Investing in stocks can feel like navigating a maze of numbers, charts, and jargon. For many, the complexity of financial reports and technical analysis is a barrier to confident decision-making. But there’s a simpler, more intuitive way to uncover stock opportunities: news. By tapping into real-time news, you can gain valuable insights into companies, industries, and market trends—all without needing a finance degree.

In this in-depth guide, we’ll explore why news is a cornerstone of smart investing, how to leverage it to spot opportunities, and how our platform makes the process effortless.

Why News Is the Backbone of Stock Investing

At its core, stock investing is about understanding a company’s value and potential. Financial statements tell part of the story, but news provides the context that brings those numbers to life. Real-time news acts like a pulse on the market, revealing events that can move stock prices in meaningful ways. Here’s why news matters:

- Company Milestones: Announcements about new products, mergers, acquisitions, or earnings results can signal growth or trouble. For example, a tech company launching a groundbreaking AI product could see its stock soar as investors bet on future profits.

- Industry Shifts: News about regulatory changes, technological advancements, or consumer trends can highlight entire sectors. For instance, a government push for clean energy might boost stocks in solar or electric vehicle companies.

- Macro Events: Global developments—like interest rate changes, geopolitical tensions, or supply chain disruptions—can ripple across markets. Understanding these events helps you anticipate how stocks might react.

- Market Sentiment: News shapes how investors perceive a company. Positive headlines can spark buying frenzies, while negative ones might trigger sell-offs, creating opportunities to buy low or sell high.

By staying informed, you’re not just reacting to the market—you’re anticipating its next move.

The Power of Real-Time News in a Fast-Moving Market

In the stock market, timing is everything. A delay of even a few hours can mean missing a golden opportunity or buying into a stock at the wrong moment. Real-time news gives you a competitive edge by delivering information as it unfolds. Here’s how it transforms your investing approach:

- Seize Breaking News: When a company secures a major contract or faces a lawsuit, its stock price can shift rapidly. Real-time news ensures you’re among the first to know, giving you time to research and act.

- Gauge Investor Sentiment: News drives emotions in the market. A flurry of positive articles about a company’s innovation can fuel demand, pushing its stock price higher. Conversely, negative press might create undervalued stocks worth considering.

- Discover Under-the-Radar Stocks: Smaller companies often don’t make it onto mainstream radar. News about their growth, partnerships, or niche market dominance can reveal hidden gems with significant upside.

- Navigate Volatility: Markets can swing wildly based on unexpected events. Real-time news helps you understand the “why” behind price movements, so you can decide whether to hold, buy, or sell.

Our platform streamlines this process by aggregating real-time news from trusted sources like Bloomberg, Reuters, and company filings, then presenting it in clear, digestible summaries.

A Step-by-Step Guide to Spotting Stock Opportunities with News

You don’t need to be a professional trader to use news effectively. Here’s a practical, beginner-friendly approach to turning news into actionable insights:

1. Curate Trusted News Sources

Not all news is created equal. Focus on reputable outlets and primary sources, such as:

- Financial news platforms (e.g., CNBC, Financial Times)

- Company press releases and SEC filings

- Industry-specific publications (e.g., TechCrunch for tech, Energy Voice for oil and gas)

Our platform saves you time by pulling these sources together and filtering out unreliable or sensationalized content.

2. Prioritize High-Impact News

Some news moves markets more than others. Pay attention to:

- Earnings Reports: Strong profits or missed expectations can cause big price swings.

- Product Launches or Innovations: A new product hitting the market can signal future revenue growth.

- Mergers and Acquisitions: These deals often boost stock prices for the acquiring or acquired company.

- Regulatory Changes: Approvals (e.g., FDA for pharmaceuticals) or restrictions can make or break a stock.

- Leadership Shifts: A new CEO with a strong track record can inspire investor confidence.

3. Link News to Fundamentals

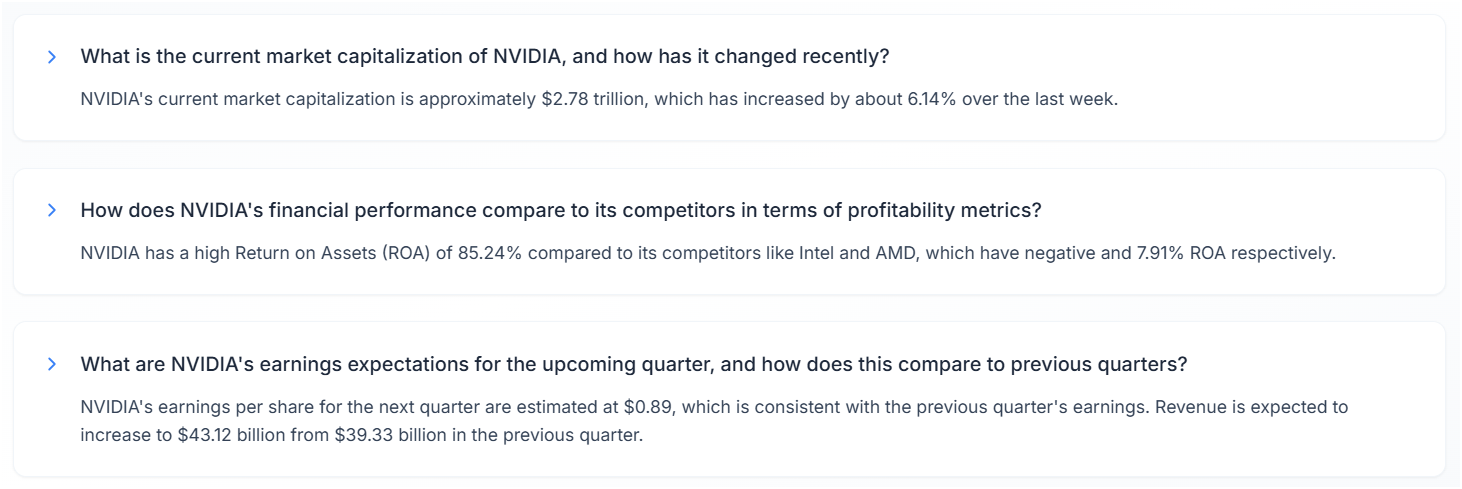

News is most powerful when paired with a company’s financial health. For example, a company announcing a new product is exciting, but it’s a stronger bet if it also has growing revenue, low debt, and a solid cash flow. Our platform integrates news with key financial metrics, like price-to-earnings ratios or revenue growth, in easy-to-read formats.

4. Analyze the Bigger Picture

A single news story might not tell the whole story. Look for patterns:

- Is the company consistently hitting milestones?

- Is its industry gaining traction?

- Are macroeconomic trends (e.g., rising interest rates) likely to help or hurt?

5. Act with Confidence

Once you’ve identified an opportunity, use news to time your moves. For instance, buying a stock after a temporary dip caused by overblown negative news can be a smart play. Always cross-check your insights with research to avoid impulsive decisions.

How Our Platform Simplifies News-Driven Investing

Manually tracking news and cross-referencing it with financial data is time-consuming and overwhelming. Our platform is designed to make news-driven investing accessible to everyone, from first-time investors to seasoned pros. Here’s how we help:

- Real-Time Aggregation: We collect news from multiple trusted sources and update it in real time, so you never miss a beat.

- Simplified Insights: We break down complex news and financial data into plain English, highlighting what matters most.

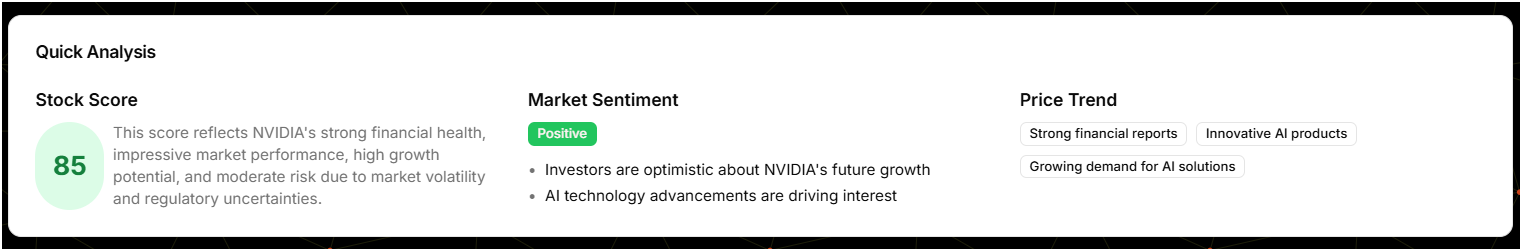

- Holistic Analysis: Our tools combine news, financial metrics, and market trends to give you a 360-degree view of any stock.

- Personalized Alerts: Set up custom alerts for the companies or industries you care about, and get notified when big news drops.

- Opportunity Spotting: Our algorithms flag potential winners based on news patterns and fundamental strength, tailored to your investment goals.

With our platform, you can focus on making decisions instead of wading through information overload.

Pitfalls to Avoid When Using News for Investing

While news is a powerful tool, it’s easy to misuse. Here are common mistakes and how to steer clear:

- Falling for Hype: Sensational headlines can inflate a stock’s price beyond its true value. Always verify news with fundamentals before jumping in.

- Reacting to Every Story: Not all news warrants action. A minor product delay might not matter if the company’s long-term outlook is strong.

- Missing the Forest for the Trees: A single negative headline doesn’t always spell doom. Look at the company’s broader trajectory and industry context.

- Information Overload: Trying to follow every news outlet can lead to analysis paralysis. Stick to high-quality sources and let our platform filter the rest.

- Ignoring Bias: Some news outlets may have agendas or conflicts of interest. Cross-reference with primary sources like company filings for accuracy.

Real-World Examples of News-Driven Opportunities

To illustrate the power of news, let’s look at two hypothetical scenarios:

- Tech Startup Breakthrough: A small biotech company announces FDA approval for a new drug. The news breaks on a Tuesday morning, and its stock jumps 20% by noon. Investors who followed real-time news and checked the company’s solid financials could have bought in early, capitalizing on the surge.

- Industry-Wide Boost: A government announces major subsidies for renewable energy. Stocks in solar, wind, and battery companies rally as investors pour in. Those who tracked industry news and identified fundamentally strong players could ride the wave.

These examples show how news, when paired with fundamental analysis, can unlock profitable opportunities.

Why Fundamental Analysis and News Go Hand in Hand

News alone isn’t enough—it’s most effective when combined with fundamental analysis, which looks at a company’s financial health. Key metrics to consider include:

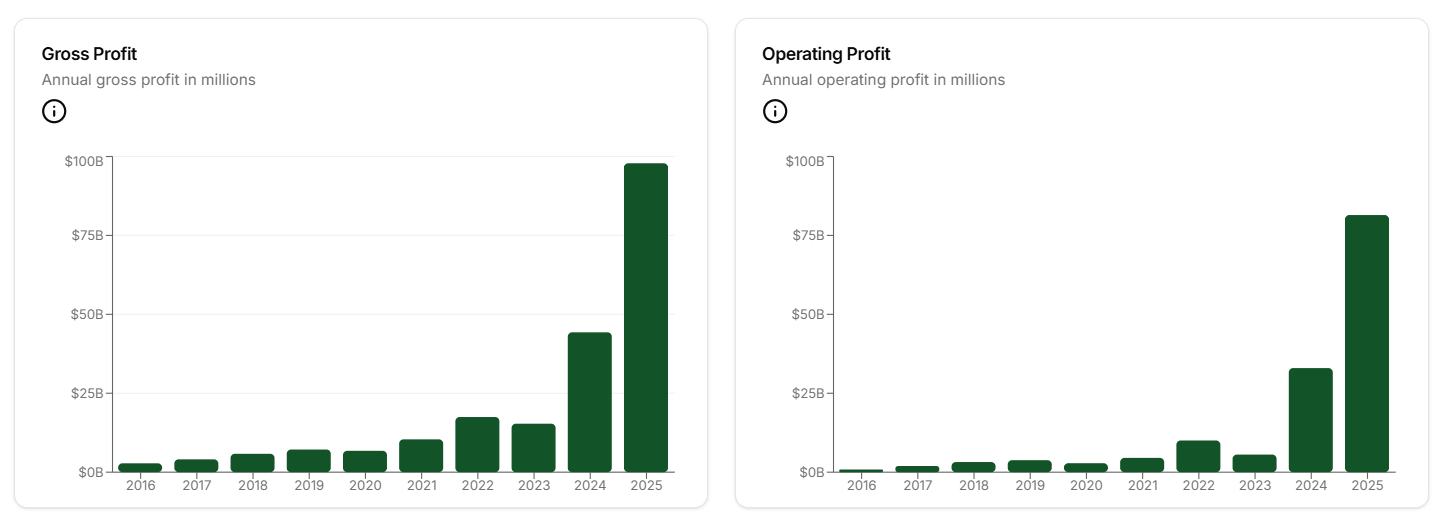

- Revenue and Profit Growth: Is the company making more money over time?

- Debt Levels: Can it manage its debts without strain?

- Cash Flow: Does it have enough cash to fund operations and growth?

- Valuation Ratios: Is the stock priced fairly compared to its earnings or assets?

Our platform bridges the gap by presenting news alongside these metrics in a way that’s easy to grasp, so you can make informed decisions without getting lost in spreadsheets.

Take Control of Your Investments Today

News is your gateway to smarter stock investing. By staying updated with real-time insights, you can spot opportunities, navigate market swings, and build a portfolio that aligns with your goals. Our platform makes it simple by delivering curated news, clear financial insights, and personalized recommendations—all in one place.

Don’t let the complexity of the stock market hold you back. Join our platform today and start spotting stock opportunities with confidence.