. This shows if it’s doing better or worse than others in the same field. Comparing helps you understand the company’s position.

Step 5: Think About Your Own Goals

Consider what you want from your investments. Are you investing for a long or short time? What is your risk level? Knowing this helps you adjust your analysis to fit your goals.

Step 6: Decide

Based on your research and goals, decide if the company is a good investment. If it looks promising and fits your goals, it might be a good time to invest. If not, think about other options.

Step 7: Monitor and Review

Investing is an ongoing process. Regularly monitor your investments and update your analysis as new information emerges. This consistent review ensures you stay informed and can adapt your investment strategy as needed. Companies and markets are dynamic, so ongoing monitoring is essential for managing risk.

Avoiding Traps That Catch Even Smart Investors

Even experienced investors can fall into common traps during basic analysis. This part talks about a few of these traps and gives easy ways to avoid them. Knowing these problems helps you make smarter investment choices from the start.

The Recency Bias Trap

Our brains often focus more on recent events. This recency bias can make us think a company’s current success will last. For example, if a company’s stock price goes up, we might believe it will keep rising. But that’s not always true. A wise investor looks at the long-term, not just what’s happening now.

To avoid this trap, study a company’s performance over several years, not just recent months. Look for steady growth and reliability. This long-term view helps in making better investment choices.

The Confirmation Bias Trap

We like to find information that supports what we already believe. This is called confirmation bias. If we already like a company, we might ignore warning signs. For instance, we might dismiss a bad earnings report as a small issue.

To fight confirmation bias, look for information that challenges your views. Think about different opinions and be open to changing your mind. Being objective is important for smart investing.

The Apples-to-Oranges Trap

Another mistake is comparing companies without considering their differences. It’s like comparing apples to oranges. Comparing a new tech company with a big retail business can lead to wrong ideas. Each company is unique and should be judged on its own.

To avoid this trap, compare companies in the same field. This gives a better measure of how they’re doing. Different fields have different conditions, and knowing these differences is key to a good analysis.

Real Investor Stories: Learning from Mistakes

Many investors have learned lessons the hard way. One investor put a lot of money into a company after hearing one good news story. Without doing enough research, they watched the stock price drop.

Another investor ignored signs of a company’s growing debt because they were too confident in the investment. This wrong belief led to big losses.

These stories show how important it is to avoid common investment mistakes. Learning from others’ errors can help you make better choices.

Simple Tips for Better Decisions

Here are some easy tips to keep your investment choices smart:

Spread out your investments: Don’t put all your money in one place. Spreading it out reduces the chance of big losses.

Set clear goals: Know what you want from your investments. This keeps you from making quick, unwise choices.

Ask for help: If unsure, talk to a financial expert. They can give you good advice.

By following these tips, you can become a wiser and more assured investor.

Want to make better investment choices? Stock Decisions gives you the tools to check out companies well. Visit now and start your journey to financial success.