Investing Made Simple: Finding What Works for You

Feeling lost about investing? This listicle explains eight basic stock investing strategies: value vs growth investing and more. We’ll use simple terms and fun examples to help you find your investing style. Ready to join the millions of Americans investing in stocks? Let’s dive in! This guide covers Value Investing, Growth Investing, GARP, Dividend Growth Investing, Quality Investing, Contrarian Value Investing, Momentum Growth Investing, and Deep Value Investing, helping you choose what suits you best. Understanding these concepts is key to building long-term wealth.

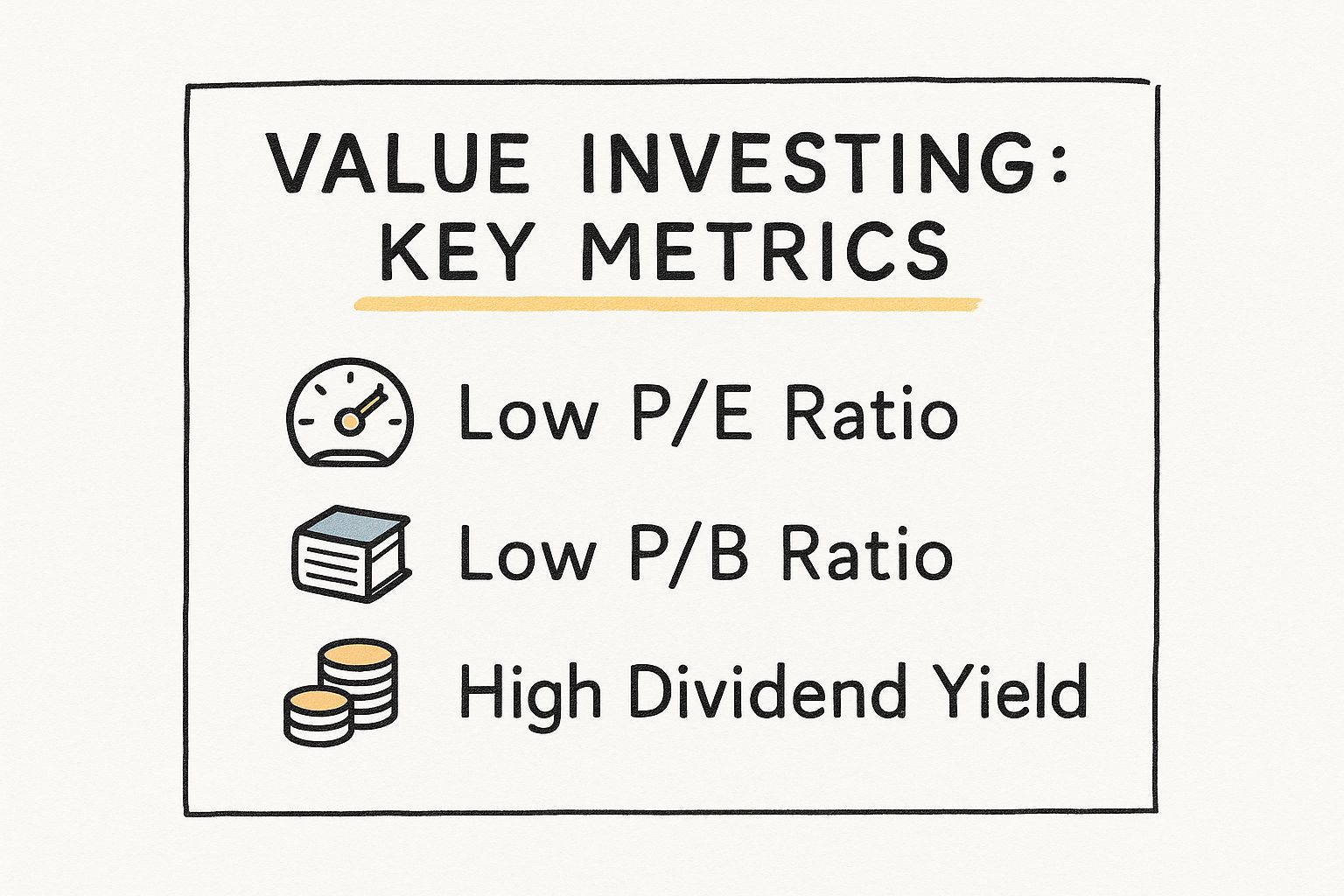

1. Value Investing

Value investing focuses on finding stocks priced below their true worth, like buying a dollar for fifty cents. This approach, favored by investors like Benjamin Graham and Warren Buffett, involves spotting undervalued companies through analysis of their financials and assets. Investors buy these stocks, waiting for the market to recognize their real value and prices to increase.

This infographic provides a quick reference for the key takeaways of value investing: finding undervalued companies by analyzing their fundamentals, having a long-term focus, and understanding that patience is key. As you can see, the focus on intrinsic value and fundamental analysis sets the stage for long-term growth potential.

Value investors rely heavily on fundamental analysis to assess a company’s intrinsic worth. For a comprehensive understanding of this process, check out A Beginner’s Guide To Stock Valuation.

So, what do value investors look for? They often focus on low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, and high dividend yields. These are like clues that suggest a stock might be undervalued. For example, a low P/E ratio might indicate that investors are underestimating the company’s future earnings potential.

Features of Value Investing:

Focus on companies trading below intrinsic value

Emphasis on fundamental analysis

Longer investment horizon (think years, not days)

Contrarian approach (going against the crowd)

Preference for established companies with steady cash flows

Pros:

Historically strong long-term performance

Lower risk due to the “margin of safety” (buying below intrinsic value)

Less volatility during market downturns

Potential for dividend income

Tax efficiency due to lower turnover rates

Cons:

Can lag behind during bull markets

Requires patience and the ability to withstand “value traps” (companies that appear cheap but are actually declining)

Demands financial analysis skills

Can be tough to buy unpopular stocks

Risk of investing in declining businesses

Examples of Successful Value Investing:

Warren Buffett’s investments in GEICO, Coca-Cola, and American Express

Seth Klarman’s investment in distressed debt during financial crises

John Neff’s long-term success with Vanguard’s Windsor Fund

Tips for Value Investors:

Focus on free cash flow (actual cash generated by the business)

Look for catalysts that could boost the company’s value

Use multiple valuation methods to estimate intrinsic value

Create a watchlist of quality companies to buy during market dips

Stay disciplined and avoid following market trends

Why Value Investing Matters:

Value investing is a reliable way to approach the stock market by focusing on a company’s true worth, offering the chance to find investments at lower prices. It requires patience and research, but the potential for long-term gains makes it worthwhile. Whether you’re new or experienced, understanding value investing is an important tool for your investment journey, providing an option beyond following current market trends.

Growth Investing

Growth investing focuses on companies expected to grow quickly. Even if their stock prices are high, growth investors see potential in businesses with rising revenue and earnings, often in emerging industries. This strategy aims for future price increases rather than immediate dividends. Growth investors are willing to pay more for companies they believe will lead the market in the future.

Growth investing deserves a spot on any “value vs growth investing” list because it represents a core investment philosophy. Its focus on future potential offers a stark contrast to value investing, providing investors with a distinctly different approach to building wealth in the stock market. Key features include targeting companies with above-average revenue and earnings growth, often in emerging industries and disruptive technologies. These companies usually have higher price-to-earnings (P/E) ratios than the market average because investors are betting on future growth. They typically reinvest profits back into the business for expansion rather than paying dividends.

Examples of Growth Investing Success:

Early bird gets the worm: Imagine buying Amazon or Netflix stock when they were just starting out. That’s the kind of early investment growth investors seek. T. Rowe Price, a famous investor, did just this!

Electric Dreams: Cathie Wood’s ARK Invest bet big on Tesla. This is a classic example of investing in a disruptive technology before it became mainstream.

From bricks to clicks: Think about Home Depot when it was rapidly expanding across the US. William O’Neil saw its growth potential early on.

Tips for Growth Investors:

Moats matter: Look for companies with a “moat,” meaning something that protects them from competition. Think of a brand like Apple or a unique technology.

Growth Spurt: Look for revenue that’s not just growing, but accelerating. This is like a plant that’s suddenly shooting up!

Big Potential: Think about how big the market for a product could be. This is called the Total Addressable Market (TAM). The bigger the TAM, the more room a company has to grow.

Management Matters: Are the people running the company hitting their growth targets? Good management is key!

Premium Price, Big Potential: Be prepared to pay a bit more for companies with exceptional growth prospects.

Pros and Cons of Growth Investing:

Pros:

Big Wins: Growth investing can lead to huge returns. Your investments can skyrocket in value!

Riding the Wave: Growth stocks often perform well during economic booms.

Future is Now: You get to invest in innovative companies shaping the future.

Momentum: Winning stocks often keep winning, creating a positive feedback loop.

Early Bird Advantage: You might discover the next big thing before everyone else.

Cons:

Roller Coaster Ride: Growth stocks can be very volatile. Be prepared for ups and downs.

Market Blues: Growth stocks often suffer more during market downturns.

Pricey Picks: High valuations mean there’s less room for error. If growth slows, the price can drop fast.

Broken Promises: Sometimes, expected growth doesn’t happen.

No Dividends: Growth companies typically reinvest profits, meaning no regular income for you.

Growth investing giants: Some famous growth investors include Philip Fisher, T. Rowe Price, Peter Lynch, Cathie Wood, and William O’Neil. They all believed in finding companies with strong future potential.

In short, growth investing is a powerful strategy within the value vs growth investing landscape. It’s about finding the companies of tomorrow, today. While it comes with risks, the potential rewards can be substantial.

3. GARP (Growth At a Reasonable Price)

When it comes to “value vs growth investing,” GARP offers a compelling middle ground. It’s like finding the sweet spot, the perfect balance. This investment strategy cherry-picks the best aspects of both value and growth investing, aiming for the best of both worlds. Think of it as getting the sizzle of growth without the high price tag. This approach seeks companies showing strong growth potential, but without the inflated valuations of pure growth stocks.

What is GARP and How Does it Work?

GARP investing focuses on companies that are growing steadily, but are also reasonably priced. It’s like finding a hidden gem – a great company that the market hasn’t fully recognized yet. Instead of chasing the hottest, most expensive stocks, GARP investors look for solid businesses with consistent earnings growth exceeding the market average, but trading at more down-to-earth valuations. Imagine finding a delicious pizza at half price!

The Magic Metric: The PEG Ratio

One of the key tools GARP investors use is the PEG ratio (Price/Earnings to Growth). This handy metric helps compare a company’s price-to-earnings ratio (P/E) with its expected earnings growth rate. A PEG ratio below 1.0 suggests a company might be undervalued relative to its growth potential. Think of it like a sale – the lower the PEG, the better the bargain.

Real-World Examples:

Dunkin’ Donuts (Peter Lynch): Lynch invested in Dunkin’ during its expansion, seeing the growth potential at a reasonable price. He basically bet on America’s love for donuts!

Amazon (Bill Miller): Miller recognized Amazon’s potential early on, even before it became a giant, buying it when it first turned a profit. Talk about being ahead of the curve!

Pros of GARP Investing:

Best of Both Worlds: Combines the upside of growth and the downside protection of value investing.

Less Risky Than Growth: Offers a smoother ride than investing in high-flying growth stocks.

Potentially Higher Returns Than Value: Aims for higher returns compared to traditional value investing.

Market Resilience: Less sensitive to market swings and changes in sentiment.

Cons of GARP Investing:

Requires Research: Demands a good understanding of both value and growth investing principles.

May Miss Out on Extremes: Could underperform pure growth in booming markets or pure value in crashes.

Finding True GARP is Hard: Identifying the perfect GARP opportunity can be a challenge.

Why GARP Deserves a Place in Your Toolkit:

GARP investing is a smart way to handle the “value vs growth” decision. It can bring good returns with less risk, making it a good choice for both new and seasoned investors. It’s like enjoying growth with a bit of safety.

4. Dividend Growth Investing

Dividend growth investing combines value and growth investing. It focuses on companies that regularly raise their dividend payments. This method looks for fairly priced companies that are strong and have enough cash flow to support rising dividends. Investors in this area seek businesses with sustainable payout ratios, solid financials, and advantages that allow them to expand while also increasing dividends.

Think of it as planting a tree that gives you more fruit each year. You get the original value of the tree (the stock) and the growing fruit (dividends) as it matures. This makes dividend growth investing an appealing choice between value and growth investing.

How It Works

This approach focuses on established companies with steady cash flow. These businesses often lead their markets. They focus on sharing profits with shareholders by regularly increasing dividends. This consistent income, along with possible stock price gains, adds to overall returns.

Success Stories

Companies like Procter & Gamble (over 68 years of dividend increases), Johnson & Johnson (over 60 years), and Coca-Cola (over 60 years) are well-known for successful dividend growth. These are known as Dividend Aristocrats, part of the S&P 500 with a long record of raising dividends. Another example is Tom Huber’s management of the T. Rowe Price Dividend Growth Fund, which has shown strong results over time.

Actionable Tips for Investors

Focus on growth, not just yield: A lower yield with a high growth rate is often better than a high yield with little to no growth.

Sustainable payout ratios: Look for companies with payout ratios (the percentage of earnings paid out as dividends) below 60% to ensure they can sustain and increase dividends.

Cash is king: Analyze free cash flow – the cash left over after a company covers its operating expenses and capital expenditures – to confirm the dividend is well-covered.

Don’t put all your eggs in one basket: Diversify across multiple sectors to protect your income stream from industry-specific downturns.

Reinvest your dividends: Dividend reinvestment plans (DRIPs) automatically reinvest dividends to buy more shares, creating a powerful compounding effect. It’s like getting free shares!

When and Why to Use This Approach

Dividend growth investing suits those seeking income and growth balance. It’s great for those nearing retirement or wanting a stable income source, and for long-term investors favoring less volatility than pure growth strategies.

Pros and Cons of Dividend Growth Investing

Pros: Growing income, potential capital gains, lower volatility, shows management confidence, strong compounding.

Cons: May underperform in growth markets, sensitive to interest rate hikes, tax issues, sector concentration, dividend cut risks.

Summary

Dividend growth investing blends income with potential stock appreciation, focusing on quality companies with sustainable dividends. It offers a less volatile way to gain market exposure compared to pure growth strategies. Prioritize dividend growth rates, sustainable payouts, and diversification.

5. Quality Investing: A Different Approach to Value vs Growth Investing

Quality investing offers a compelling alternative within the value vs growth investing debate. It doesn’t try to box companies into rigid categories. Instead, it focuses on finding truly great businesses, regardless of whether they look like traditional value or growth stocks. Think of it like picking the best apples in the orchard, no matter their size or color.

What is Quality Investing?

This strategy looks for companies with rock-solid foundations. These are businesses with strong competitive advantages, efficient operations, and smart management. Quality investors seek out companies that consistently make good profits, have low debt, and can weather any economic storm. They prioritize long-term durability over short-term market trends.

Why Quality Matters in Value vs Growth Investing

Quality investing carves its own path in the value vs growth landscape. Instead of hunting for bargains (value) or betting on fast-growing companies (growth), it prioritizes businesses built to last. This approach can provide stability during market swings, making it attractive for long-term investors.

Features of Quality Companies

High Return on Invested Capital (ROIC): They efficiently use their money to generate profits. Think of it like getting a good return on your savings account!

Strong “Moats”: These are competitive advantages that protect a business, like a castle moat. Think of Coca-Cola’s brand recognition or Apple’s loyal customer base.

Skilled Management: The people running the company are smart and make good decisions.

Healthy Finances: Low debt and strong cash flow mean the company is financially sound.

Pros of Quality Investing

Downside Protection: Quality companies tend to hold up better during tough times.

Consistent Performance: These companies often deliver steady returns over the long haul.

Lower Risk: Strong fundamentals mean less chance of the business failing.

Cons of Quality Investing

Premium Valuations: High-quality companies often come with higher price tags.

Potential Underperformance in Speculative Markets: When the market gets excited about risky bets, quality stocks can lag behind.

Difficulty in Identifying Durable Advantages: Figuring out which “moats” will last can be tricky.

When and Why to Use This Approach

Quality investing makes sense if you’re a long-term investor who values stability and prefers to sleep well at night. It’s less about chasing quick gains and more about building wealth steadily over time. If you’re looking for a less volatile approach to value vs growth investing, quality investing might be a good fit.

Key Takeaways

Quality investing involves focusing on strong businesses with solid fundamentals and lasting competitive edges. Although these companies might be pricier, their reliability and steady performance can make them worthwhile for long-term investment. This strategy emphasizes the business’s core strength, beyond typical value or growth categories.

6. Contrarian Value Investing: Finding Hidden Gems

Contrarian value investing is about spotting undervalued companies ignored by the market. It involves buying when others are selling, capitalizing on market pessimism that lowers prices too much. Investors seek companies with temporary issues, requiring careful research to avoid those in permanent decline. This approach often targets cyclical industries like airlines or housing.

Examples of Success:

David Dreman bought tobacco stocks when everyone was worried about lawsuits. This was a contrarian move that paid off big.

John Templeton famously invested in Japanese stocks after their market crash. He bought low when everyone else was scared.

Tips for Contrarian Value Investing:

Check the Balance Sheet: A strong balance sheet helps companies survive tough times. Think of it as a financial safety net.

Look for Insider Buying: When company insiders buy stock, it’s often a good sign. They know the business better than anyone.

Think About Catalysts: What could turn the company around? A new product? A change in management?

Pros:

Big Potential Returns: When sentiment turns positive, profits can be huge.

Safety Net: Depressed prices provide a margin of safety. This limits potential losses.

Less Competition: Fewer investors means more opportunities.

Cons:

“Falling Knives”: Sometimes, a struggling company continues to decline. This is a “falling knife” you don’t want to catch.

Tough Mentally: It takes strong conviction to go against the crowd.

Slow Returns: It can take time for the market to recognize the value.

Why Consider Contrarian Value Investing:

In the debate between value and growth investing, contrarian value investing offers a different way to make a profit. It’s not for everyone, but it can be very rewarding for those who have the patience and skill to do it well. It requires careful analysis, patience, and the courage to go against popular opinion. However, the potential gains can be significant.

When to Use This Method:

Think about using this method during market slumps or when certain sectors are facing negativity. This is often when the best deals are available.

In Summary:

Contrarian value investing is a useful method in the value vs growth investing debate. It involves finding undervalued companies that others have ignored. It takes research, patience, and some boldness, but it can lead to great opportunities. Always do your homework and be ready for a potentially rough journey.

7. Momentum Growth Investing

Momentum growth investing is an interesting method in the value vs growth investing debate. It involves picking stocks that are rapidly increasing in value, much like riding a wave with fast-rising stocks.

What is Momentum Growth Investing?

This strategy targets companies with quickly rising stock prices and earnings. The idea is straightforward: stocks that perform well often continue to do so for some time. It combines analyzing a company’s financial health with observing its stock price trends, similar to checking both the engine and speedometer of a car before buying.

Examples of Momentum Growth

The Tech Boom: In the 1990s, companies like Cisco and Home Depot saw huge growth. Early investors made significant profits. More recently, Cathie Wood’s ARK Invest saw large gains by investing in Tesla and Zoom during their growth periods.

Fidelity Contrafund: Some mutual funds, like Fidelity Contrafund, use momentum strategies to pick stocks showing strong upward trends during market growth.

Why Momentum Deserves a Spot in Value vs Growth Discussions

Momentum investing offers a distinct contrast to the value approach. While value investors seek undervalued bargains, momentum investors chase exciting growth stories, even if they seem pricey. This focus on high-growth potential makes it a vital part of the growth side of the value vs growth debate. It highlights a different way to think about growth, emphasizing speed and trajectory over intrinsic value.

How Momentum Growth Works

Momentum investors look for stocks hitting new highs with lots of trading activity. They like to see earnings and revenue growing quickly, quarter after quarter. They use tools to compare a stock’s performance to the overall market. It’s like checking if a swimmer is faster than the current.

Features of Momentum Growth Investing

Focuses on strong price and earnings growth: Think fast-moving stocks.

Combines fundamental and technical analysis: Checks both the company’s financials and its stock chart.

Short-term focus: These investors are not buy-and-hold forever types.

Pros of Momentum Investing

Big potential returns: Catching a rising star can lead to substantial profits.

Early entry to growth stories: You can find the next big thing before everyone else.

Avoids value traps: Momentum investing avoids companies that look cheap but stay cheap.

Cons of Momentum Investing

Higher risk: These fast-moving stocks can also fall fast.

Needs active management: You need to watch the market closely.

Higher costs: Frequent buying and selling can lead to more transaction costs and taxes.

Tips for Momentum Investors

Look for 52-week highs: Like finding athletes breaking records.

Check earnings growth: Make sure the company is making more money.

Use stop-loss orders: This helps limit your losses if a stock falls.

When to Use Momentum Growth

Momentum investing works best in strong bull markets, where most stocks are going up. It’s like surfing – you need good waves to ride. It’s less effective in choppy or bearish markets, when the tide is going out.

Key Figures in Momentum Investing

William O’Neil (Investor’s Business Daily)

Richard Driehaus (Driehaus Capital Management)

Cathie Wood (ARK Invest)

Summary

Momentum growth investing is a strategy focused on finding and riding the fastest-growing stocks. It can be exciting and profitable, but it’s also riskier than other approaches. Remember to do your research, manage your risk, and only invest what you can afford to lose.

8. Deep Value Investing

Deep value investing is like searching for treasure in stocks. It’s part of the value vs growth investing approach. Instead of focusing on fast-growing companies, you look for undervalued ones: companies whose stocks are priced much lower than their actual worth. It’s like finding a dollar for fifty cents.

What is it?

Deep value investing targets companies that the market has ignored. These companies often face short-term issues that have lowered their stock prices. Sometimes, these issues are unrelated to the business itself. It could be a general market decline or an unfavored industry. The main point is that the company’s real value is much higher than its stock price.

How does it work?

Deep value investors look for companies selling at very low prices, often less than their “net asset value.” This means the stock price is below what the company’s assets would be worth if sold. It’s like getting business operations for free! Benjamin Graham, known for value investing, favored this method.

Examples:

Bargain Hunting: Picture a company owning lots of land and buildings. Its stock might be low because of short-term poor earnings. A deep value investor might see this as a good deal, believing the land and buildings alone are worth more than the current stock price. Walter Schloss, a student of Graham, followed this approach.

Post-Crisis Opportunities: After the 2008 financial crisis, Seth Klarman found opportunities in complex mortgage securities that others avoided. He saw hidden value.

Spotting Trouble: David Einhorn’s decision to bet against Allied Capital also demonstrated deep value principles. He analyzed their assets and realized the company was worth less than claimed.

Tips for Deep Value Investing:

Check the Net-Net: Calculate the “net-net working capital.” This is like checking a company’s pocket change. It’s the current assets (cash, inventory) minus all liabilities (debts). If this is higher than the stock price, that’s a good sign.

Low Debt is Key: Look for companies with little or no debt. This provides a cushion in tough times.

Hidden Treasures: Look for hidden assets not fully reflected on the balance sheets. These can be undervalued real estate, patents, or even brand recognition.

Pros:

Big Safety Net: Deep value offers a large “margin of safety.” This means there’s less risk of losing money if you’re wrong about the company’s value.

High Potential Returns: When the market recognizes the true value of these overlooked companies, the stock price can jump significantly.

Weathering the Storm: Deep value stocks can perform well in bear markets because their underlying assets provide protection.

Cons:

Waiting Game: Sometimes, these undervalued stocks can stay cheap for a long time. Patience is crucial.

Higher Risk: Deeply discounted stocks often belong to companies facing real problems. It’s important to thoroughly research these companies.

Illiquidity: These stocks can be hard to buy or sell quickly, especially in smaller companies.

When to use Deep Value:

This approach suits investors who:

Are comfortable with higher risk in exchange for potentially high rewards.

Can be patient and wait for the market to recognize the true value.

Enjoy in-depth research and analysis.

Why it deserves a spot on the Value vs Growth Investing list:

Deep value investing represents the extreme end of the value spectrum. It highlights the potential for finding significantly undervalued companies, offering a unique approach within the broader context of value investing. It reminds investors that successful investing isn’t always about chasing the hottest trends but can also involve uncovering hidden value in overlooked corners of the market. It’s an important strategy to consider when comparing and contrasting value and growth investment styles.

Value vs Growth: 8 Strategy Comparison

|

Strategy |

Implementation Complexity 🔄 |

Resource Requirements 💡 |

Expected Outcomes 📊 |

Ideal Use Cases 💡 |

Key Advantages ⭐ |

|---|---|---|---|---|---|

|

Value Investing |

Moderate – requires strong fundamental analysis |

High – financial statement analysis and valuation skills |

Moderate to high long-term returns, lower volatility |

Investors seeking undervalued, stable companies for long-term holding |

Built-in margin of safety, dividend income, tax efficiency |

|

Growth Investing |

Moderate to high – focus on growth metrics and trend |

Moderate – research on industry and revenue growth |

Potential for high capital appreciation, higher volatility |

Investors targeting high-growth sectors and innovation |

High returns in bull markets, exposure to innovation |

|

GARP (Growth At a Reasonable Price) |

High – combines value and growth analysis skills |

High – requires multi-metric evaluation |

Balanced returns with moderate risk |

Investors seeking growth with valuation discipline |

Combines growth upside with value downside protection |

|

Dividend Growth Investing |

Moderate – focuses on dividend sustainability metrics |

Moderate – analysis of payout ratios and cash flows |

Growing income stream plus capital appreciation |

Income-focused investors wanting inflation-beating dividends |

Growing income, lower volatility, compounding dividends |

|

Quality Investing |

Moderate – focuses on business durability and management quality |

Moderate to high – analysis of ROIC, margins, management |

Consistent performance, downside protection |

Investors prioritizing durable competitive advantages |

Strong fundamentals, business durability, tax efficiency |

|

Contrarian Value Investing |

High – deep fundamental research and market sentiment understanding |

High – requires patience and market cycle knowledge |

Potential for high returns but with higher risk |

Investors willing to buy unpopular, depressed stocks |

Substantial returns from sentiment reversals, margin of safety |

|

Momentum Growth Investing |

High – requires technical and fundamental analysis |

High – active monitoring and frequent trading |

Potential for rapid gains with high volatility |

Active traders focusing on short- to mid-term price trends |

Capitalizes on strong market trends, avoids value traps |

|

Deep Value Investing |

Very high – intensive balance sheet and special situation analysis |

Very high – extensive, detailed research needed |

High returns potential with significant risk |

Investors targeting extreme undervaluation and special situations |

Maximum margin of safety, potential for substantial gains |

Ready to Start Investing? Let Stock Decisions Assist!

We’ve delved into value vs. growth investing, exploring eight strategies: Value, Growth, GARP, Dividend Growth, Quality, Contrarian Value, Momentum Growth, and Deep Value Investing. It’s like picking your favorite ice cream flavor—each is unique! Value investing is the dependable vanilla, while growth investing is a new, exciting flavor with high return potential.

The main point? There’s no “best” strategy. Your choice depends on your risk tolerance and investment timeline. Young and risk-tolerant? Consider growth. Near retirement? Value might suit you better. Understanding these concepts helps you make informed decisions for your financial goals. Long-term investors often outperform short-term traders—patience is key!

Stock Decisions offers insights on value vs. growth investing, guiding you to choose stocks like GOOGL, MSFT, AMZN, AAPL, META, and NVDA. Ready to make wiser investment choices? Visit Stock Decisions to explore value vs. growth investing!