Starting Your Investment Journey Without Fear

Let’s face it, investing can feel overwhelming for newcomers. The ups and downs of the market and tricky words can make anyone feel confused. But here’s a tip from those who do well in investing: everyone begins somewhere. This beginner’s guide will help clear things up and let you take control of your money.

The first challenge is often fear of the unknown. Many people hesitate, thinking they need a finance degree or a lot of money to start. This is not true. Like learning to play an instrument or bake bread, investing is a skill you build over time. You start small and slowly become more confident.

Think of it like learning to ride a bike. You wouldn’t start on a mountain trail right away. Starting small, even with just $50 a month, can make a big difference over time. Consistency, not big amounts, is the key.

Regular, small investments are a great way to learn and get comfortable. It also changes how you think about money. Instead of just saving it, you start seeing it as a tool to grow over time.

Another common fear is losing money. While markets go up and down, the biggest risk is not short-term drops, but the slow loss of your money’s value due to inflation.

Money in a savings account loses value over time, especially when the economy is shaky. Investing can help your money grow faster than inflation and build real wealth. Learning about market trends and what influences investments is important for beginners.

Here’s an example. As of 2025, global stock and bond markets have been shaky. Surprisingly, non-U.S. stocks did better than U.S. stocks by about 10% up to April 25, 2025. In the U.S., the S&P 500 companies showed over 13.5% earnings growth for Q1 2025. This shows why having a mix of investments is so important. Find more insights about market trends.

Lastly, remember investing is not just about numbers. It’s about reaching your financial dreams. Whether it’s buying a house, retiring comfortably, or just building a secure future, investing can help. By focusing on your long goals and taking steady steps, you can change your financial life, one small move at a time. This guide will keep giving you the knowledge and tools you need to confidently handle the markets and build a brighter future.

Understanding Investment Types with Real-Life Examples

Imagine building an investment plan like preparing a healthy meal. You wouldn’t eat just one thing, right? You’d want a mix of foods for a balanced diet. In the same way, a good investment plan includes different types of assets working together to help you achieve your financial goals. Let’s look at some basic investment types for beginners, using real examples to make them easy to understand.

Stocks: Owning Part of a Business

Think of buying a stock like owning a piece of your favorite bakery. You become a part-owner. If the bakery does well and sells many treats, your investment grows. But if it struggles, your investment could shrink. This chance of both profit and loss is key in stock investing. For example, if you had put $100 in Apple stock in 2010, it would be worth a lot more today, showing the potential growth over time of stocks.

Bonds: Lending Money and Earning Interest

Consider bonds as lending money to a trusted friend. They promise to pay you back with a bit extra (interest) by a certain date. Governments and big companies issue bonds to fund projects. Bonds usually give lower returns than stocks, but they are also seen as safer. This makes them a useful “steadying” part of your plan. A bond’s yield shows what you can earn back, like getting 3% yearly on the money you lent.

Mutual Funds and ETFs: Easy Diversification

Picture going to a buffet. Instead of just one dish, you try a bit of everything. Mutual funds and exchange-traded funds (ETFs) work like this. They let you invest in a mix of stocks, bonds, or other assets at once. This variety helps manage risk because if one investment drops, others might rise. Investing in a market ETF, like one that tracks the S&P 500, is like owning small parts of 500 companies.

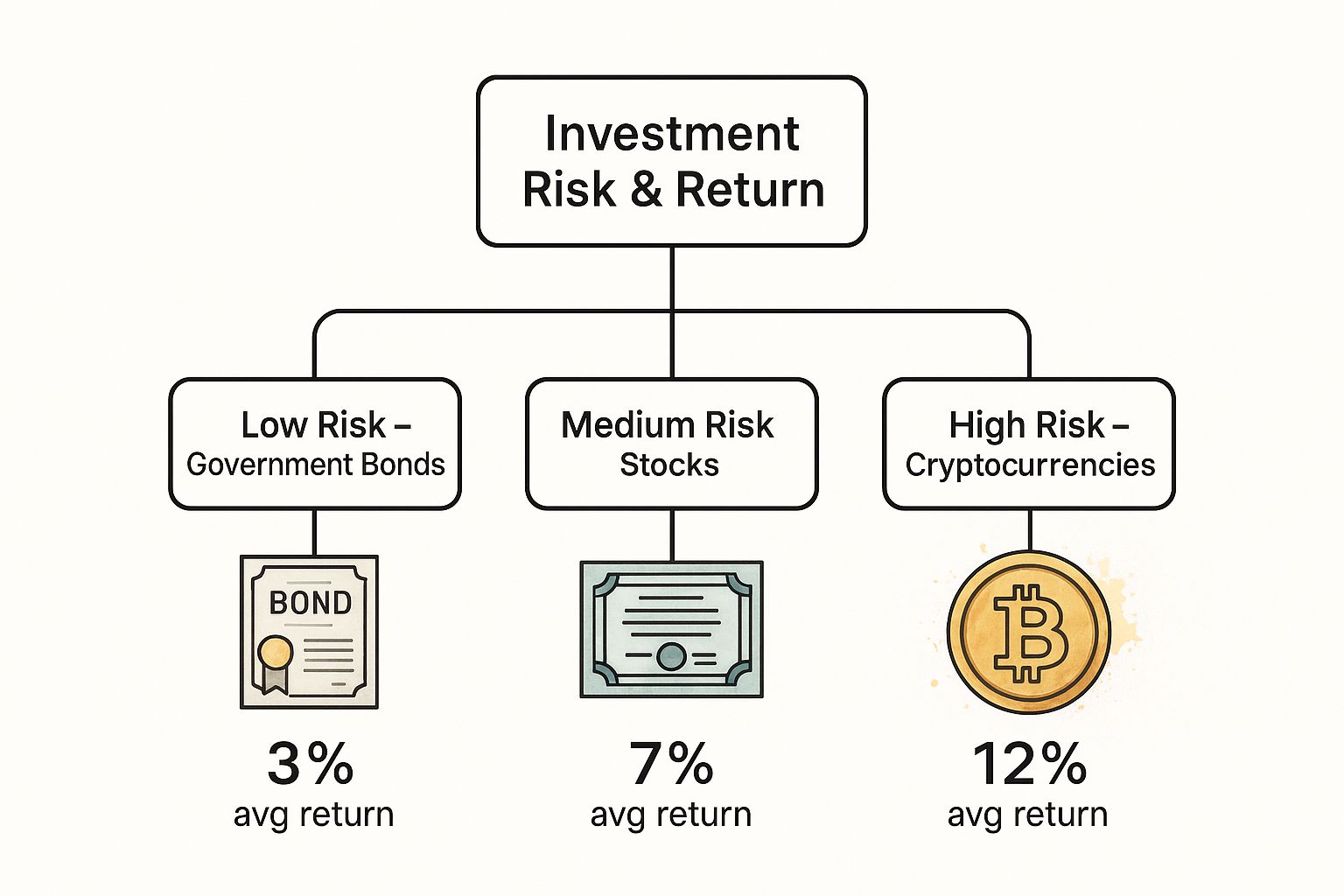

The following infographic helps visualize the relationship between investment risk and potential returns across different asset classes:

According to the infographic, government bonds give lower returns, about 3%, but they are usually less risky. Stocks can offer better returns, around 7%, but they have medium risk. Cryptocurrencies might give high returns, about 12%, but they are much riskier.

To help you see the differences, here is a table. It compares common ways to invest. You can see how risky they are, what returns you might get, and the best uses for beginners.

|

Investment Type |

Risk Level |

Potential Return |

Best For |

Minimum Investment |

|---|---|---|---|---|

|

Stocks |

Medium to High |

High |

Long-term growth |

Varies, can be less than $1 |

|

Bonds |

Low to Medium |

Low to Moderate |

Income and stability |

Varies, can be $1,000 or less |

|

Mutual Funds |

Varies depending on holdings |

Varies depending on holdings |

Diversification and professional management |

Varies, can be $1,000 or less |

|

ETFs |

Varies depending on holdings |

Varies depending on holdings |

Diversification and low costs |

Varies, can be less than $100 |

|

REITs |

Medium |

Moderate |

Real estate exposure without direct ownership |

Varies, can be less than $100 |

Each type of investment has its own risk and return. Picking the right one depends on your goals and how much risk you can handle.

REITs: Easy Real Estate Investing

Think about investing in real estate without the trouble of managing buildings, dealing with renters, or fixing things. Real Estate Investment Trusts (REITs) make this easy. They own places like malls, offices, and apartments. When you invest in a REIT, you become a part-owner of these places. You get into real estate without the stress of owning property directly. Plus, it’s easier to buy and sell your share than with physical property.

These are the main investment choices for beginners. Each has different risks and rewards. It’s important to pick ones that match your financial goals and how much risk you can take. We will talk more about this in the next section.

Building Your Financial Foundation First

This image from Mint.com shows a quick look at someone’s money life – their budget, how they spend, and their account balances. Mint helps you see your financial health clearly, pointing out areas to improve. Before you start investing, it’s key to know where your money comes from and where it goes.

Think of investing like adding a roof to a house. You need strong walls first. Focus on two main things: an emergency fund and paying off high-interest debt.

Emergency Fund: Your Safety Net

Experts say to save six months of expenses. But it’s best to save what works for you. If you have a steady job and health insurance, three months might be okay. If your income changes, save six to nine months. This fund helps you avoid using investments or going into debt when things go wrong.

For instance, if your car suddenly needs $2,000 in repairs, an emergency fund lets you fix it without using credit cards or selling investments at a loss.

Clearing High-Interest Debt: Freeing Resources

Getting rid of high-interest debt, like credit card debt, saves you money and stress. If you pay 20% interest on a credit card but earn 7% on investments, you’re losing out. High debt can also stress you out and affect your investment choices. Paying off debt lets you invest more regularly and grow your money over time. Tools like Mint.com help track your debt and keep you motivated.

Automating Your Savings: Making it Easy

Saving money doesn’t have to be hard. Automate your savings to make it simple. Set up transfers from checking to savings and investment accounts. Small, regular amounts add up quickly. This makes saving easy and keeps you from spending. For example, saving $50 every week adds up to over $2,600 a year without trying hard.

By focusing on these basics, you’ll be ready to invest with confidence and build wealth over time. The next part will talk about the mindset needed for investing, showing how having a good financial base helps you make better choices and reach your goals.

Creating Your Personal Investment Plan

Your investment plan should be as unique as you are. Forget one-size-fits-all strategies; building wealth means making a plan that matches your financial goals. This involves honestly assessing your comfort with risk, setting clear goals, and knowing the importance of spreading your investments.

Knowing Your Risk Comfort

There is a big difference between how much risk you think you can handle and how you’ll really react if your investments drop. Imagine your portfolio falls 20% – would you panic and sell, or stay calm, remembering that markets go up and down? Understanding your risk comfort is key to making smart choices. It’s not about avoiding risk; it’s about finding what lets you sleep well. A risk questionnaire or talking with a financial advisor can help you find your comfort level.

Setting Clear Timelines

Think of it like this: a marathon runner trains differently than a sprinter. Your investment timeline is just as important. Saving for retirement in 30 years? Your plan will differ from someone saving for a house in 5 years. Longer timelines usually allow for more risk. Shorter goals often need a careful approach. Younger investors can handle market changes, while those near retirement may focus on keeping their savings safe.

Diversifying: Spread Your Money

Diversifying is like building a house on a strong base. It spreads the weight and makes it stronger. In investing, this means putting your money in different things like stocks, bonds, and real estate. It’s not about having a lot of investments, but about having a mix to handle market ups and downs. If one area struggles, others can balance the losses, keeping your investment safe.

Also, smart diversification means looking beyond your home country. Stay informed about global trends to make smart choices. For example, the MSCI ACWI Index showed a drop in non-U.S. stocks, but this changed in early 2025 as investors looked to international markets. The Asia Pacific region, especially China, showed strength and growth, with earnings expected to grow about 8% in 2025. Meanwhile, the U.S. market expected 9% growth, with possible share buybacks if spending fell. Learn more about market trends.

Adapting to Life Changes

Your investment blueprint isn’t set in stone; it should adapt to the changes in your life. Marriage, kids, a career shift – these milestones can reshape your financial priorities. Regularly reviewing and adjusting your strategy keeps it in sync with your current needs and long-term goals. You might boost contributions as your income grows, or move towards a more conservative approach as retirement nears. A dynamic investment plan acknowledges that life unfolds, and adjusts accordingly.

Choosing Your Investment Platform Wisely

Picking the right investment platform is a big step for new investors. Think of it like choosing a sherpa to guide you on your climb up Investment Mountain. Whether you prefer to blaze your own trail or have someone else lead the way, the right platform can make or break your entire experience. Let’s explore what to consider when making this important decision.

Understanding Your Options

Just like there are different kinds of restaurants–fast food, casual dining, fine dining–there are different kinds of investment platforms. Traditional brokerage firms are like having a personal chef. They offer tailored advice and a full menu of services, but come with a higher price tag. Robo-advisors are like automated meal prep services. They create a balanced investment “meal” based on your goals and risk tolerance, usually at a lower cost. Online platforms are like grocery stores for investors. They give you all the tools and ingredients to cook up your own portfolio, usually charging a small fee per trade or annually. Understanding the pros and cons of each is key to finding the right fit.

Fees: What You Pay Matters

Investment fees may look small, like a few extra cents on your grocery bill. But over time, these small costs can reduce your returns. Imagine a 1% yearly fee on a $10,000 investment. It seems like just $100 in the first year, right? Yet over 20 years, that 1% could cost you thousands in potential earnings. It’s like buying expensive cereal every week when the cheaper brand offers the same nutrients. Make sure you know all the fees, like trading fees, account maintenance fees, and expense ratios for mutual funds or ETFs. Some platforms may tempt you with low fees but then sneak in hidden costs. Always read the fine print!

Features and Resources For Beginners

For new investors, a simple platform with helpful resources can make a big difference. It’s like having a cooking teacher help you with a new recipe. Look for features like automatic investing, which lets you set up regular contributions so you can “set it and forget it.” Tax-loss harvesting can help lower your tax bill by selling losing investments wisely, just like using up those wilting vegetables before they spoil. Educational resources, such as articles, tutorials, and webinars, are like cookbooks, teaching you the basics of investing.

A screenshot of the Fidelity website, a popular investment platform, shows why it’s important to have clear, easy-to-use navigation. Imagine cooking in a messy kitchen–it makes everything more frustrating! A clean and simple interface can make investing feel less scary, especially when you’re just starting. Access to important info like account balances, market data, and research tools should be easy to find.

Reviews and Recommendations: Learning From Others

Before signing up with any platform, check out reviews and recommendations from other investors, especially beginners. It’s like reading restaurant reviews before making a reservation. Look for feedback on customer service, how easy the platform is to use, and the quality of educational resources. Learning from others’ experiences can help you find the platform that’s right for you.

To help you get started, we’ve put together a comparison of some popular platforms:

Introduction to the Investment Platform Comparison Table: The table below compares some popular investment platforms, showing their fees, features, and who they are best for. This can help you narrow down your options and choose a platform that fits your investing style and goals.

|

Platform |

Account Minimums |

Trading Fees |

Key Features |

Best For |

|---|---|---|---|---|

|

$0 |

$0 for stocks, ETFs, and options |

Research tools, educational resources, international trading |

Beginners and experienced investors | |

|

Varies by fund |

$0 for Vanguard ETFs and mutual funds |

Low-cost funds, retirement planning tools |

Long-term investors, retirement savers | |

|

$0 |

$0 for stocks and ETFs |

Financial planning advice, banking services |

Beginners and active traders | |

|

$0 |

$0 for stocks, ETFs, and options |

User-friendly mobile app, fractional shares |

Mobile-first investors, beginners |

Key Insights from Comparing Investment Platforms

When you look at different platforms, you’ll notice each one serves different needs. Some focus on keeping costs low. Others offer more features and services. Think about what matters most to you—whether it’s low fees, research tools, learning resources, or a simple mobile app. Choose based on your preferences.

Robo-Advisors vs. Self-Directed Trading

If managing your own investments seems difficult, robo-advisors provide an easy solution. They work like a personal chef, planning and managing your investments for you. They create and manage a varied portfolio based on what you want and how much risk you can handle. As you get more confident, you might want to try self-directed trading. This is like learning to cook your own meals. It gives you more control over where you invest. Many platforms let you start with a robo-advisor and then move to self-directed trading when you feel ready.

Making Your First Investment With Confidence

Taking that first step into investing might feel like getting on a rollercoaster—full of nervousness and excitement. This part of our beginner’s guide will help you through the process, from setting up your account to making your first investment.

From Account to Action: Easy Steps

First, you’ve picked your investment platform and added some money. Now comes the fun part: buying your first investment. It might seem like a big challenge, but let’s break it down into easy steps.

Choose Your Investment: Use your new knowledge to pick what to buy. It could be a company’s stock, a bond, an ETF, or a mutual fund.

Decide on the Amount: Think about how much you want to invest. You don’t have to start big. Even a small amount is a great start. Remember, confidence grows with practice.

Place Your Order: Press the “buy” button! This click means you are officially investing. It’s a big step towards building your financial future.

Start Small and Build Confidence

There’s no need to invest a lot of money right away. Think of it like learning to ride a bike. You wouldn’t start on a mountain trail. You would begin with training wheels, get the hang of it, and slowly gain confidence.

Starting small helps you get used to the process. You can learn how the market works without risking a lot of money.

The Strength of Automation: Dollar-Cost Averaging and Automatic Contributions

For those new to investing, two useful methods are dollar-cost averaging and automatic contributions. Dollar-cost averaging involves putting a fixed amount of money into investments on a regular basis, regardless of market trends. This approach reduces the chance of investing a lump sum just before a market drop.

Automatic contributions make it even easier by automating the process. It’s similar to setting up automatic payments for bills. Money is transferred from your bank to your investment account on a schedule you choose. This way, you invest regularly and without much effort, allowing your money to grow even while you sleep.

Avoiding Common Beginner Pitfalls

Like anything new, investing comes with common mistakes. A major one is trying to time the market, or guessing when prices will rise or fall. Even experts find this challenging.

Another error is making decisions based on emotions. Fear might make you sell at a loss, while excitement might lead to risky choices. It’s important to stick to your plan and stay disciplined.

Learning From Others: Real Stories of New Investors

Listening to stories from other beginners can be comforting and informative. Many first-time investors have similar fears and experiences. Learning from their mistakes and successes can save you time and money. For instance, a new investor mentioned, “I wish I’d known about dollar-cost averaging sooner. It would have made downturns less worrying.” Another shared, “The best tip I got was to start small and be patient. Investing is more like a marathon than a sprint.”

By following these steps and learning from others, you can start your investment journey with confidence and build a stronger financial future. Remember, patience and consistency are key to long-term success.

Growing Your Portfolio Like an Expert

Think of your investment portfolio like a garden. You wouldn’t check each leaf’s growth daily, right? Instead, you’d look at the garden’s overall health. The same idea applies to managing your investments. This part of our guide explains how to review, adjust, and improve your investment strategy as you gain more experience.

Mastering the Portfolio Review

Portfolio reviews are essential, but not constantly. Just as you wouldn’t dig up plants every day to see the roots, you don’t need to check your investments every day or even weekly. A quarterly or semi-annual review is usually enough. Focus on the overall health of your portfolio rather than short-term market changes. Ask yourself: Are my investments still aligned with my long-term goals? Am I happy with my current asset allocation given my risk tolerance?

Important Metrics

For long-term investors, metrics like overall return and asset allocation matter more than daily market swings. Imagine measuring a child’s growth every hour. You’d get lots of data, but would it really help? Looking at growth over months and years gives a clearer picture. Apply this logic to your investments: focus on the big picture and don’t let daily fluctuations affect your long-term plan.

Keeping Your Portfolio on Track

Over time, your portfolio might drift from its original plan. Think of a garden where one plant thrives while others lag. Realigning is like trimming and nourishing your garden to restore balance. It involves selling some high-performers and buying more of those that haven’t done well, bringing your portfolio back to its target mix. This helps manage risk and opens up new opportunities.

Reinvesting Dividends: The Strength of Compounding

Dividends are like bonus fruits from your investment garden. Reinvesting them is like planting those seeds to grow more. This process, known as compounding, lets your earnings generate more earnings over time. Compounding is a strong tool for growth, especially when starting out. Even small dividends, when reinvested, can greatly increase your portfolio’s value over the years.

Changing Your Strategy: From Beginner to Seasoned Investor

Just like a gardener changes methods as plants grow, your investment strategy should adapt as you learn and get closer to your goals. As your income rises, you might increase your investments. As you near retirement, you might choose a safer path, focusing on keeping your capital rather than seeking high returns. Continuous learning and adapting to market changes are key for long-term success.

Ready to simplify your investment path and make better choices? Stock Decisions helps you face the markets with confidence. Our platform turns complex data into clear insights, providing simple investment advice and strong risk assessment tools. Explore our easy-to-use interface and see how Stock Decisions can help you achieve your financial goals. Start investing smarter with Stock Decisions.